A Big Tax Cut For Workers Through National Insurance - And It Does Apply In Scotland

23rd November 2023

In today's Autumn Statement, the Chancellor announced a significant cut in rates of NICs. From 6 January 2024, while the thresholds will remain fixed, the rate of NICs on earnings in the primary threshold (£12,571 to £50,270) will decrease from 12% to 10% - a far more sizeable cut than many had anticipated.

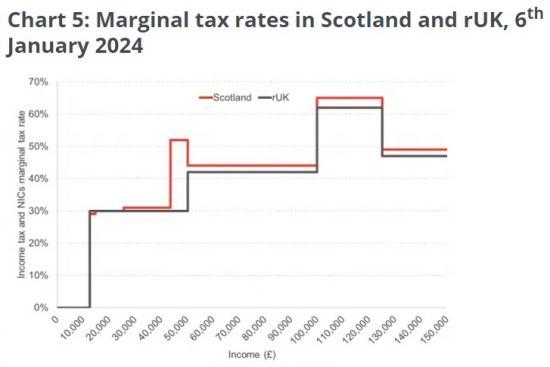

Although income tax is partly devolved in Scotland, National Insurance is not. This means that today's cut in NICs will impact earners in Scotland in the same way that it impacts earners in the rest of the UK. For a worker earning the median wage in Scotland of £33,332, today's announcements mean they will experience a reduction in their marginal tax rate (income tax plus employee NICs) from 33% down to 31%.

Owing to NICs status as a UK-wide tax, today's planned changes to NICs will not generate any additional consequential for the Scottish budget by themselves. If the Chancellor had decided to cut the rate of income tax in the rUK, then through the Block Grant Adjustment, the Scottish Government would have received additional revenue to reflect any additional divergences between income tax policy in Scotland and rUK.

However, for many earners in Scotland and the rUK, today’s announcement is likely to come as welcomed news. For those in Scotland earning the median wage, today’s cut in NICs will mean they are £415 better off at the end of the year. Meanwhile, for the highest and lowest 10% earners in Scotland, we estimate today’s announcement will reduce their NICs by £754 and £146 each year, respectively.

Source

https://fraserofallander.org/autumn-statement-reaction-a-tax-cutting-statement-that-continues-to-raise-taxes-amid-slowing-growth-and-what-does-this-mean-for-scotland/