What Is The Impact Of A Housing Crash On Economy?

5th August 2023

Economist Tejvan Pettinger looks at the problems if there is a big fall in housing values.

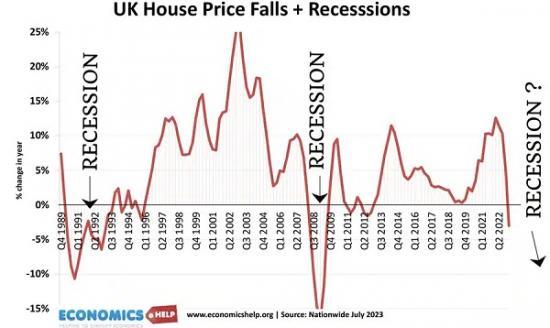

High interest rates and falling house prices will fundamentally alter both the housing market, and also the economy. The last two house price crashes co-incided with two deep recessions and if prices fall as much as expected, it will worsen an already weak economy.

But, it is not all bad news, falling prices could be a lifeline for potential future buyers and in the long-term help to rebalance the market and even encourage an economy less focused on passive wealth gains.

The change in conditions is causing a big readjustment. In the past low interest rate environment, assets like bonds and house prices soared. But, as interest rates rise the price of government bonds falls. The Resolution Foundation show that the UK has experienced its biggest fall in wealth for decades, and this trend will continue if interest rates remain elevated.

In recent decades, the ratio of wealth to income has soared and this has benefitted a relatively small share of the population who own substantial wealth. When house prices are rising, homeowners can withdraw equity through remortgaging to spend on holidays, and home extensions. But, with high-interest rates and house prices falling, equity withdrawal is going into reverse as people seek to overpay their mortgage - I'm trying to do that at the moment.

But in the short-term, this will depress consumer spending.

Falling house prices cause a big dent in our perceived financial well-being - more so in the UK than anywhere else in the world. In the UK over 50% of wealth is tied up in non-produced assets like land and housing. This compares to 35% in Japan and 26% in Germany (FT). The high price of housing and land has distorted the economy, meaning we spend more on land and property and less on productive capital. The hope is a fall in property and land prices could in the long term free up business to invest in more productive capital.

On the other hand, although wealth is falling, there is a compensation of higher interest returns. For example, those with savings will see a rise in interest income. So far, there has been a greater rise in interest income, than a rise in debt payments, this will soften the blow. Though the debt burden will increases as more people remortgage to higher rates. Also the benefit of higher interest income is mostly felt by the wealthier deciles. Those on low and mid incomes are more affected, by higher borrowing and renting costs.

Read much more HERE