How The National Living Wage Helps The UKs Poorest Households: New Research

14th April 2024

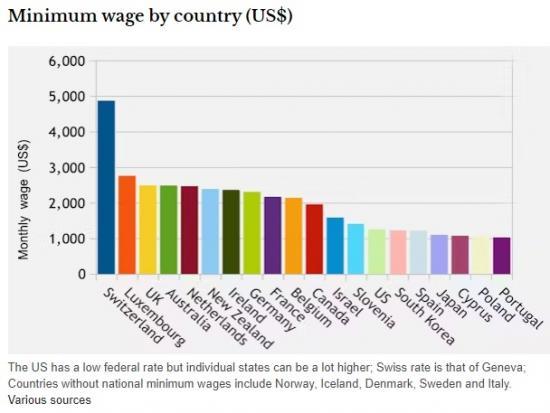

The UK's national living wage has just been raised by 10% to £11.44 per hour. It is now payable for all workers aged 21 and over, where previously it was for those aged 23 and over. Introduced by the Conservative government in 2016 as the flagship policy for boosting the wages of low-paid workers, the national living wage is now one of the highest minimum wages in the world.

It reached 63% of the median wage in the UK in 2023, having been 52% as recently as 2015, and compares favourably to rivals such as France and Germany.

What have been the consequences? Researchers at the Institute for Fiscal Studies (IFS) and University College London and I have sought to comprehensively evaluate the effects on wages, employment and household income. In a new paper published in the Journal of Labor Economics, we looked at the period between 2016 and the last pre-pandemic increase in 2019 (during this time the national living wage was legally binding only for those aged 25 and over, with lower rates applying to younger workers).

Many previous studies have focused on the effects on jobs, but we have analysed this using a new empirical methodology, while for household incomes we used an IFS model of tax and benefits called Taxben, which is the most accurate of its kind in the UK.

Few previous studies have investigated how the distributions of wages and household incomes are affected by minimum wage policies, and most have focused on the US. Minimum wage levels in the US are comparably low, at least at federal level, so we were interested to see how the UK results might differ.

How jobs have been affected

As you might expect, each increase in the national living wage during 2016-19 benefited those whose pay was below that level. On average, 5.4% of low-paid workers received the raises each time.

We find almost equivalent increases in the number of jobs paid at the new minimum wage level and up to approximately £2 per hour above it. So not only has the policy raised wages for low-paid workers, there have been spillover effects on those slightly above the minimum.

Our research suggests that this was achieved with minimal negative effects on employment. Each wage increase reduced employment for those aged 25 and over by an estimated 0.1% of the level of employment before the policy was introduced. This finding aligns with previous studies both in the UK and elsewhere.

Household income

Our analysis reveals that increases in the national living wage considerably benefit poorer households. Every £1 increase in the minimum wage results in an average 0.6% increase in income for households in the bottom half of household incomes, with positive effects fading out rapidly in the upper half.

This effect is similar across the lower half, meaning that the poorest households don't seem to benefit proportionally more than somewhat richer ones. This is partly because earnings represent a lower share of total income for many poor households, since they often do not have anyone in work and so cannot gain from the minimum wage increase.

The poorest households' wage increases are also often offset by benefit reductions. For a £1 increase in the minimum wage, the average increase in earnings among existing minimum wage workers is £30.68 per week. However, after accounting for taxes and reductions in means-tested benefits such as universal credit, net household income increases by £21.60 per week.

It's worth noting that our results differ from what was documented by this 2019 study of the US, which showed that the minimum wage only benefited earners with the very lowest household incomes. This difference is partly because minimum wage workers in the US are predominantly located at the lower end of household incomes, whereas in the UK they tend to be concentrated in the middle (meaning they might be more likely to be living with a higher earning partner, for instance).

Also, minimum wage workers in the UK in the lowest income households tend to gain less from wage increases than in the US because of the simultaneous reduction in benefits, and because they work fewer hours. They also tend to derive a significant proportion of their income from self-employment, which falls outside the scope of the minimum wage.

What it means

Although our analysis only looks at minimum wages in the late 2010s, it hopefully gives a strong indication of how more recent increases will have affected workers' finances and employment overall. However, it will be trickier to separate out effects during the pandemic period because it created such huge economic upheaval.

Our findings indicate that the minimum wage can be a successful policy tool in delivering what it was intended for: boosting the wages of low wage earners.

The fact that this has occurred without reducing overall employment levels, both in the UK and elsewhere, removes one of the main potential objections to the policy.

The effectiveness of minimum wages as policy levers to support the working poor requires careful consideration of how such policies interact with tax and benefit systems. If the UK government wanted to tweak the current system so that the national living wage was more beneficial to the lowest earners, one option would be to reform the tax system so that they paid less tax on each additional £1 of income than they do at present.

Author

Giulia Giupponi - Assistant Professor of Economics, Bocconi University

Note

This article is from The Conversation web site. To read it with links to more information go HERE