Understanding Retirement In The UK

5th November 2023

A report by the Institute for Fiscal Studies.

We comprehensively examine the changing patterns of retirement in the UK for different groups in society.

Employment declines significantly after age 55, accompanied by rising rates of self-reported retirement. For men aged 55, 81% are in paid work, falling to 44% by age 65. For women, employment rates fall from 74% to 34% over the same ages. At the state pension age (66), employment drops sharply whilst retirement rates rise by more as individuals are particularly likely to self-report themselves as retired when they reach the state pension age, even if they had left work prior to this

Long-run trends in retirement and employment patterns for men and women are dramatically different. Employment rates of men in their late 50s and early 60s are still lower than they were in the mid-1970s. This is despite strong growth since the mid-1990s, with more men of these ages both retired, and economically inactive but not retired (most of whom have a health problem) compared with the mid-1970s. Women are much more likely to be in paid work in their late 50s and early 60s than in the mid-1990s or before.

People with average levels of wealth in their late 50s and early 60s have the highest employment rates (76%) compared with the poorest fifth (46% employment rate) or the richest fifth (65%). Employment grew most between the early 2000s and the pandemic among those with average wealth levels. Retirement before state pension age is increasingly concentrated amongst the wealthier population. The fraction of people who are retired aged 55-64 that are in the richest 20% of the population has risen from 23% in 2002-03 to 32% by 2018-19. Poorer people aged 55-64 are much more likely than richer people to report being out of work due to health reasons.

There are some striking differences in employment rates between different groups for people aged 55-65. 83% of people with mortgages are still in employment aged 55-65, compared to 57% of people who own outright and 52% of renters. Only 40% of those with a disability are employed (73% for those without a disability). In terms of ethnicity, Black men have the highest employment rate at this age (76%) while Asian women have the lowest employment rate (52%).

Although people with average levels of wealth are more likely to work in the run up to state pension age, employment rates for those above the state pension age are highest among wealthier people. Of the wealthiest fifth of the population, 15% are still in paid work aged 70-74 compared to 11% for the middle fifth, and 6% for the poorest fifth. Those working beyond state pension age are disproportionately likely to work fewer than 16 hours per week (around 45% of men and women still working at 74) or to be self-employed (50% of men and 41% of women still working at age 74 are self-employed).

The income sources people have at these ages are very heterogeneous. Before state pension age, those in paid work rely on their earnings (83% of income for workers aged 60–65), and those retired rely on their private pension (58% of income for retired people aged 60–65) and, to a lesser extent, a spouse's earnings. Those out of work but not retired generally rely on state benefits (42% of income for this group at ages 60–65) and potentially a spouse's earnings. However, after state pension age, retired people rely on a combination of state and private pensions. Many of those still in paid work above state pension age have a mixture of income sources: in addition to earnings, 83% of those working in their late 60s draw a state pension and 35% draw a private pension. 31% of people in paid work aged 66–69 have income from earnings and the state pension and a private pension all together.

Above state pension age, the state pension forms a very important part of income even for middle- and high-income people. Amongst those aged 66–74 who have left paid work (almost all of whom report being retired), the state pension makes up 70% of the income for the lowest-income fifth, 45% for the middle fifth, and even 20% for the highest-income fifth. The highest-income fifth of this group relies mostly on private pensions, making up half of income.

Patterns of retirement, and employment, at older ages, are of key interest to policymakers, in part because of the broad goal of encouraging longer working lives as a part-solution to the challenges caused by an ageing population. There have been large changes in employment and retirement behaviours in recent decades across the developed world (see Börsch-Supan and Coile, 2023), though the UK stands out compared with other major OECD countries in having falling labour force participation at older ages since the COVID-19 pandemic (Cribb, 2023a,b).

This report is designed to provide new evidence on retirement patterns in the UK, as part of the Pensions Review,1 a larger project run by the IFS in partnership with the abrdn Financial Fairness Trust, which is examining the future of financial security in retirement. Understanding patterns of retirement at older ages is key to understanding the challenges facing pensions systems, as pensions are designed to enable households to finance spending in old age when people are no longer in paid work. This report seeks to understand how patterns of employment and retirement have changed, both before and after state pension age, and how people finance their retirement. Where possible, we draw on the latest data in order to show the labour market and retirement behaviour of people aged 50–74 since the COVID-19 pandemic.

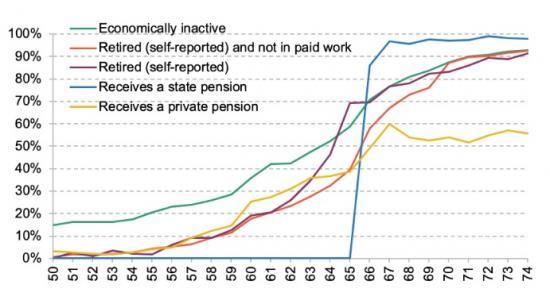

To start, we need to answer a basic question: what is retirement? There is a range of potential definitions (as shown in Figure 1), the appropriateness of which can differ across countries depending on the institutional context.

In some countries, particularly where state or public pensions form the vast majority of pension wealth and there is an early retirement age which allows early access to an (actuarily reduced) state pension, an appropriate definition of a retirement is often ‘claiming a state pension'. This definition, using UK data, is shown by the blue line in Figure 1. However, in the UK this is not a useful definition. There is no early claiming age in the UK, meaning people can only claim a state pension from age 66. And it is perfectly possible to claim the UK state pension while working – there is no earnings test. Therefore, this definition is dramatically at odds with definitions based either on self-reports or on labour market behaviour.2 Neither is claiming a private or occupational pension an appropriate definition (yellow line). While it shows similar retirement rates to other definitions between the ages of 50 and early 60s, because many people in their late 60s and early 70s do not have private pension income, it fails to capture high rates of self-reported retirement at these ages.

An alternative definition could be to define as retired all people aged over a certain age – say 50 – who are not in paid work or actively seeking work (‘unemployed’). These people are technically known as ‘economically inactive’, shown by the green line in Figure 1. Rates of economic inactivity rise from 15% at age 50 to 36% at 60 and 87% at 70. But – as is shown in Figure 4 later – many of those who are economically inactive in their 50s (in particular) do not consider themselves retired but out of the labour force due to sickness, disability or responsibility for looking after family.

Therefore, this leaves measures of retirement based on self-reported status. The purple line shows the fraction of people who consider themselves retired. This is essentially zero for people in their early 50s, rising to 20% by age 60, jumping to 70% in their mid-60s, and gradually rising to 90% by their early 70s. This is similar to a related definition, ‘self-reported retired, and economically inactive’, which uses self-reported status and conditions on being out of the labour force, as shown by the red line. As this definition is available in a variety of data sets, and allows us to distinguish between employed and retired people separately, we use this as our working definition of ‘retirement’ throughout this report.

Read the full report HERE