Average Savings Rates At Highest Levels Since 2008

18th September 2023

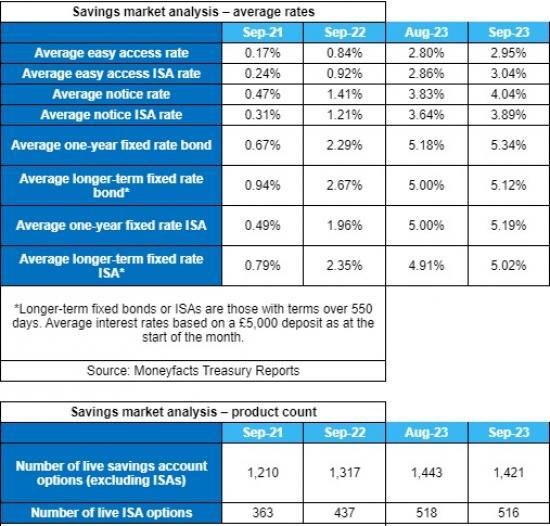

Moneyfacts UK Savings Trends Treasury Report data shows average fixed bond and ISA rates, for one-year and longer-term fixed, all now stand above 5% for the first time in almost 15 years. Average savings rates across easy access, notice and ISA equivalents now stand at levels not seen since 2008.

All variable rates (easy access, notice and ISA equivalents) rose for the 19th consecutive month, the first time on Moneyfacts' records (this data set began in 2007).

Both the average easy access and notice rates hit their highest levels since 2008. The average easy access rate rose to 2.95% and stands at its highest point since November 2008 (3.63%). The average notice rate rose to 4.04%, breaching 4% for the first time since March 2008, which was also its previous highest point on our records (4.05%).

The average easy access ISA rate rose month-on-month to 3.04% and stands at its highest point since December 2008 (3.74%). The average notice ISA rate rose to 3.89% and is at its highest since November 2008 (4.91%).

The average fixed bond and ISA rates have now risen month-on-month for the past six months. The average one-year fixed bond rose to 5.34% and stands at its highest point since November 2008 (5.79%). The average longer-term fixed bond rose to 5.12% and stands at its highest point since November 2008 (5.19%).

The average one-year fixed ISA rose to 5.19%, its highest point since November 2008 (5.86%). The average longer-term fixed ISA rate rose to 5.02% and stands at its highest point since November 2008 (5.23%).

Product choice overall fell month-on-month to 1,937 savings deals (including ISAs).

Rachel Springall, Finance Expert at Moneyfacts, said, ""Savers may be delighted to see average rates reaching levels not seen since 2008. The average rates on one-year and longer-term fixed bonds and ISAs all stand above 5% for the first time in almost 15 years (November 2008).

Due to intensive competition among challenger banks, average fixed rates have risen for the past six months. This will come as good news to those who may be coming to the end of their fixed bond or ISA, as much higher returns can be found. The average one-year fixed bond rate was 2.29% in September 2022; it's now 5.34%, on a £20,000 lump sum investment, that's an extra £610 in interest after one year.

"Those savers who want flexibility with their cash will find the average easy access rate rose to 2.95%, its highest point since November 2008, when it was 3.63%. At the time, the Bank of England base rate was 4.50%; it now stands at 5.25%. There is room for improvement and some savers may not be feeling the full benefits of the consecutive base rate rises, nor might they be getting the best possible return if they fail to switch.

As of the start of this month, fewer than a third of live savings accounts on the market pay more than 5.25%. Back in November 2008, around 48% of the live market paid more than base rate (4.50%). As UK Savings Week begins, it's a good reminder for savers to review any existing accounts and any personal savings goals. Comparing different types of accounts and exploring the more unfamiliar brands is wise, particularly when challenger banks offer some of the most lucrative returns.

"It is evident that consumers are still chasing down the top rates on offer from fixed rate bonds, but there are also savers dipping into more flexible pots, according to recent figures published by the Bank of England. There was an outflow of just over £10 billion from interest-bearing sight deposits in July 2023 and demand for fixed accounts recorded an inflow of just over £10 billion into time deposits.

According to our own data, the average shelf life of fixed rate bonds stands at 32 days, which is much lower than 46 days six months ago. This means savers will have less time to grab a fixed rate bond compared to the start of the year, so it's imperative they sign up to rate alerts to stay in the know."

moneyfactsgroup.co.uk