No Respite Yet On Consumer Price Inflation, UK May 2023

21st June 2023

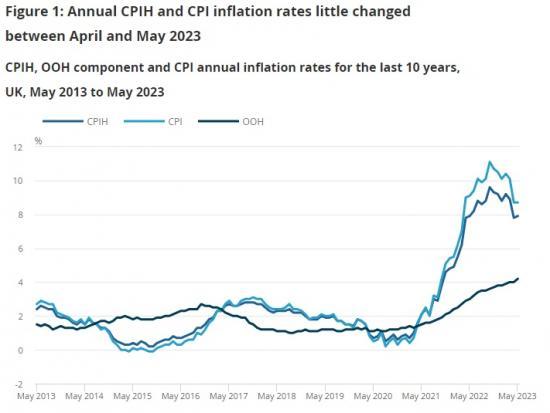

The Consumer Prices Index including owner occupiers' housing costs (CPIH) rose by 7.9% in the 12 months to May 2023, up from 7.8% in April.

On a monthly basis, CPIH rose by 0.6% in May 2023, compared with a rise of 0.6% in May 2022.

The Consumer Prices Index (CPI) rose by 8.7% in the 12 months to May 2023, unchanged from April.

On a monthly basis, CPI rose by 0.7% in May 2023, compared with a rise of 0.7% in May 2022.

Rising prices for air travel, recreational and cultural goods and services, and second-hand cars resulted in the largest upward contributions to the monthly change in both the CPIH and CPI annual rates.

Falling prices for motor fuel led to the largest downward contribution to the monthly change in CPIH and CPI annual rates, while prices for food and non-alcoholic beverages rose in May 2023 but by less than in May 2022, also leading to an easing in the annual rates.

Core CPIH (excluding energy, food, alcohol and tobacco) rose by 6.5% in the 12 months to May 2023, up from 6.2% in April, and the highest rate for over 30 years; the CPIH goods annual rate eased from 10.0% to 9.7%, while the CPIH services annual rate rose from 6.0% to 6.3%.

Core CPI (excluding energy, food, alcohol and tobacco) rose by 7.1% in the 12 months to May 2023, up from 6.8% in April, and the highest rate since March 1992; the CPI goods annual rate eased from 10.0% to 9.7%, while the CPI services annual rate rose from 6.9% to 7.4%.

Comment

It looks almost certain due to these latest inflation figures that the Bank of England will tomorrow increase interest rates yet again.

Note

Read the full report HERE