GDP Monthly Estimate UK - January 2024

13th March 2024

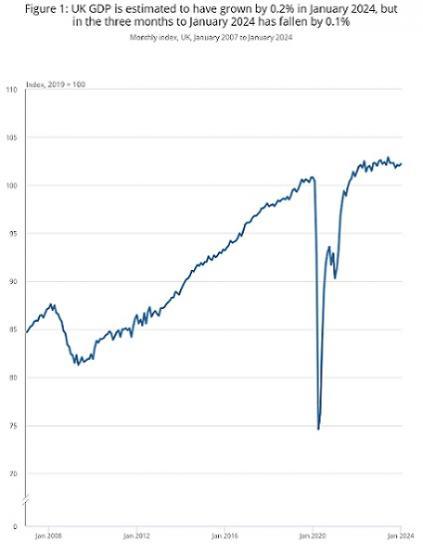

Monthly real gross domestic product (GDP) is estimated to have grown by 0.2% in January 2024, following a fall of 0.1% in December 2023.

Real GDP is estimated to have fallen by 0.1% in the three months to January 2024, compared with the three months to October 2023.

Services output grew by 0.2% in January 2024 and was the largest contributor to the rise in GDP, but in the three months to January 2024 services output showed no growth.

Production output fell by 0.2% in January 2024, and in the three months to January 2024 production output also fell by 0.2%.

Construction output grew by 1.1% in January 2024, but in the three months to January 2024 construction output fell by 0.9%.

Monthly GDP

Real gross domestic product (GDP) is estimated to have fallen by 0.1% in the three months to January 2024, compared with the three months to October 2023. Services output showed no growth in this period, while production output fell by 0.2% and construction output also fell, by 0.9%.

Monthly GDP is estimated to have grown by 0.2% in January 2024, following a fall of 0.1% in December 2023. There are no periods open for revision in this publication.

Services output grew by 0.2% in January 2024 after a fall of 0.1% in December 2023, and was the largest contributor to the growth in monthly GDP. Construction output also grew in January 2024, by 1.1%, after a fall in December 2023, of 0.5%. While production output fell by 0.2% in January 2024 after a growth of 0.6% in December 2023.

The services sector

Overall, the services sector is estimated to have shown no growth in the three months to January 2024 compared with the three months to October 2023, with 6 of the 14 subsectors declining over this period.

Education was the largest negative contributor to services output in this three-month period, falling by 1.7%. Wholesale and retail trade; repair and maintenance of motor vehicles and motorcycles, and finance and insurance activities also fell by 0.4% and 0.5%, respectively.

These falls were offset by growth in 6 of the 14 services subsectors over the same period, with the largest positive contribution coming from growth of 0.8% in professional, scientific and technical activities.

On the month, services output is estimated to have grown by 0.2% in January 2024, following a fall of 0.1% in December 2023, with 9 of the 14 subsectors experiencing growth in January 2024. Figure 3 shows both the monthly and the three-month contributions from the services sector to gross domestic product (GDP) in January 2024.

The largest contribution to the 0.2% growth in services in January 2024 was wholesale and retail trade; repair of motor vehicles and motorcycles, which saw a 1.9% growth on the month, following a 1.9% fall in December 2023. The largest contribution came from retail trade, except of motor vehicles and motorcycles, which grew by 3.4%. More information on this can be found in our Retail sales, Great Britain: January 2024 publication. Wholesale trade, excluding motor vehicles and motorcycles grew by 1.8% while wholesale and retail trade and repair of motor vehicles and motorcycles fell by 3.1%.

Human health and social work activities grew by 0.6% in January 2024 following a 0.9% fall in December 2023. Human health activities grew by 0.9%, mainly caused by growth in the market sector, and was the largest contributor to this growth in January 2024. Education also saw growth on the month, up by 0.7%, following three consecutive monthly declines.

These growths were partially offset by a monthly fall of 0.9% in professional, scientific and technical activities, where five of the eight industries saw falls on the month. The largest contributions came from legal activities (down 3.5%), architectural and engineering activities; technical testing and analysis (down 2.6%), and accounting, bookkeeping and auditing activities; tax consultancy (down 1.8%).

Information and communication fell by 0.7% in January 2024, mainly attributed to a 9.5% fall in motion picture, video and TV programme production, sound recording and music publishing activities.

An overview of data sources used in our estimates of service output can be found in our data sources catalogue. The Monthly Business Survey (MBS) is used for 42.9% of the services sector by industry weight. In January 2024, the turnover response rate for the MBS element of the services sector was 85.3%. We would expect this to increase over time as more responses are received and any new data will be included in future monthly GDP releases. For context the average turnover response rate for the service sector in 2022 now stands at 97.0%.

Consumer-facing services

Consumer-facing services showed no growth in the three months to January 2024 compared with the three months to October 2023. The largest positive contribution over this period was a 5.2% growth in sports activities and amusement and recreation activities, while the largest negative contributor was buying and selling, renting and operating of own or leased real estate, excluding imputed rental, which fell by 1.1%.

