Public Sector Finances Uk October 2023 - October Borrowing Since Monthly Records Began In 1993

21st November 2023

Public sector net borrowing excluding public sector banks (PSNB ex) in October 2023 was £14.9 billion, £4.4 billion more than in October 2022 and the second highest October borrowing since monthly records began in 1993.

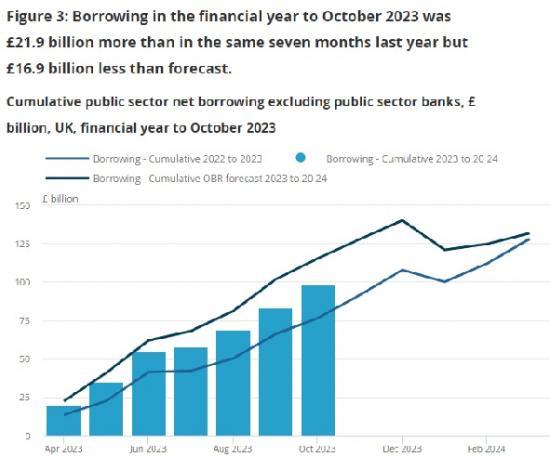

PSNB ex in the financial year-to-October 2023 was £98.3 billion, £21.9 billion more than in the same seven-month period last year, but £16.9 billion less than the £115.2 billion forecast by the Office for Budget Responsibility (OBR) in March 2023.

Public sector net debt (PSND ex) was £2,643.7 billion at the end of October 2023 and was provisionally estimated at around 97.8% of the UK's annual gross domestic product (GDP); this is 2.3 percentage points higher than in October 2022 and remains at levels last seen in the early 1960s.

Excluding the Bank of England, public sector net debt was £2,394.8 billion, or around 88.6% of GDP, £248.9 billion (or 9.2 percentage points) lower than the wider measure.

Estimates of public sector net worth (PSNW ex) was in deficit by £715.9 billion at the end of October 2023; this compares with a £533.9 billion deficit at the end of October 2022.

Central government net cash requirement (excluding UK Asset Resolution Ltd and Network Rail) was £18.2 billion in October 2023, £9.6 billion more than in October 2022 and £1.9 billion more than the £16.3 billion forecast by the OBR in March 2023.

In October 2023, the public sector spent more than it received in taxes and other income, requiring it to borrow £14.9 billion. This was £4.4 billion more than was borrowed in October 2022 and is the second highest October borrowing since monthly records began in 1993, behind that of 2020 during the coronavirus (COVID-19) pandemic period.

Central government borrowing

Central government forms the largest part of the public sector and includes HM Revenue and Customs, the Department of Health and Social Care, the Department for Education, and the Ministry of Defence.

The relationship between central government's receipts and expenditure is the main determinant of public sector borrowing.

In October 2023, central government borrowed £22.7 billion, £11.2 billion more than in October 2022 and £4.1 billion more than the £18.6 billion forecast by the Office for Budget Responsibility (OBR) in its Economic and fiscal outlook -- March 2023 report.

Central government receipts

Central government's receipts were £76.9 billion, £2.5 billion more than in October 2022 and £1.5 billion more than the £75.4 billion forecast by the OBR in March 2023.

Of this £76.9 billion, tax receipts were £57.9 billion, £2.7 billion more than in October 2022, with Value Added Tax (VAT) receipts increasing by £1.2 billion and income tax receipts increasing by £1.1 billion.

A detailed breakdown of central government income is presented in our Public sector current receipts: Appendix D dataset.

Central government expenditure

In October 2023, central government's total expenditure was £99.6 billion, £13.7 billion more than in October 2022 and £5.5 billion more than the £94.1 billion forecast by the OBR in March 2023.

Net social benefits

Net social benefits paid by central government were £24.9 billion in October 2023, £4.5 billion more than in October 2022. In recent months we have seen large increases in benefit payments largely because of inflation-linked benefits uprating and cost-of-living payments.

For more information on these benefit payments, see UK Parliament's Benefit uprating 2023 to 2024 report and GOV.UK's Cost of Living Payments 2023 to 2024 guidance.

Subsidies

Subsidies paid by central government were £2.2 billion in October 2023, £2.6 billion less than in October 2022. This is largely because of the cost of the Energy Price Guarantee (for households) and Energy Bill Relief Scheme (for businesses) affecting this month last year.

Other current expenditure

Payments recorded under central government "other current grants" were £1.7 billion in October 2023, £2.0 billion less than in October 2022, largely because of the cost of last year's Energy Bills Support Scheme.

Net investment

Central government net investment was £14.2 billion in October 2023, £9.7 billion more than in October 2022. This increase was largely a result of payments to the Bank of England Asset Purchase Facility Fund (APF) from HM Treasury under the indemnity agreement. These payments, recorded as capital transfers, began in October 2022 and occur every three months. This month saw a payment of £9.1 billion to the APF, £8.3 billion more than in October 2022.

As with other such payments, intra-public sector transfers are public sector net borrowing neutral. However, these central government transactions do affect our public sector net borrowing excluding the Bank of England (PSNB ex BoE) measure.

Interest payable on central government debt

In October 2023, the interest payable on central government debt was £7.5 billion, £1.1 billion more than in October 2022, and £2.6 billion more than the OBR's March 2023 forecast of £4.9 billion. This was the highest interest payable in any October since monthly records began in April 1997.

Borrowing in the financial year-to-October 2023

The £14.9 billion borrowed in October 2023, combined with an upward revision of £1.7 billion to our previously published financial year-to-September 2023 borrowing estimate, brings our provisional estimate for the total borrowed in the financial year-to-October 2023 to £98.3 billion.

The principal determinants of the £98.3 billion borrowed by the public sector in the first seven months of the current financial year was the £123.4 billion borrowed by central government, which was partially offset by a £19.3 billion Bank of England (BoE) surplus.

The borrowing of both of these subsectors is affected by payments totalling £33.2 billion made by central government to the BoE over the last seven months under the Asset Purchase Facility Fund (APF) indemnity agreement. This was £32.4 billion more than the £0.8 billion paid in the same period last year.

As with similar intra public sector transactions, these payments are public sector borrowing neutral. They increase central government's borrowing by £32.4 billion compared with the same period last year, but reduce the borrowing impact of the BoE by an equal and offsetting amount.

The receipt of these indemnity payments reduced the BoE's contribution to net borrowing by £32.4 billion compared with a year earlier. However, this decrease was partially offset by a £16.0 billion increase in the net interest payable by the BoE, largely on the reserves created to finance the quantitative easing activities of the APF.

In the seven months to October 2023, central government received £540.5 billion in taxes and other payments, an increase of £23.4 billion compared with the same period a year ago. However, this increase was exceeded by a £67.4 billion increase in total expenditure, rising to £663.9 billion over the same period. This additional spending included increases in:

net investment of £40.2 billion, of which £32.4 billion was an increase in payments to the APF (these reduce BoE borrowing)

inflation-linked uprated benefits and cost-of-living payments of £20.5 billion

consumption spending (largely pay and procurement) of £17.9 billion

grants to local government of £5.2 billion (these reduce local government borrowing)

These increases were partially offset by a reduction in central government debt interest payable of £12.6 billion, largely because of a slowing of the month-on-month growth in the Retail Prices Index.

Read the full report HERE