Big Banks Failing To Offer More Competitive Savings Rates, Updated Figures Show

20th February 2024

Analysis using the Moneyfacts Consumer Duty Audit Tool for Savings indicates that big banks are still failing to make their easy access rates more competitive, despite continued focus from the Financial Conduct Authority around Consumer Duty.

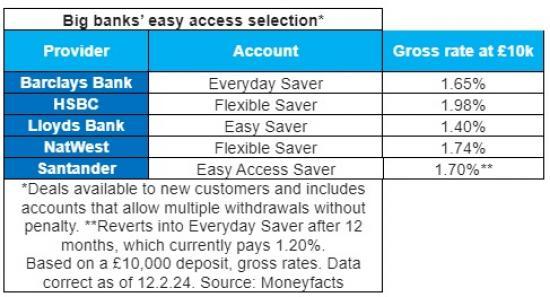

The big banks' flexible easy access accounts* all remain in the bottom quartiles, and all now pay less than 2% on their easy access rates: Barclays Bank (third quartile), HSBC (third quartile), Lloyds Bank (bottom quartile), NatWest (third quartile) and Santander (third quartile).

As recently as November, all of these banks did at least offer a fixed rate bond in the top quartile of the market - now only Barclays Bank does.

James Hyde, Spokesperson at Moneyfacts, said, "Despite the continued focus on the passing of interest rates onto savers, the big five banks are still yet to make their easy access rates more competitive in relation to the rest of the market.

"The big banks' most accessible no notice accounts remain in the bottom quartiles of the market, with the only rate change to these products in recent months being Santander slashing the interest paid on its Easy Access Saver from 2.50% to 1.70%. That account sits alongside the equivalent products from Barclays, HSBC and NatWest, towards the bottom of the third quartile, while Lloyds Bank's 1.40% offering does occupy the bottom tier.

"The Financial Conduct Authority's regulations around Consumer Duty directed financial services institutions to offer fair value, and the big banks are still failing in some areas to meet those expectations. With new rules regarding closed accounts coming into effect this summer, it remains to be seen if there is more urgency to improve rates going forward.

"Having all offered fixed rate bonds that sat in the top quartile of the market as recently as November, only Barclays Bank remains in that top group - but the other four have seen their products become less competitive in the market, with all dropping to the second quartile.

"As always, it is down to customers to proactively monitor savings rates and switch if they feel their loyalty is not being adequately rewarded."

Fixed bond data extracts from using the Moneyfacts Consumer Duty Tool for Savings (Data correct as of 12 February 2024):

Barclays Bank - The one-year fixed rate bond pays 4.65% and sits in the top quartile. For some term options, Barclays Bank Premier Banking customers can earn higher rates. To qualify for these accounts customers must meet the eligibility criteria - either paying in gross annual income of at least £75,000 or hold savings and investments totalling a minimum of £100,000. These requirements are out of bounds for the vast majority of everyday banking customers.

HSBC - Fixed Rate Savings accounts paying gross rates of 4.35% for one year, and 4.05% for two, are available to new and existing HSBC current or savings account holders. Both accounts have dropped into the second quartile recently.

Lloyds Bank - All the bonds offered by Lloyds Bank have fallen into the second quartile, having recently sat in the first. Customers who have held a current account for at least 40 days can benefit from an increased rate of up to 0.20%, however, new customers are eligible for gross interest of 4.15% on a one-year fixed term, or 4.00% for two years.

NatWest - NatWest's fixed terms also occupy the second quartile of the market. The one-year option pays 4.22%, while as typical in the market right now the two-year account pays less at 3.74%. These accounts are restricted to current account holders, either new or existing.

Santander - All of Santander's fixed rate bonds currently sit in the second quartile, with its one-year fixed bonds having previously been in the top tier. While Private Banking or Select customers are offered preferential rates of 0.05% higher than the everyday customer, the ordinary one-, two- and three-year bonds all pay 4.10%, 3.85% and 3.70% gross respectively for new customers.

There is also an option to receive interest monthly rather than yearly on these accounts, but the rate on each term is up to 0.08% lower in this case. The usual fixed rate restrictions apply, such as further additions and withdrawals are not permitted.

https://moneyfactscompare.co.uk/savings-accounts/easy-access-savings-accounts/