Scottish Council Tax Proposals Are A Small Step In The Right Direction But Duck The Biggest Issue: Revaluation

12th September 2023

Proposed reforms to council tax in Scotland would further reduce regressivity but should go further, and the issue of revaluation is ducked yet again.

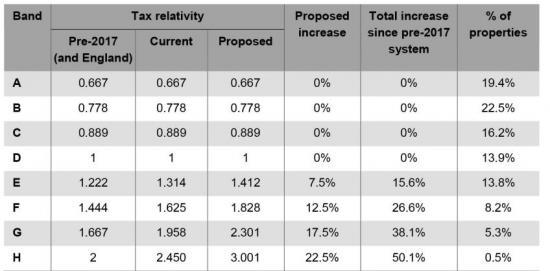

In 2017, the Scottish Government increased the relative tax rates (termed ‘tax relativities') applied to properties in bands E-H by between 7.5% and 22.5% in an effort to raise revenues and reduce the regressivity of council tax. It is currently consulting on proposals to increase the relative tax rates by a further 7.5% to 22.5%, with the same objectives in mind.

Table 1 shows the relative tax rates applied to properties in each council tax band as a multiple of the rates applied to properties in band D for the pre-2017, current and proposed Scottish council tax systems. It shows that taken together, if the proposed reforms go ahead, the tax rate applied to a band H property would be 50% higher relative to a band D property than it was prior to 2017. In particular, a band H property would face a tax bill 3 times as high as a band D property and 4.5 times as high as a band A property, compared with 2 and 3 times higher, respectively, prior to 2017 in Scotland and in England to this day.

The proposed reforms would therefore make the Scottish council tax less regressive than is currently the case, and particularly compared with the pre-2017 and English situations.

Their impact on council tax revenues and bills is less clear. That is because while the Scottish Government determines the relative tax rates applied to different tax bands, it is councils that set the overall level of council tax (by choosing a band D rate). The impact of the proposed reforms on council tax revenues and bills will therefore depend on councils' decisions.

Suppose that the Scottish Government were to provide the same level of grant funding to councils that it would have in the absence of the reforms. If councils decided to spend the same amount on services that they otherwise would have as well, they would need to raise the same amount from council tax as they would have in the absence of the reform. Because of the higher relative tax rates applied to properties in bands E-H, they could do this while setting a lower band D tax rate. That would mean that the reform would lead to a fall in the council tax bills faced by properties in bands A-D, and that the increase in bills for properties in bands E-H would be smaller than the 7.5-22.5% increase in their relative tax rates.

Conversely, if the Scottish Government decided to cut the grant funding it gives councils, or councils decided to spend more, council tax revenues would increase following the reform. Given a difficult financial situation facing both the Scottish Government and councils, such an increase in revenues is probably to be expected. If councils set the same band D rate as in the absence of the reform, for example, properties in bands A–D would see no change in their bills and properties in bands E–H would see their bills increase by 7.5% to 22.5%. Based on current average council tax rates in Scotland, this would be an increase of between £140 for a band E property and £780 for a band H property, raising up to £175 million per year (the amount in future years would grow in line with band D tax rates set by councils).

The words ‘up to' are important here because the Scottish Government has suggested fully exempting single adults without children with net incomes up to £16,750 per year and other households with net incomes up to £25,000 per year from the increase in tax rates on band E–H properties, provided they have savings below £16,000 (for every £1 of income above these thresholds, households have to pay 20p of the increase in tax bills). A similar exemption is in place for the increases already made as part of the 2017 reforms, with households applying for the exemptions via councils' means-tested council tax reduction scheme (CTRS). Combined with the fact that the very low-income households that have their bills covered by the standard CTRS would not pay any of the increase in bills, a special exemption for other low- to middle-income households would somewhat reduce the potential increase in revenues as a result of this reform.

The full article can be read at the Institute for Fiscal Studies web site. Read the full report HERE