GDP First Quarterly Estimate, Uk - October To December 2023 - Technical Recession With Two Quarters Fall

15th February 2024

UK gross domestic product (GDP) is estimated to have fallen by 0.3% in Quarter 4 (Oct to Dec) 2023, following an unrevised fall of 0.1% in the previous quarter.

While the economy has now decreased for two consecutive quarters, across 2023, GDP is estimated to have increased by 0.1% compared with 2022.

In output terms in Quarter 4 2023, there were falls in all three main sectors in the latest quarter with declines of 0.2% in services, 1.0% in production, and 1.3% in construction output.

In expenditure terms, there was a fall in the volume of net trade, household spending and government consumption in Quarter 4 2023, partially offset by an increase in gross capital formation.

This release includes revisions to periods Quarter 1 (Jan to Mar) to Quarter 3 (July to Sept) 2023, where growth in Quarter 1 2023 has been revised down by 0.1 percentage points, while total GDP in Quarter 2 (Apr to June) and Quarter 3 2023 are unrevised.

Historically, the absolute average revision between the initial quarterly GDP estimate and the estimate three years later is 0.2 percentage points, when more detailed information is available through the comprehensive annual supply and use balancing process.

Headline GDP figures

UK real gross domestic product (GDP) is estimated to have fallen by 0.3% in Quarter 4 (Oct to Dec) 2023. This follows an unrevised estimated fall of 0.1% in the previous quarter. Across Quarter 3 (July to Sept) and Quarter 4 2023, we estimate that the UK economy contracted by a cumulative 0.5%. Compared with the same quarter a year ago, real GDP is estimated to have fallen by 0.2%.

As explained in our Communicating the UK economic cycle methodology, the concept of a "technical" recession includes two or more consecutive quarters of contracting output. Most experts, as noted in our recent blog, consider other factors in the broader picture while accounting for the latest data, such as the depth, diffusion (how widespread), and duration of the change in GDP.

UK GDP is estimated to have increased by 0.1% in 2023, following growth of 4.3% in 2022. This is the weakest annual change in real GDP since the financial crisis in 2009, excluding the year 2020, which was affected by the coronavirus (COVID-19) pandemic. Data up to 2021 have been reconciled through the supply and use tables (SUTs) framework to produce one coherent estimate of GDP, as explained in our Impact of Blue Book 2023 changes on gross domestic product article.

Estimates of real GDP in 2022 and 2023 have not been fully reconciled in a SUTs framework, so this estimate of real GDP growth in 2023 reflects the average of the output, expenditure and income measures. There can be differences in the three approaches, reflecting data uncertainty at this stage. Statistical discrepancies published in our GDP data tables show how far apart the measures are at this stage in the production cycle (Figure 3). Further information on the three approaches to measuring GDP is discussed at the end of this section.

Nominal GDP is estimated to have fallen by 0.2% in Quarter 4 2023, attributed to a fall in gross operating surplus for corporations. Compared with the same quarter a year ago, nominal GDP is estimated to have increased by 5.0%.

The implied GDP deflator represents the broadest measure of inflation in the domestic economy, reflecting changes in the price of all goods and services that comprise GDP. Note that the GDP deflator covers the whole of the domestic economy, not just consumer spending, and also reflects the change in the relative price of exports to imports. For more information on the implied GDP deflator, see our Measuring price changes of the UK national accounts: February 2023 article.

The implied price of GDP rose by 0.2% in Quarter 4 2023, where the quarterly increase is primarily driven by higher prices in exports, government consumption and household consumption. These were partially offset by a fall in the implied price for gross capital formation, as well as an increase in the implied price of imports, which contributes negatively to the GDP implied deflator.

Compared with the same quarter a year ago, there was a continued easing in the GDP implied deflator, which increased by 5.2% (Figure 2).

There have been revisions to the implied deflator from Quarter 1 2023, particularly in Quarter 3 2023, where the implied deflator is estimated to have increased by 0.9%, revised down from the previous estimate of 1.5%. This revision is because of downward revisions in gross capital formation and net trade.

Services

We now estimate that services output decreased for three consecutive quarters, with a fall of 0.2% in the latest quarter. Figure 4 shows that there were falls in 8 out of 14 sub-sectors in Quarter 4 2023.

