Retail Sales Great Britain - July 2023 - Sales Fall 1.2%

18th August 2023

Retail sales volumes are estimated to have fallen by 1.2% in July 2023 following a rise of 0.6% in June 2023 (revised from an increase of 0.7%).

Food stores sales volumes fell by 2.6% in July 2023, with supermarkets reporting that the wet weather reduced clothing sales, although food sales also fell back; retailers indicated that the increased cost of living and food prices continued to affect sales volumes.

Non-food stores sales volumes fell by 1.7% in July 2023, following a rise of 0.6% in June 2023; retailers reported that the fall over the month was because of poor weather reducing footfall.

Automotive fuel stores sales volumes rose by 0.7% in July 2023, following a fall of 0.6% in June 2023.

Non-store retailing sales volumes rose by 2.8% in July 2023; online retailers suggested that a range of promotions boosted sales.

Shoppers switching to online shopping because of poor weather and increased promotions led to 27.4% of retail sales taking place online in July 2023, up from 26.0% in June 2023; this is the highest proportion since February 2022 (28.0%).

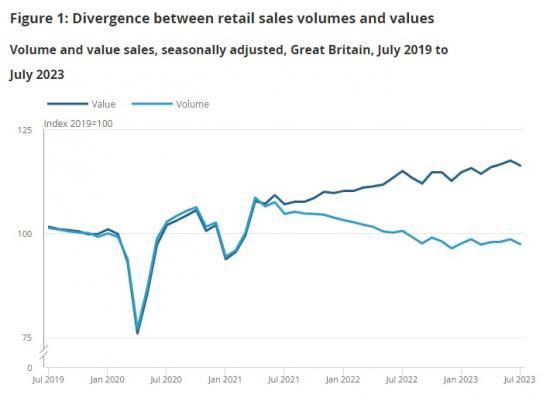

Figure 1 shows the continued divergence between the quantity bought (volume) and amount spent (value) in retail sales over time because of price increases.

When compared with their pre-coronavirus (COVID-19) level in February 2020, total retail sales were 16.4% higher in value terms, but volumes were 1.8% lower.

Food stores sales volumes fell by 2.6% in July 2023, following a rise of 1.1% in June 2023. Supermarkets reported that some of the fall was because of the poor weather reducing summer clothing sales. However, food sales in supermarkets also fell back.

Retailers also indicated that the increased cost of living and food prices continued to affect sales volumes.

Non-store retailing sales volumes, which are predominantly online retailers, rose by 2.8% in July 2023, following a rise of 0.2% in June 2023.

Feedback from online retailers suggested that the wet weather and a range of promotions in July 2023 boosted sales.

Online spending values rose by 4.1% in July 2023 because of strong growth in non-store retailing and other non-food stores.

The value of online spending rose, while the value of retail sales as a whole fell. Because of this the proportion of online sales rose to 27.4% in July 2023 from 26.0% in June 2023.

This is the highest proportion of retail sales taking place online since February 2022 (28.0%) and remains significantly above the pre-coronavirus (COVID-19) pandemic levels (19.6% in February 2020).

Read the full ONS report HERE