Output in consumer-facing services grew by 0.6% in January 2024, following a fall of 0.8% in December 2023 (Figure 4). The largest positive contribution in January 2024 came from retail trade, except of motor vehicles and motorcycles, which grew by 3.4% as published in our Retail sales, Great Britain: January 2024 bulletin. The largest negative contribution to consumer-facing services in January 2024 came from the wholesale and retail trade and repair of motor vehicles and motorcycles industry, which fell by 3.1% in January 2024.

The production sector

Production output is estimated to have fallen by 0.2% in the three months to January 2024 compared with the three months to October 2023, driven by a 3.3% fall in mining and quarrying. The fall in mining and quarrying over this period was mainly caused by declines in the extraction of crude petroleum and natural gas (down 2.8%) as well as other mining and quarrying (down 7.3%), which saw a large fall on the month in January 2024.

Manufacturing output grew by 0.3% in the three months to January 2024, compared with the three months to October 2023. Electricity, gas, steam and air conditioning supply, and water supply; sewerage, waste management and remediation activities fell by 1.6% and 1.0%, respectively, over the same period.

On the month, production output is estimated to have fallen by 0.2% in January 2024, driven by a fall of 2.2% in water supply; sewerage, waste management and remediation activities. This monthly fall in production follows two months of growth in November and December 2023 (0.5% in November and 0.6% in December) and a fall of 1.4% in October.

Mining and quarrying output fell by 1.3% in January 2024, after a fall of 1.8% in December 2023. The January 2024 fall was driven by a 11.4% decline in other mining and quarrying.

Mining and quarrying output is estimated to be 19.3% below its level in January 2022. The decline since January 2022 can be mainly attributed to the extraction of crude petroleum and natural gas. The Department for Energy Security and Net Zero (DESNZ) energy trends publication reports reduced investment in the mature North Sea basin as a reason for the recent downward trend in this industry. Figure 6 shows the longer-term downwards trend in mining and quarrying output.

Electricity, gas, steam and air conditioning supply grew by 0.5% in January 2024 after growth of 1.1% in December 2023. Electric power generation, transmission and distribution grew by 1.0%. This was partially offset by manufacture of gas; distribution of gaseous fuels through mains; steam and aircon supply. This fell by 1.4% after growth of 13.3% in December 2023, which was the strongest growth in this industry since December 2021.

Water supply; sewerage, waste management and remediation activities fell by 2.2% in January 2024 and was the largest contributor to the fall in production output in this period. This was mainly caused by falls in sewerage (down 3.5%), and waste collection, treatment and disposal activities; materials recovery (down 2.1%).

Manufacturing showed no growth in January 2024, with growth in 7 of the 13 subsectors offset by falls in the other 6 subsectors, after growth of 0.8% in December 2023. The largest positive contributions in January 2024 came from manufacture of transport equipment (up 2.3%), other manufacturing and repair (up 1.8%), and manufacture of machinery and equipment not elsewhere classified (n.e.c.) (up 1.7%). The largest negative contributor came from manufacture of basic pharmaceutical products and pharmaceutical preparations (down 5.1%).

The construction sector

Construction output is estimated to have fallen 0.9% in the three months to January 2024 compared with the three months to October 2023. New work decreased 4.5% over the period, while repair and maintenance rose by 4.0%. Within new work, the largest contributor to the decrease came from infrastructure new work, which decreased by 9.3%.

In January 2024, monthly construction output is estimated to have increased 1.1% in volume terms. This follows three consecutive falls in monthly construction output.

The increase in monthly output in January 2024 came from increases in both new work (1.1%) and repair and maintenance (1.2%).

Six out of the nine construction sectors saw an increase on the month; the main contributors to the monthly increase were private new housing, and non-housing repair and maintenance, which increased 2.6% and 1.9%, respectively.

Construction data are sourced from our Monthly Business Survey. For January 2024, the survey turnover response rate for construction was 75.0%. We would expect this to increase over time as more responses are received and any new data will be included in future monthly gross domestic product (GDP) releases. For context, the average turnover response rate in 2022 now stands at 94.6%.

Cross-industry themes

There were some common themes that were anecdotally reported (as part of the Monthly Business Survey (MBS) for production and services) to have played a part in performance across different industries. However, it is difficult to quantify the exact impact.

Comments provided to the MBS for January 2024 suggested some industries saw supply chains impacted by disruption in the Red Sea. These comments to the survey centred in the wholesale and warehousing industries.

Further analysis on the Business Insights and Conditions Survey (BICS) suggested the conflict in the Middle East also impacted industries in the manufacturing sector. While unable to quantify the impact this was cited as the main reason for global supply chain disruption in January 2024 by a range of manufacturing industries, including the manufacture of textiles, rubber and plastic products, food products and electrical equipment.

Like recent months, industrial action was again cited as a reason this month, which may have negatively impacted output. In January 2024, there were six days of industrial action by junior doctors and hospital dental trainees after three days of industrial action took place in December 2023. NHS England reported that 113,779 inpatient procedures and outpatient appointments were rescheduled during the industrial action in January 2024. Industrial action was also cited as a reason in the rail sector and while the industrial action had ceased, the Screen Actors Guild strikes in America were cited as a factor which may have reduced film and TV production this month.

Read the full ONS report HERE