GDP News, And Looking Ahead To GERS Next Week

12th August 2023

News out this morning (11 August) from the ONS showed surprisingly strong UK GDP growth in the second quarter of the year. The monthly figure for June looks large (0.5% relative to May), but this is distorted by the additional bank holiday for the King's coronation artificially bringing down May's GDP. If we instead focus on the three months to June, GDP grew by 0.2% - hardly spectacular growth, but better than generally expected.

This piece of good news is slightly tempered by two other snippets of data from the ONS release. One is that year-on-year growth for the UK on Q2 of 2022 was 0.4% - which is very low and serves as a reminder that while we are not in a recession by its technical definition, economic conditions are unlikely to feel like they are significantly improving. The other figure worth drawing attention to is that UK GDP is still 0.2% below the pre-pandemic peak, as a consequence of both the large shock felt by the UK and the weak rebound that has followed. While there are comparability issues internationally, the UK seems to have fared poorly when compared with other large advanced economies, and is the only G7 country yet to regain its economic output level from the end of 2019.

While first estimates can be revised considerably, these are welcome news relative to expectations. But while the economy is growing (slightly), it's likely it will take a while until most people feel an improvement in their economic situation - the reading today is still consistent with falling living standards this year. Scottish GDP estimates for the same period come out at the end of the month, so we don't have long to wait until we know how Scotland's performance compares.

Looking ahead to the release of GERS

Next Wednesday sees the release of Government Expenditure and Revenue Scotland (GERS) 2022-23, the annual National Statistics publication which sets out:

Revenues raised in Scotland, both from devolved and reserved taxation;

Public spending for and on behalf of Scotland, again both for devolved and reserved powers; and

The difference between the two figures, called the "net fiscal balance" and often referred to as the "deficit".

These statistics form the backdrop to a key battleground in the constitutional debate, particularly regarding the fiscal sustainability of an independent Scotland and what different choices Scotland could make in terms of tax and spending.

We have a handy guide to GERS, going into detail on the production of these statistics and their publication, and addressing some of the myths and odd theories around them. We also did a podcast episode back in 2020 focused on these. But to go through the main claims usually made about it:

GERS is an accredited National Statistics produced by statisticians in the Scottish Government (so is not produced by the UK Government) and is a serious attempt to understand the key fiscal facts under the current constitutional arrangement.

Some people look to discredit the veracity of GERS because it relies - in part - on estimation. Estimation is a part of all economic statistics and is not a reason to dismiss the figures as "made up".

Will the numbers change if you make different reasonable assumptions about the bits of GERS that are estimated? In short, not to any great extent.

If you have any more questions about how revenues and spending are compiled in GERS, the SG publish a very helpful FAQs page, including dealing with issues around company headquarters and the whisky industry.

So what can we expect when GERS does come out next week?

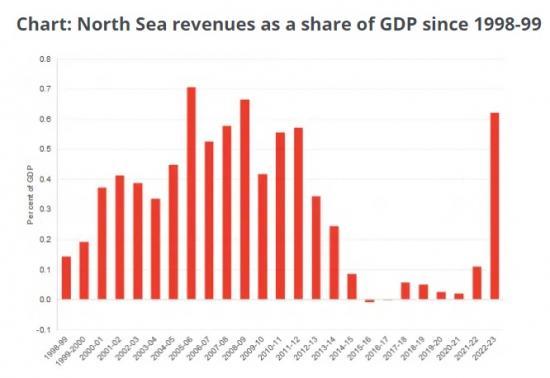

2022-23 will be somewhat different from recent years, for a number of reasons. One is that after a decade of decline, revenues from the North Sea - offshore corporation tax, petroleum revenue tax and the recently introduced energy profits levy, better known as the "windfall tax" - increased dramatically as a result of increased energy prices, and reached their highest share of national income since 2008-09. This will substantially increase revenues in GERS, reducing the deficit considerably.

Of course, while increase in energy prices brought in higher revenues from oil and gas, it was not good news for consumers and businesses in other sectors, increasing input costs and inflation and reducing disposable incomes. The spike in forecasts for the energy price cap prompted the UK Government to introduce a number of schemes, most notably the Energy Price Guarantee for households and the Energy Bill Relief Scheme for businesses. UK-wide, these schemes were estimated by the OBR to have cost around £30 billion in 2022-23. And with interest on the UK's stock of debt increasing due to higher inflation, this will also add to reserved spending on behalf of Scotland.

Overall, we expect that Scotland's net fiscal balance will still be negative, albeit less so - that is, a smaller deficit – largely due to increased oil and gas revenues, while partially offset by stronger spending on energy support schemes (both household and business-focused) and on debt interest. Because of these offsetting effects, we can't be sure how Scotland’s net fiscal balance will compare with that of the UK as a whole for 2022-23 (5.2% of GDP), but we expect it to be relatively close (when including North Sea) – and certainly closer than in the 2021-22 GERS.

Source - https://fraserofallander.org/weekly-update-gdp-news-and-looking-ahead-to-gers-next-week/