Guide To The Bank Of Englands UK Spending On Credit And Debit Cards Experimental

8th August 2023

Overview of the ‘UK spending on credit and debit cards' experimental data series

These data series are experimental faster indicators for monitoring UK spending on credit and debit cards. They track the daily CHAPS payments made by credit and debit card payment processors (often known as ‘merchant acquirers') to around 100 major UK retail corporates. These payments are the proceeds of recent credit and debit card transactions made by customers at their stores (both physical and via telephone/online platforms).

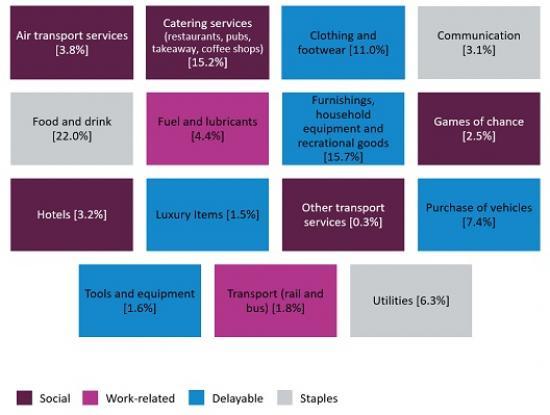

The five series consist of one series covering all types of spending on credit and debit cards, and four disaggregated series, each covering a different type of purchase (staples, work-related, social, delayable). Retailers are allocated to one of the disaggregated series based on their primary business. These data series are updated weekly; the charts in the ONS Faster Indicators weekly bulletinOpens in a new window are based on transactional data from January 2020 up to the Thursday of the week before publication.

Users of the data series should note that the use of the term ‘retail' in CHAPS is not consistent with that used in the ONS Retail Sales figuresOpens in a new window. ONS' figures provide monthly estimates on what consumers are buying, and how much they are spending on items in stores and online. Retail in the CHAPS data uses a broader definition adding to the mix, expenditure on train fares and social activities, such as meals or drinks in a pub or restaurant.

Detailed description of the ‘UK spending on credit and debit cards experimental data series

Introduction and background

Credit and debit cards are one of the most common methods for consumers to pay for goods and services. The two largest card schemes in the UK, MasterCard and Visa, operate what is known as ‘four-party' model. In this model, ‘card issuers' provide consumers with debit/credit cards and ‘merchant acquirers’ offer card accepting services (e.g. point-of-sale card machines and/or an online payments portal) to retailers (or merchants).

When merchant acquirers pay retailers the proceeds from card transactions made at their stores (including telephone/online platforms), they will typically make a single bulk payment to the retailer each working day. The daily payment is for the sum of card transactions processed the previous working day (plus any weekends or bank holidays since then). Therefore the payment made by the merchant acquirer on a Friday typically reflects Thursday’s card transactions, and on a Monday generally reflects Friday to Sunday’s card transactions.

For the largest retailers, this bulk payment can be for millions or tens of millions of pounds. Where the merchant acquirer and retailer use different banks (or payment service providers), these bulk payments will often be made via CHAPS, the sterling high value payments system operated by the Bank of England. The Bank has access to CHAPS transactional data as the operator of RTGS and CHAPS.

Read the full report HERE