The largest contributor to the fall in total services was a 0.6% fall in the wholesale and retail trade; repair of motor vehicles and motorcycles sub-sector. This was largely because of a 1.3% fall in wholesale trade, except of motor vehicles and motorcycles and a 0.9% fall in retail trade, except of motor vehicles and motorcycles. Our recent Retail sales: December 2023 bulletin shows that December 2023 was the largest monthly decrease in retail sales since January 2021, when coronavirus (COVID-19) restrictions were in place.

Education also contributed negatively to the fall in services in Quarter 4 2023, with a decline of 0.8% partially attributed to a drop in school attendance. We also estimate that other service activities decreased by 2.4%. This is the third consecutive quarterly fall and the largest quarterly decline in this sub-sector since Quarter 1 (Jan to Mar) 2021. The fall in Quarter 4 2023 was mainly driven by a 3.4% fall in other personal services, where we have seen particular weakness in hairdressing and other beauty treatment over the Christmas period compared with usual.

The largest positive contribution to services growth was from administrative and support service activities, which increased by 0.6%, driven by growth of 6.9% in rental and leasing activities.

Overall, consumer-facing services fell by 0.7% in Quarter 4 2023 and this was largely driven by falls in food and beverage service activities and retail trade, except of motor vehicles and motorcycles. This offset an increase in accommodation services, particularly hotels, which performed strongly in Quarter 4 2023. This follows an unrevised fall of 1.0% in consumer-facing services in Quarter 3 2023, which was the largest decline in consumer-facing services since Quarter 1 (Jan to Mar) 2021.

Annual service sector growth for 2023 is estimated at 0.3% with 7 of the 14 service subsectors showing growth across the year. The largest positive contributor was administrative and support service activities, which increased by 5.8% in 2023. However, this was partially offset by a 1.8% fall in wholesale and retail trade; repair of motor vehicles and motorcycles.

Across 2023, the services sector sees revisions for the following reasons, with only Quarter 1 2023 seeing growth revised from our previous publication, including:

updated input data for the deflator used for telecommunications

updated seasonal adjustment which now uses a complete year of data for 2023

Production

The production sector is estimated to have decreased by 1.0% in the latest quarter after growth of 0.1% in Quarter 3 2023 (unrevised from our previous publication). This reflects a 1.4% fall in October, despite growth in November (0.5%) and December (0.6%). Further information is provided in our GDP monthly estimate bulletins.

Within production, manufacturing was the largest contributor to the 1.0% fall, with 10 out of the 13 manufacturing sub-sectors performing negatively over this period.

Manufacturing output is estimated to have fallen by 0.9% in Quarter 4 2023 after four consecutive quarters of growth. The largest negative contributors are a 7.0% decline in the manufacture of machinery and equipment n.e.c and a 4.7% fall in the manufacture of rubber and plastics products, and other non-metallic mineral products. However, there were some positive movements in manufacturing, as shown in Figure 5. In particular, the manufacture of transport equipment grew by 1.8%. Anecdotal evidence from the Society of Motor Manufacturers and Traders (SMMT) reported that car manufacturing for December 2023 was up 20.7% compared with the same month last year.

Elsewhere in the production sector, there was a 3.0% fall in mining and quarrying, which fell for the sixth consecutive quarter and a 2.6% fall in electricity, gas, steam and air conditioning supply. However, water supply; sewerage, waste management and remediation activities increased 0.5% on the quarter.

Annual production output is estimated to have fallen 0.3% in the year 2023. This was caused mostly by a 14.3% fall in mining and quarrying as well as falls in water supply; sewerage, waste management and remediation activities; and electricity, gas, steam and air conditioning supply, despite manufacturing showing 1.2% growth in 2023.

Across 2023, the production sector sees revisions to growth, mainly driven by manufacturing. Overall, the revisions to production reflect:

late and updated monthly business survey data, particularly for the manufacturing sub-sector

updated seasonal adjustment, accounting for a full year's worth of data for 2023

Construction

Construction output is shown to have fallen by 1.3% in Quarter 4 2023 following growth of 0.1% (previously estimated to be 0.4%).

The fall reflects a fall in new work of 5.0%, though there was growth of 4.0% in repair and maintenance. Within new work, private housing sees its fifth consecutive quarterly decline, falling 8.0% in the latest quarter.

