Catastrophic Caps - An Analysis Of The Impact Of The Two-child Limit And The Benefit Cap

1st February 2024

In the benefit system, entitlement and need are intertwined: the greater the need, the more benefit income a family is usually entitled to receive. But in the 2010s, two policies were introduced that delinked entitlement and need by limiting the amount of benefits some families could receive: the benefit cap in 2013, and the two-child limit in 2017.

At present, nearly half a million families are hit by at least one of these policies. Although the benefit cap affects out-of-work families only, this is not the case for the two-child limit, and six out of ten families affected by the two-child limit today contain at least one adult that is in work.

The two-child limit results in low-income families losing around £3,200 a year for any third or subsequent child born after April 2017. And when 100,000s of families lose out on £1,000s of benefit income a year, poverty rates soar. In 2013-14, 34 per cent of children in larger families were in poverty, but this is projected to rise to 51 per cent in 2028-29.

In contrast, the proportion of two-child families in poverty is projected to remain more or less constant over the same 15-year period, at around 25 per cent. Other outcomes are also worse for larger families: in the year 2021-22, three-quarters (75 per cent) of larger families were in material deprivation, compared to 3-in-10 families with fewer than three children (34 per cent); and 16 per cent of larger families were in food insecurity, compared to 7 per cent of families with fewer than three children.

Abolishing the two-child limit would cost the Government £2.5 billion in 2024-25, rising to £3.6 billion in 2024-25 prices if the policy were at full coverage. These costs are low compared to the harm that the policy causes, and scrapping the two-child limit would be one of the most efficient ways to drive down child poverty rates. If abolished today, 490,000 children would be lifted out of poverty.

There are two especially sharp corners in the benefits system today

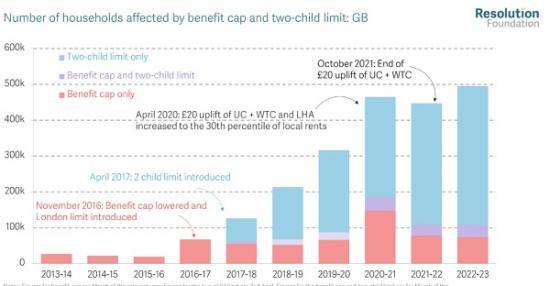

Over the last decade, successive UK governments have introduced two policies that undermine the core principle of connecting need and entitlement in the benefit system. The first was the benefit cap, introduced in April 2013, which puts an upper limit on the amount of benefit income out-of-work households can receive.[1] The second was the two-child limit, which prevents the vast majority of families from receiving means-tested benefit support for any third or subsequent children born from April 2017 onwards.[2] These two policies together affected nearly half a million families in Great Britain in 2022-23, including 34,000 who are affected by both (see Figure 1), up from 26,000 in 2013-14 (when only the benefit cap was in operation). [3] [4]

There are several reasons for the over-ten-fold growth over the past nine years. Consider the benefit cap, where the numbers affected have increased from around 26,000 in 2013-14 to 108,000 families in 2022-23. The cap's real value has fallen every year since its introduction, with the solitary exception of April 2023 when it was uprated in line with inflation: it was cut in nominal terms in 2016, and frozen in all other years.

As a result, by April 2024, the benefit cap will be worth £14,000 less in real terms for families outside of London, and £10,000 less for those in London, than it was at its introduction in 2013.[5] The impact of this can be seen very clearly in Figure 1: when benefits were substantially increased in April 2020 (when the £20 a week uplift to Universal Credit (UC) and Working Tax Credit (WTC) was in place and Local Housing Allowance (LHA) was increased to the 30th percentile of local rents), the number of households affected by the benefit cap surged.

