Scotland's Budget Report Preview - Social Security Spending - An Extra £1 Billion In The Past Five Years

13th December 2023

Social security has become a priority for the Scottish Government following the devolution of certain social security benefits and powers through the Scotland Act 2016.

This allowed the Scottish Government to introduce new benefits, change the process for devolved benefits, and ‘top-up' UK benefits - powers which the Scottish Government have made substantial use of.

In this article, we discuss trends, risks, and forecasts in social security spending.

Trends in Spending

Scotland is spending a rapidly increasing amount on social security.

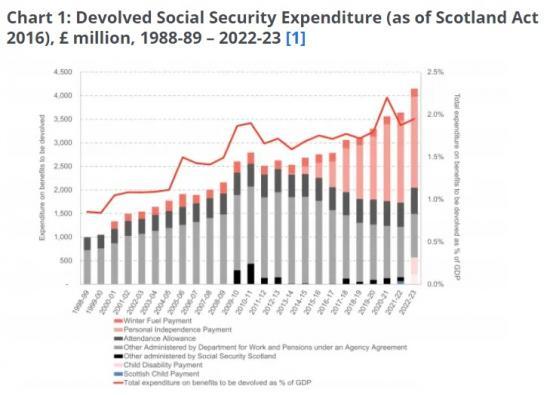

Devolved social security makes up around 10% of the Scottish Budget in 2023-24, up from 7.5% in 2017-18.

In cash terms, the amount paid out in devolved social security benefits has increased by over £1 billion in the past five years, from £3 billion in 2017-18 to over £4.1 billion in 2022-23 - growing at an annual average of 6.9%. See Chart 1.

So, what's driving this increase in spending?

A big chunk of the increase in cash terms comes from uprating for inflation and population growth. For example, in the 2023-24 financial year benefits received a 10.1% increase (in line with the September 2022 CPI rate). This added £433 million to spending in 2023-24. The Scottish Government will announce on 19 December what policy in this area will be for 2024-25, but in the absence of any statements indicating a new policy, it would be reasonable to assume the same uprating policy will be in place this year - which would also match what the UK Government announced in the Autumn Statement. This will mean uprating benefits by 6.7%.

The remaining part of the increases can be explained by the introduction and expansion of devolved social security programs administered by Social Security Scotland. Some benefits are still in the process of being transferred from the Department of Work and Pensions (DWP) to Social Security Scotland, such as Winter Fuel Payments which have just been fully operationally devolved from next year onwards.

Most (over 80%) of the increase in social security spending over the past year is focused on two benefits:

Adult Disability Payment (ADP) and Personal Independence Payment, increasing by £642 million and

Scottish Child Payment, increasing by £216 million.

The Scottish Child Payment is a new social security program, launched in February 2021, and is expected to increase from £56m in 2021-22 to £442m in 2023-24 – £80m higher than initially forecasted in December 2021. This is because eligibility was extended to include all children under 16 in low-income families and the increase in the weekly payment rate from £20 to £25.

Some modelling suggests it could lift around 50,000 children out of poverty in 2023-24. It’s the flagship policy for meeting statutory targets to reduce relative child poverty to 10% by 2030, so it is clear why the Scottish Government are spending a large chunk of the budget on it.

The ADP is Scotland’s replacement for the main disability benefit for people of working age, namely the Personal Independence Payment (PIP). Launched in August 2022, the shift from the DWP to Social Security Scotland is ongoing and expected to take two years.

The Scottish Fiscal Commission anticipates higher spending on ADP due to the "friendlier" application process, which is likely to lead to more claimants. It is forecasted that the caseload will increase from around 420,000 in 2023-24 to 660,000 in 2028-29.

However, these estimations are quite uncertain, as we are not yet sure how many people will successfully take up this benefit.

Another reason for the increased caseload is because there is growing demand for disability payments across the UK.

While the reasons for this aren’t yet fully clear, the SFC and the Institute for Fiscal Studies point to increasing NHS waiting times, economic inactivity due to ill health, and people being more likely to seek support in response to the rising cost of living. All of this drives higher caseloads and puts additional pressure on spending.

This trend is expected to add £60 million to spending in 2023-24, reaching £223 million in 2027-28. But, since this trend is happening nationwide, it could also mean increased funding provided by the UK Government.

Risks in Managing Spending

The main risk that the Scottish Government faces is the difficulty in managing a demand led program through a fixed budget for social security spending.

The UK government adjusts the Barnett formula allocation to fund social security provision in Scotland at UK rates, but the Scottish Government has widened the scope of existing payments and introduced additional payments, such as the Scottish Child Payment.

Read the full article from Fraser of Allender HERE