Losers From the Budget - Pensioners and Low Income Earners

9th March 2024

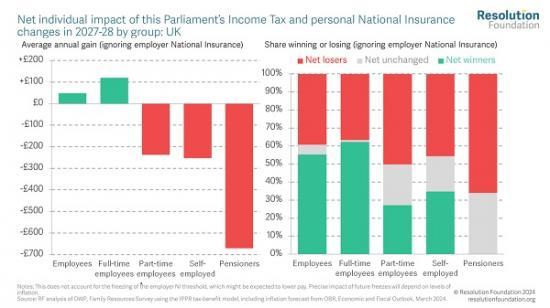

So much talk about the cut in national insurance but if you are a pensioner you re going to pat more in tax due to the freezing of allowances. Low earners also gain little from the reduction in National Insurance and will also see their tax rise due to the freeze on allowances.

Torsten Bell at the Resolution Foundation sets it out.

Hang on, you've heard that personal taxes are going up - and they are by £21 billion. But the majority of employees are seeing their tax bills fall. So, where's the money coming from? Now it's time to set out the losers. To start, £8 billion is being raised by the freezes to thresholds for employer NI.

The politics of raising taxes on firms not people is easier, but in time this will feed through into lower pay levels for employees. And then we come to the biggest group of losers: pensioners, who are already exempt from NI but affected by freezes to Income Tax thresholds. All eight million taxpaying pensioners will see their taxes increase, by an average of £1,000 - an £8 billion collective hit.

The Chancellor's approach to targeting tax cuts through National Insurance is perfectly justifiable, even if affordability concerns haven’t been addressed (we’ll come to that).

The focus on working-age employees reflects that they already pay higher rates of tax than pensioners or landlords. Furthermore, pensioners’ income growth has outstripped that of working households for some time.

But this is also a staggering turnaround from the approach of Conservative governments since 2010, who have generally focused support on pensioners (hello the triple lock).

The pivot to policies that benefit younger, and hit older, voters is quite something - even if it’s been lost in the usual Budget fog. We can see it if we look at all tax and benefit measures announced this parliament: they boost the incomes of adults aged under 45 by £590, while households headed by someone aged 66 and over will see losses of £770 on average.

This is the Conservative core vote losing out, as the next chart spells out. Whether this is an intentional choice to pivot towards those the Tories are struggling to win over, or a bit of an accident, is far from clear. Economically this is the right approach to tax reform, but it’s one hell of a political gamble.

https://www.resolutionfoundation.org/comment/budget-watch/

Read the full budget article HERE