The numbers affected by the two-child limit are inevitably growing over time because of its design: it affects families who have a third or subsequent child born after 6 April 2017. In 2018, just 70,000 families were affected by the two-child limit; by 2023, that figure had risen to 420,000, or nearly a quarter (24 per cent) of families with three or more children. When the two-child limit is fully rolled-out and affects all families with three or more dependent children regardless of their age, it is set to affect around 750,000 families.[6]

Self-evidently, it is larger families who are worse off as a result of the two-child limit. In 2023-24, families capped by the two-child limit lose up to around £3,200 a year in benefit support for their third and each subsequent child.[7] Although a range of different families are affected by the two-child limit, disadvantaged groups are disproportionately represented: almost half of the households affected by the two-child limit are single parent families, for example.

Families with more than one child are also more likely than childless or one-child families to hit the benefit cap (claimants are also more likely to be capped if they live in areas with higher private rents). That policy results in differently sized losses dependent on circumstances, but the latest data suggests affected families lose an average of £2,700 a year if benefit capped.

However, there are key differences between the types of families affected by the two policies. The benefit cap only affects non-disabled, non-carer out-of-work families earning less than £722 a month, the equivalent of 16 hours a week at the National Living Wage, but the two-child limit applies no matter the working patterns of the parents. Strikingly, nearly six-in-ten families affected by the two-child limit are in families with income from employment.

Families with three or more children have seen their poverty rates soar in recent years

The effect of losing such a large amount of money has a detrimental effect on the low-income families involved. Figure 2 shows rates of relative child poverty by the number of children in a family. The first thing to note is that child poverty rates for larger families have been consistently higher than those for smaller families. This reflects, in part, parental employment patterns: the more children a family has, the less likely the adults in the household are to be in full-time work or to work at all (especially in the case of single parents, and parents with younger children).

But the trends in the figure also reflect the benefit system and how it operates and has changed: the gap between the child poverty rates of smaller and larger families has not been static over time. There was a large fall in the poverty rate for larger families in the 2000s, which can be attributed in large part to the significant increase to per-child payments; firstly through the Working Families' Tax Credit and other means-tested benefits (from autumn 1999), then through the Child Tax Credit (from April 2003). In addition, employment rates for parents rose in the 2000s (until the 2008 recession), particularly for lone parents, where 9 percentage points more were in work in 2010 than 1997.

However, the child poverty rates of larger families started rising from 2013-14 and, after some blips through the pandemic years, are forecast to continue the upward trend. As a result, 34 per cent of children in larger families were in poverty in 2013-14, and this is projected to rise to 51 per cent in 2028-29. In contrast, 25 per cent of children in families with two children were in poverty in 2013-14, and this is forecast to hardly change over the next few years (we forecast a rate of just 24 per cent in 2028-29). It is well-evidenced that cuts to benefit spending during the austerity years were concentrated on child-related expenditure, while working-age benefit expenditure stayed consistent during the 2010s, and the benefit cap and two-child limit intensified the income hit for those with multiple children. It is also worth noting that for eldest children born before the introduction of the two-child limit, families receive a higher amount of child-related elements of means-tested benefits (this higher element does not exist for children born after the introduction of the two-child limit).

But it's not just in statistical measures of poverty where we can see a divergence in outcomes for larger families. There is a clear difference in families' lived experience between those with one or two children, and those with three or more. For example, three-quarters (75 per cent) of larger families were in material deprivation in 2021-22, compared to 3-in-10 families with less than three children (34 per cent); 16 per cent of larger families were in food insecurity, compared to 7 per cent of families with fewer than three children (see Figure 3).[8] It is also no surprise today that larger families have especially struggled during the cost of living crisis. Findings from the Resolution Foundation's cost of living survey in October 2023 show that people in families with three or more children were over four times as likely to have used a food bank in the last 30 days (13 per cent) compared to those with no children, or one or two children (3 per cent), as Figure 3 shows.[9]

The impact of the two-child limit will worsen over time

As Figure 2 also makes clear, our forecasts imply that child poverty rates for families with three or more children are set to rise further in the coming years: by 2028-29, we project more than half (51 per cent) of children in larger families will be living in relative poverty, a higher rate than in 1996-97 (48 per cent). This is partly because the reach of the two-child limit will increase over time.

