Scottish Income Tax HMRC Annual Report 2023

8th October 2023

The Scotland Act 2016 provides the Scottish Parliament with Scottish Income Tax (SIT) powers. It enables the Scottish Parliament to set the Income Tax rates and thresholds that apply to the non-savings and non-dividend income of Scottish taxpayers. The Income Tax Personal Allowance remains reserved to the UK Parliament.

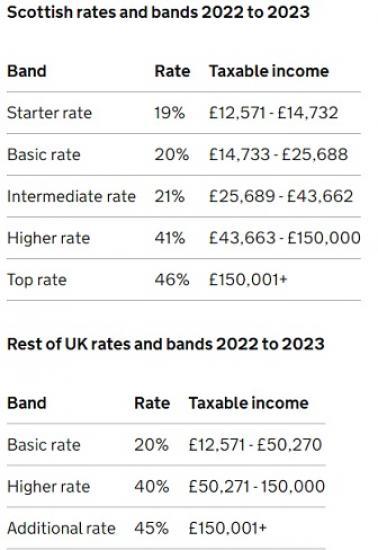

The tables below show how the power to set SIT was exercised in 2022 to 2023. The 2022 to 2023 rest of UK rates are included as a comparison.

Scottish Income Tax and rest of UK Rates in 2022 to 2023

See Poster

HMRC administers SIT through existing Pay As You Earn (PAYE) and Self Assessment processes, including for Income Tax compliance and communications. This ensures the correct amount of tax is collected. In the vast majority of cases Scottish taxpayers will notice no difference in how HMRC interacts with them.

One of the key requirements of HMRC's administration of SIT is for HMRC to report annually on its delivery of the agreed services. This report sets out information about HMRC's administration in 2022 to 2023, covering:

identification and assurance of Scottish taxpayers

compliance activity

the collection of and accounting for SIT revenues

customer service and support

data for SIT rate setting and forecasting

governance and oversight of SIT

the costs of delivering SIT and the recharging of these costs to the Scottish Government

Section 1: Identification and assurance

Who is a Scottish taxpayer?

For most people, whether or not they are a Scottish taxpayer in a given tax year is straightforward. Individuals who live in Scotland, and have their sole or main place of residence there, are Scottish taxpayers. Those whose sole or main place of residence is elsewhere in the UK are not Scottish taxpayers.

If a person has more than one place of residence, their main place or places of residence determines where they pay Income Tax. If a person has 2 or more ‘main places of residence' in different parts of the UK, they will be a Scottish taxpayer if their main place of residence was in Scotland for more of the year than any other part of the UK.

Members of the UK Parliament representing Scottish constituencies and Members of the Scottish Parliament are also Scottish taxpayers, regardless of their residence. As they are not subject to the normal residency rules, we operate a separate process to ensure they have the correct residency status applied on our system.

Identification and assurance work

The National Audit Office (NAO) reports that identifying Scottish taxpayers is the key challenge of HMRC's administration of SIT in 2021 to 2022. There is no definitive data set of Scottish residents against which to judge success, but we are confident in our identification of Scottish taxpayers as detailed below.

The population is not static, and figures from the Office of National Statistics (ONS) suggest that an estimated 75,000 people (not all of whom will be taxpayers) move their address across the border each year. About 40,000 of these are from the rest of the UK to Scotland and 35,000 in the other direction. Identifying Scottish taxpayers is an on-going process, and we work closely with the Scottish Government to ensure this remains robust.

Third party data clash

HMRC engages an external supplier to carry out a third party data clash exercise. This compares or ‘clashes' data held by HMRC with that from the third party to assess the accuracy of HMRC's address data with respect to the identification of Scottish taxpayers. Under our current arrangements with the Scottish Government we conduct a data clash every 2 years.

There are 2 stages to the third party data clash:

The external supplier carries out the initial scan by comparing HMRC's address data for individuals across the UK with data held by third parties. For example, the electoral roll and credit reference agencies.

Following the initial scan carried out by the external supplier, HMRC carries out an analysis of the results to assess the accuracy of HMRC's identification of Scottish taxpayers. HMRC compares records unmatched in the initial scan against the latest PAYE and Self Assessment records.

The third party data clash scan was last conducted in 2021. Following the analysis of the results we estimated that the correct Scottish taxpayer status was applied in 98% to 99% of cases. The remaining 1% to 2% were not necessarily wrong, but they were uncorroborated.

Many of the uncorroborated cases were likely to be in respect of individuals without a source of PAYE income, which is why these were not identified in HMRC's data. These individuals would therefore be outside the scope of Scottish Income Tax.

These results are consistent with analysis of previous data clash exercises, and suggest that the accuracy of HMRC’s address data remains high. We will continue to assess this, and a data clash will take place in the 2023 to 2024 tax year.

Data updates

Postcodes, and the properties within them, occasionally change to reflect new build properties and subdivision of existing properties. HMRC receives quarterly postcode updates from the ONS and updates its processes for flagging Scottish residency to ensure ongoing accuracy of HMRC’s record of postcodes and their residency statuses.

Postcode scans

HMRC conducts scans to identify any data quality issues and make corrections. There will always be the need to assure the quality of the data we receive, and this is not an issue specific to SIT. Our address data comes from a variety of sources, including individuals, employers and other government departments. There are no issues with the vast majority of the address data recorded on our systems, however a small minority requires correcting.

HMRC relies on data from external sources to complete our records. We have a program of work in place to ensure that any data issues for Scottish taxpayer records are identified and corrected, preventing any loss of revenue to the Scottish Government.

The scan to assure the quality of our address data operates in 2 parts:

Identification of taxpayer records with a Scottish postcode prefix but where the postcode is not recorded on HMRC’s list of live and deleted Scottish postcodes.

Identification of taxpayer records with a blank postcode but which has a key word in the body of the address that indicates it is a Scottish postcode, for example, Aberdeen.

Employers’ application of Scottish tax codes

When HMRC identifies an individual in PAYE as a Scottish taxpayer, a tax code is issued to their employer for them to operate. All tax codes for Scottish taxpayers have an ‘S’ prefix. The vast majority of employers operate the codes issued to them. However, a small minority make errors and operate codes, without the ‘S’ prefix. This means that the rest of UK rates of tax are applied instead of the Scottish rates.

Individuals affected by these errors are still identified as Scottish taxpayers by HMRC. There is therefore no loss of revenue to the Scottish Government, as we use our identification to calculate the SIT outturn. Although some individuals may pay the wrong amount of tax in-year, HMRC’s end of year reconciliation process ensures that any over or under-payments are corrected. It is therefore important that codes are correctly applied in year to minimise the under- or overpayments that taxpayers would face at that end of year reconciliation. HMRC supports employers to correctly apply the Scottish codes issued to them. We carry out regular scans to monitor the proportion of employments that are missing the ‘S’ prefix.

Read the full report HERE