Interest Rate Hikes Could See 1.4 Million People Lose 20% Of Their Disposable Income

23rd June 2023

Today Thursday 22 June 2023, the Monetary Policy Committee (MPC) of the Bank of England decided whether to increase the base rate once again to 5% after 12 consecutive rate rises from 0.1% in December 2021 to 4.5% last month. With last month's publication of inflation rates showing a slower decline than had been expected, and last Tuesday's earnings figures showing continued strength, many banks have increased mortgage rates again in recent weeks, in anticipation of the MPC raising the base rate further. The average two-year fixed mortgage now stands at 6.01%, having been just 2.65% in March 2022.1

Overall, over 14 million adults aged 20 and over, or over around a third of them, have a mortgage (including just over half of 30 to 50-year olds).2 Many have fixed rate mortgages and so in the short run are shielded from rate rises. But eventually those fixed terms will come to an end and they will be exposed to much higher rates, implying bigger monthly repayments. Around a quarter of mortgages are set to come off a fixed term deal between 2022Q4 and 2023Q4.3

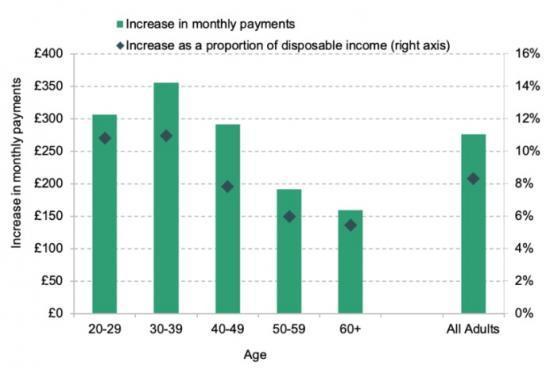

In March 2022, households with a mortgage were spending an average of £670 per month on mortgage payments, £230 of which was on interest payments. Figure 1 shows how those figures will change if mortgage interest rates remain at their current level, relative to a situation where the March 2022 interest rates persisted. On average those in mortgage-holding households will pay almost £280 more each month, with 30-39-year olds paying almost £360 more. This will be a significant hit to mortgagors' disposable incomes (i.e. incomes after mortgage payments) at a time that families are already under strain - on average disposable incomes will fall by 8.3%, with those aged 30-39 again seeing the biggest hit (almost 11%). For some the rise will be substantially larger: almost 1.4 million - 690,000 of whom are under 40 - will see their disposable incomes fall by over 20%.

Read the full article HERE