As stated earlier, the policy applies only to third or subsequent children born from 6 April 2017 onwards, so its full impact will not be felt until 2035. Figure 4 shows the impact that the policy is having on household incomes, both at its current stage and if it were fully rolled out. In 2024-25, the lowest-income households would be an average of £1,000 worse off a year as a result of the two-child limit, equivalent to 4 per cent of their overall income (this is averaged across all working-age households, and not just those with children). When the policy reaches a steady state, then this fall would increase to £1,500, or 6 per cent of annual income. The effect of this on the families affected is substantial: under a fully rolled out two-child limit, we estimate 590,000 more children would be in relative poverty than if the two-child limit did not exist.

The two-child limit is not meeting its own criteria for success, and should be abolished

That said, the impact of the two-child limit would not be as stark as the ‘fully rolled-out' picture presented in Figure 4 if the policy achieved its stated aim of ensuring "families on benefits face the same financial choices about having children as families who are supporting themselves solely through work". By this logic, the number of births into low-income families with three or more children should have fallen since the introduction of the two-child limit in 2017. To date, however, studies suggest that there has been only a small fall in the number of births in families that would be affected as a result of the policy. This is unsurprising: qualitative work investigating the effect of the two-child limit on fertility decisions has shown, for example, that half the participants were unaware of the policy when their third or subsequent child was conceived. Equally, families are often unable to predict whether they would be affected by the policy at a later date: a parent could be in well-paid employment at the time of conception (and so not be eligible for Universal Credit), but face unemployment later in the child's life.

The evidence is weak, then, that the two-child limit is delivering on its rationale. Add to this the detrimental effect the policy has on the incomes of affected families, and the inevitable increase in child poverty as the policy affects more and more families, and it is hard not to conclude that the time is ripe to abandon the policy altogether. We estimate that abolishing the two-child limit would cost the Government around £2.5 billion in 2024-25[10]; this cost would rise over time, reaching £3.6 billion in 2024-25 prices by 2035 (the point at which the policy will be fully rolled-out).

Scrapping the two-child limit and the benefit cap would boost the incomes of the poorest families by £1,000 next year

Abolishing the two-child limit would provide a major boost to the incomes of many of the poorest families in the UK today. But as we noted at the outset, whenever benefit rates increase, the numbers affected by the benefit cap also rise. This would especially be the case if the two-child limit were removed, given the strong overlap between the types of families affected by either policy. If the two-child limit were scrapped, we estimate that 9 per cent (39,000) of families wouldn't see the full gains because they would become newly affected by the benefit cap, on top of the 8 per cent who would see no gain at all due to already being subject to the benefit cap.[11] This would represent around a one-third (36 per cent) increase in the total affected by the benefit cap this year.

The impact of the benefit cap could be softened if the Government committed to uprating its value annually. But, in a similar vein to the two-child limit, it is hard not to conclude the benefit cap is a policy that has hardly met its stated objectives while impoverishing so many. Although the policy succeeds at reducing spending, the Government's own review suggests that the benefit cap has only been partially successful in getting people into work or moving to lower-cost areas: 19 per cent of capped households were in work after a year, for example, compared to 11 per cent in the control group (these numbers increased slightly after the cap was lowered in 2016). Similarly, marginally more people moved house in the benefit capped group compared to the control group; reasons why people didn't move included a lack of affordable properties and the high costs associated with moving.

Scrapping the benefit cap alongside the two-child limit would mean large income gains for some of the poorest families in the UK, as Figure 5 shows. We estimate that scrapping both policies would lead the lowest-income households to be on average £1,000 better-off in 2024-25, equivalent to a 5 per cent boost to incomes in this group (as above, this is an average over households with and without children: for the specific families affected by both policies, the increase would be far larger than this). Taken together, abolishing the two-child limit and the benefit cap would cost the Government £3 billion.

