Public Sector Finances, Uk - January 2024 Ons Report

22nd February 2024

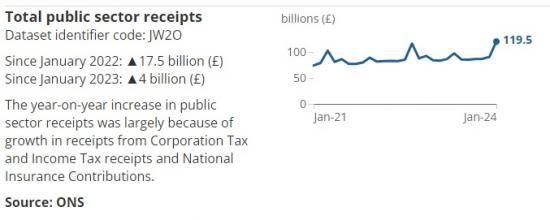

Public sector net borrowing excluding public sector banks (borrowing) in January 2024 was in surplus by £16.7 billion, more than double the surplus of January 2023 and the largest surplus since monthly records began in 1993 in nominal terms.

Each January tax receipts are always higher than in other months, owing to receipts from self-assessed taxes; combined self-assessed income and capital gains tax receipts were £33.0 billion, £1.8 billion less than a year earlier.

Borrowing in the financial year-to-January 2024 was £96.6 billion, £3.1 billion less than in the same ten-month period a year ago; this is the first time in the present financial year that year-to-date borrowing has been lower than in the equivalent period in the last financial year, partly because central government receipts have been revised.

Public sector net debt excluding public sector banks (debt) was £2,646.5 billion at the end of January 2024 and was provisionally estimated at around 96.5% of the UK's annual gross domestic product (GDP); this is 1.8 percentage points higher than in January 2023 and remains at levels last seen in the early 1960s.

Excluding the Bank of England, debt was £2,417.6 billion, or around 88.1% of GDP, £228.9 billion (or 8.4 percentage points) lower than the wider measure.

Public sector net worth excluding public sector banks was in deficit by £677.5 billion at the end of January 2024; this compares with a £576.5 billion deficit at the end of January 2023.

Central government net cash requirement (excluding UK Asset Resolution Ltd and Network Rail) was in surplus by £19.5 billion in January 2024, a £1.4 billion lower surplus than in January 2023.

Read the full report HERE

Pdf