Day-after Reaction - Barnett Consequentials And Changes To Net Scottish Government Funding

25th November 2023

The team at Fraser of Allender Institute look at how the Autumn Statement affects Scotland's consequentials.

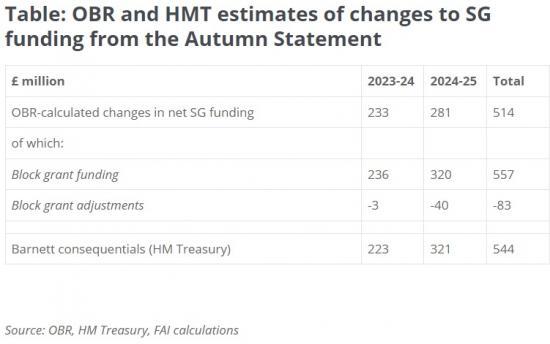

Just after the release of the OBR's documents, we tweeted out our calculations of the effect of the Autumn Statement on Scotland's finances in 2023-24 (£233m) and 2024-25 (£281m), adding up to £514m for the two years.

As part of the Autumn Statement documents, the Treasury announced an additional £545m in Barnett consequentials for the Scottish Government (SG) over the next two years: £223m in 2023-24 and £321m in 2024-25.

Why are these figures different?

The Treasury's numbers refer to the additions to the Block Grant, which is the main source of funding for the Scottish Government via a transfer from Westminster. These are Treasury allocations and essentially are just the additions to the DEL settlements that are available to the Scottish Government.

Table 3.11 of the OBR's supplementary fiscal release includes the fiscal effect of these additional allocations. These can differ slightly, and do in this case - especially for 2023-24. We’re not sure exactly why - there can be non-cash items that are treated differently in the public finances and in the Government’s internal accounting, especially depreciation, and we will come back to this if we discover more.

However, that is not the only thing that’s happened to funding in Scotland. As part of the Fiscal Framework Agreement, the Scottish Government controls income tax in Scotland (or most of it) but the block grant gets deducted - through a mechanism known as BGAs, or block grant adjustments - to account for the revenue forgone by the UK Government.

And in addition to the spending decisions announced by the UK Government that generate consequentials – funding for the English NHS’s pay deal in 2023-24 and business rate reliefs for 2024-25 – there are also two main measures that increase the BGAs by around £40m next year. These are:

The cut in national insurance, which adds to the number of hours worked in the economy and therefore increases income tax revenues. This increases the BGA by around £27m; and

A measure to increase debt management capability in HMRC, which is expected to increase the BGA by around £11m.

Of course, there might also be some additional revenue through Scottish Income Tax from these measures – but that is an assessment to be made by the Scottish Fiscal Commission in the round through their forecast process in advance of the Scottish Budget.

As it stands, however, the table below summarises the effect of the Autumn Statement on Scottish Government funding, both an OBR and Treasury basis. (Note that we have excluded the additional BGA from the devolution of winter fuel payment to ensure comparability.)

Source

https://fraserofallander.org/day-after-reaction-1-barnett-consequentials-and-changes-to-net-scottish-government-funding/