Foreign Direct Investment Involving UK Companies

21st June 2023

Investment of UK companies abroad (outward) and foreign companies into the UK (inward), including investment flows, positions and earnings, by country, component and industry.

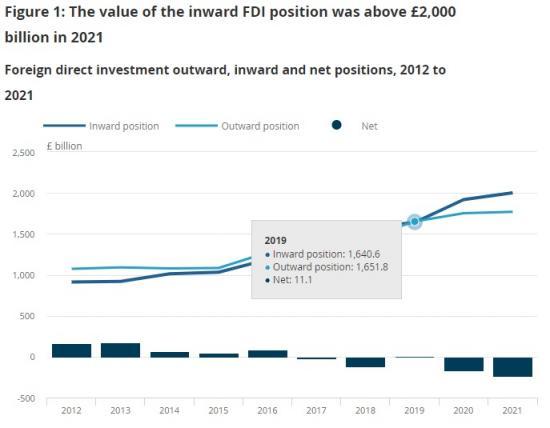

Both the inward and the outward foreign direct investment (FDI) positions (stocks) increased in 2021 compared with 2020; the value of the UK's inward position increased by £83.1 billion to £2,002.4 billion, while the outward position increased by £16.0 billion to £1,769.3 billion.

The increase in the inward FDI position mainly reflects higher positions with the Americas (by £89.7 billion) and non-EU Europe (by £37.3 billion); the increase in the Americas was primarily from professional, scientific and technical services with the United States.

The value of outward FDI earnings (profits) was almost three times higher in 2021 compared with 2020, rising by £85.1 billion from £49.6 billion, to £134.7 billion; this partly reflects the much lower outward FDI earnings reported in 2020, during the coronavirus (COVID-19) pandemic.

The increase in outward FDI earnings was seen across all continents; particularly, the Americas was more than four times higher in 2021 than in 2020; this mainly reflects higher earnings reported by a few companies, compared with the low earnings values in 2020.

Net FDI earnings (outward less inward) were much higher in 2021 (£62.9 billion) than in 2020 (negative £6.5 billion); FDI made a positive contribution to the UK's current account in 2021, having been slightly negative in 2020.

Several factors affected FDI statistics for 2020, including disruption from the coronavirus (COVID-19) pandemic, global recession, and changes to the FDI statistical populations and sampling methods.

Foreign direct investment positions

The foreign direct investment (FDI) position is the value of the stock of investment at a point in time. Figure 1 shows that the UK's inward FDI position - the stock of FDI in the UK controlled by foreign companies - rose by £83.1 billion to £2,002.4 billion in 2021. By contrast, the value of the UK's outward FDI position - stock of investment that UK-based companies control abroad - was £16.0 billion higher in 2021 (£1,769.3 billion) compared with 2020 (£1,753.3 billion). This means that the UK's negative net international investment position (outward less inward positions) widened to negative £233.0 billion in 2021, compared with negative £165.9 billion in 2020.

The UK's inward FDI position with Asia and the EU decreased by £26.3 billion and £20.3 billion respectively, between 2020 and 2021. The difference for Asia reflects lower values with Japan (by £17.8 billion). Regarding the EU, the UK's inward FDI position with Belgium was £42.2 billion lower in 2021 compared with 2020, which was higher than the decrease for the EU total overall. For both Japan and Belgium, these positions resulted from much lower inward FDI positions reported by a few companies.

As in 2020, the UK's inward FDI position value with the Americas was higher than with the EU in 2021. We implemented changes to the FDI statistical populations and sampling methods in 2020, and recommend using caution when comparing results since 2020 with earlier years. Some of the increase in the value of the UK's inward FDI position with the Americas in 2020 compared with 2019 was from companies reporting higher values.

Foreign direct investment earnings

Foreign direct investment (FDI) earnings are the profits of multinational enterprises. Outward FDI earnings are the profits that UK companies generate on their stock of investment abroad, while inward FDI earnings are those that foreign companies generate from their UK-based businesses.

The values for both outward and inward FDI earnings increased in 2021, compared with 2020. Outward earnings were almost three-times higher over that period, rising £85.1 billion from £49.6 billion, to £134.7 billion. Inward earnings increased by £15.6 billion to £71.8 billion, meaning net FDI earnings (outward less inward) were much higher in 2021 (£62.9 billion) than in 2020 (negative £6.5 billion). Therefore, FDI made a positive contribution to the UK's current account in 2021, having been slightly negative in 2020.

Read the full report HERE