Revisions to construction from Quarter 1 2023 are attributed to new survey data and improvements to repair and maintenance deflators.

In the year 2023, construction is estimated to have grown 2.0%. Further detail on construction output can be found in our Construction output in Great Britain releases.

Expenditure

There was a fall in the volume of net trade, household spending and government consumption in Quarter 4 (Oct to Dec) 2023, partially offset by an increase in gross capital formation (Figure 6).

Household consumption

There was a fall of 0.1% in real household expenditure in Quarter 4 2023, following a downwardly revised fall of 0.9% in Quarter 3 (July to Sept) 2023 (previously estimated as a 0.5% fall). In 2023, household consumption is estimated to have increased by 0.3%, following an increase of 4.8% in 2022.

Within household consumption, the largest contributions to the fall in the latest quarter were from lower spending on recreation and culture, miscellaneous goods and services, and transport. Net tourism contributed positively to growth in the latest quarter. Information on how we measure net tourism is provided in our National Accounts articles: Treatment of tourism in the UK National Accounts article.

Revisions in household consumption reflect updated data on transport, housing, and water, gas and electricity spending. There are also revisions to net tourism because of updated International Passenger Survey data (see our Definitions and conventions for UK household final consumption expenditure methodology). While household consumption sees revisions because of net tourism, these are offset within trade and, therefore, there is no impact on the gross domestic product (GDP) aggregate.

Consumption of government goods and services

Real government consumption expenditure fell by 0.3%, following a revised increase of 1.1% in Quarter 3 2023 (previously estimated to have increased 0.8%). In 2023, government consumption is estimated to have increased by 0.6%, following an increase of 2.3% in 2022.

The fall in government consumption in the latest quarter mainly reflects lower activity in education and health. The fall in health may reflect lower activity because of industrial action across the quarter. Further information is provided in our GDP monthly estimate bulletins.

Revisions to government consumption reflect updated data on public administration and defence, and health.

Gross capital formation

Gross fixed capital formation (GFCF) is estimated to have increased by 1.4% in the latest quarter, following a revised fall of 1.4% in the previous quarter (previously estimated as a 1.6% fall). Growth in the latest quarter was driven by increases in other buildings and structures. Within gross fixed capital formation, business investment is estimated to have increased by 1.5%, following a 2.8% fall in Quarter 3 2023.

Across 2023 as a whole, gross capital formation is estimated to have increased by 2.9% with a 6.1% increase in business investment. This reflects strong growth in Quarter 1 2023 as businesses brought forward investment in response to the super-deduction allowance expiring on 31 March 2023, as well as a large increase in transport investment (particularly aircraft imports from the United States) in Quarter 2 (Apr to June) 2023.

There have been revisions to the path of business investment in 2023, reflecting revised survey data and the latest seasonal adjustment.

Excluding the alignment and balancing adjustments, early estimates show that inventories increased by £1.8 billion in Quarter 4 2023. In current price terms, early estimates show that there was a fall of £3.6 billion in the latest quarter.

Net trade

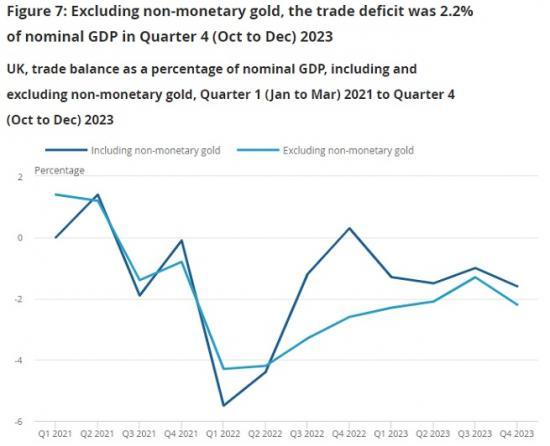

The UK's trade deficit for goods and services was 1.6% of nominal gross domestic product (GDP) in Quarter 4 2023. However, this includes non-monetary gold, which is an erratic series so it can be useful to exclude this from the trade balance. Excluding non-monetary gold, the trade deficit was 2.2% of nominal GDP in Quarter 4 2023 (Figure 7).

Read the full NS report HERE