The cost of abolishing the two-child limit and benefit cap is low, but the benefit from removing them is high

The cost of abolishing the two-child limit in 2024-25 is just £2.5 billion, and abolishing the benefit cap with it would bring the cost up to £3 billion. While energy in the benefits policy sphere has often focused on improving benefit uprating or adequacy, abolishing the benefit cap and two-child limit would make a more immediate difference for the close to 500,000 families affected by these policies. Therefore, to ensure meaningful income growth for the lowest-income families, and to prevent ever increasing numbers of large families from falling into poverty, the Government should abolish the two-child limit and benefit cap.

[1] The benefit cap in London is £16,967 for single adults without children and £25,323 for couples or single parents. The benefit cap in the rest of the UK is £14,753 for single adults without children and £22,020 for couples and single parents. Families that include an adult unable to work due to health or a disability are exempt from the benefit cap, as are those where any member (including children) is in receipt of disability benefits. See: GOV.UK, Benefit Cap, accessed 13/12/2023, for further details. Note that the Scottish government provide Discretionary Housing Payments to mitigate the impact of the benefit cap. See: Scottish Government, Helping families with their living costs, accessed 3 January 2024, for more information.

[2] Exemptions exist for families who have a third or subsequent child because of multiple births, adoption, non-parental caring arrangements, and non-consensual conception. See GOV.UK, Families with more than 2 children: claiming benefits, accessed 13/12/2023, for more details. The family element of Child Tax Credits was also abolished for claims started after 6 April 2017, worth up to £545 in 2023-24.

[3] Throughout this spotlight, we use the term ‘families’ as a shorthand for benefit unit. A benefit unit is defined as a single adult along with any co-habitating partner and dependent children.

[4] There is comprehensive academic work that examines the impact of the benefit cap and two-child limit on larger families. See: R Patrick et al., Needs and entitlement: Welfare reform and larger families, Benefit changes and larger families, July 2023.

[5] See: A Clegg, A temporary thaw: An analysis of Local Housing Allowance uprating over time, Resolution Foundation, December 2023 for further details.

[6] It is difficult to know how many families will be impacted by the two-child limit once it reaches full coverage in 2035. The IFS estimate that 750,000 families will be affected at that point. In 2022-23, there were 770,000 families with three or more children receiving benefits affected by the two-child limit, meaning if the policy were at full coverage then, that many families would have been impacted.

[7] £3,200 is the maximum loss: families would lose less if the level of their earnings meant that their annual UC entitlement was less than this figure.

[8] Material deprivation is a measure of whether a family can afford certain goods and services. Our approach to measuring material deprivation follow’s the DWP approach (see Department for Work and Pensions, Quality and methodology information report, accessed 8 January 2024), and is based on nine questions from the Family Resources Survey. Prevalence weighting is used to combine these measures into one indicator. For more information, see Box 1 of O El-Dessouky & C McCurdy, Costly differences: Living standards for working-age people with disabilities, Resolution Foundation, January 2023.

[9] This research uses data from three online surveys conducted by YouGov. Fieldwork for the more recent one was undertaken online during 13-17 October 2023, and the total sample size was 8,378 UK adults aged 18 and over. All figures have been weighted and are representative of all UK adults. The figures presented from the online surveys have been analysed independently by the Resolution Foundation. The views expressed here are not the views of YouGov. We are grateful to The Health Foundation for funding this survey.

[10] A major uncertainty associated with this costing is how many of the families that become newly entitled to UC as a result of abolishing the two-child limit would actually claim UC in practice.

[11] Estimate of those newly affected by the benefit cap calculated by taking the number of families affected by the benefit cap and two-child limit away from the number of families in work affected by the two-child limit, then multiplying this number by the proportion of families with three or more children benefit capped in March 2017, the last data point before the two-child limit was introduced. However, the fall in the real-terms level of the benefit cap since then means that this is likely to be a conservative estimate.

Author

Lalitha Try - Economist

Read the Resolution Foundation report with all the graphs HERE