Giving With One Hand ... Exploring The Impact Of Minimum Wage Uprating In 2024 On Living Standards

5th November 2023

At this year's Conservative Party Conference, the Chancellor announced that the minimum wage would rise to at least £11 next year, up from its current rate of £10.42. But he may have under-promised. Using the standard uprating methodology, we estimate that the new adult-rate minimum wage could be as high as £11.46 in April 2024 - a 10 per cent cash increase. As a result, 1.7 million workers on the adult-rate minimum wage could be in for a real-terms pay rise of 6.3 per cent next year - the third largest in the minimum wage's 25-year history.

But for minimum wage earners on means-tested benefits (particularly those with children), the legacy of prolonged high inflation, falls in support through the benefit system and frozen tax thresholds will offset this welcome increase in their pay. Indeed, even if the minimum wage rises to £11.46 in April 2024, families with three young children where both adults earn the minimum wage would still be less well-off than the same family would have been a decade previously, despite their wages rising 35 per cent in real terms over that period.

When the Chancellor formally announces the 2024 minimum wage rate, most likely at the Autumn Statement, it is crucial to view this in the round, and consider other policy changes too that impact on the living standards of the nation's lowest earners.

The Chancellor under-promised when he recently said the minimum wage would rise to £11

In his recent speech to the Conservative Party Conference, the Chancellor made headlines by promising a 2024 adult-rate minimum wage of at least £11, up from £10.42 in 2023.[1] (This was widely interpreted, wrongly, as announcing a minimum wage of £11.) The announcement was surprising for two reasons. First, at that point, the Low Pay Commission (LPC) were mid-deliberation, deciding on their recommendation for next year's rate - the normal process would have been to wait for their recommendation and announce the new rate at the Autumn Statement.[2] But second, and more substantively, the minimum wage is likely to be much higher than £11 next year - meaning the Chancellor could have gone further in his Conference speech.

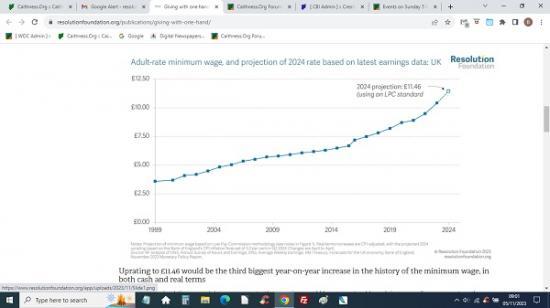

Back in March of this year when the LPC published its forecast for the 2024 rate, their central projection for the ‘on-course' rate (that is, ‘on course’ to hit their target of the minimum wage reaching two-thirds of median hourly pay in October 2024) was £11.16 - already well above the Chancellor’s £11. But since then, wage growth has strengthened. The latest available data at the time of the LPC’s forecast (for January) showed average weekly earnings (AWE) growing at 6.6 per cent per year; by August (the latest available AWE data now), pay growth had reached 7.8 per cent.[3] But we also now have data from the April 2023 Annual Survey of Hours and Earnings (ASHE), showing median hourly pay rising 7.4 per cent on the previous April. Plugging these latest earnings numbers into the LPC’s standard uprating methodology suggests a 2024 minimum wage rate of £11.46 (this projection is shown in Figure 1).

Uprating to £11.46 would be the third biggest year-on-year increase in the history of the minimum wage, in both cash and real terms

If £11.46 was indeed the 2024 minimum wage rate, the uprating would be a very sizeable cash increase of 10.0 per cent on the previous year – giving around 1.7 million workers on the minimum wage a real-terms rise of 6.3 per cent (going by the Bank of England’s forecast for CPI growth of 3.6 per cent in Q2 next year). In percentage terms, this would be the third largest cash increase in the minimum wage’s history, and also the third largest real-terms increase (see Figure 2). It would see the minimum wage return to a very sizeable real-terms rise after three years of low or negative real-terms increases – which is what happens when a cost of living crisis comes along. By contrast, if the minimum wage was uprated instead to just £11 (in line with the Chancellor’s conference speech), the cash increase next year would be a much more modest 5.6 per cent (or 1.9 per cent in real terms).

Read the dull article HERE