Economic Activity And Social Change In The UK - Real-time Indicators

23rd April 2024

Consumer behaviour indicators showed increased activity in the latest week, with aggregate UK spending on credit and debit cards increasing by 1% compared with the previous week and transactions at Pret A Manger stores increasing in 9 of the 10 location categories; meanwhile, overall retail footfall remained broadly unchanged. (Bank of England CHAPS, Pret A Manger, MRI OnLocation). Section 3: Consumer behaviour.

The total number of online job adverts on 12 April 2024 decreased by 2% when compared with the previous week; this was 19% below the level seen for the equivalent period of 2023 (Adzuna). Section 4: Business and workforce.

In March 2024, 5% more firms reported a decrease than an increase in turnover on the previous month, falling from a net increase of 2% in February 2024 (HM Revenue and Customs Value Added Tax returns). Section 4: Business and workforce.

Nearly half (49%) of trading businesses reported they were not considering raising prices in May 2024; in comparison, labour costs (24%) were reported as the top reason for businesses considering doing so, both broadly stable with April 2024 (final results from wave 106 of the Business Insights and Conditions Survey).

In the week ending 14 April 2024, the System Price of electricity decreased by 40%, falling to the lowest level since July 2020, while the System Average Price (SAP) of gas increased by 6%; both remained below the levels seen for the equivalent week of 2023 at 68% and 31% lower, respectively (Elexon, National Gas Transmission). Section 5: Energy.

In the latest week, the daily average number of UK flights increased by 2% when compared with the previous week, and the average traffic camera activity for cars in London increased by 5% (EUROCONTROL, Transport for London). Section 6: Transport.

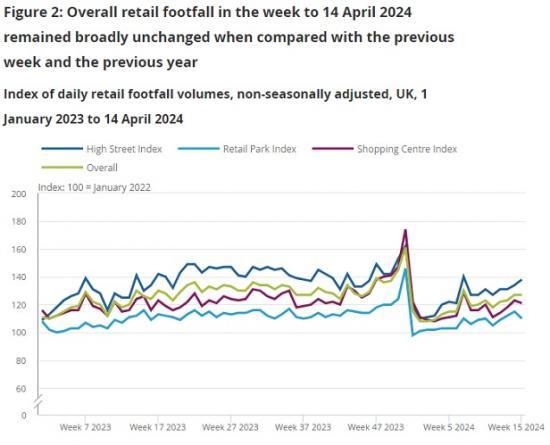

Overall retail footfall in the week to 14 April 2024 remained broadly unchanged when compared with the level seen in the previous week, and also when compared with the level for the equivalent week of 2023.

Retail park footfall decreased to 95% of the previous week, showing the biggest change across the three location categories. High street footfall increased to 103%, while shopping centre footfall decreased to 98%. When compared against the equivalent week in 2023, the largest changes were observed in high street footfall, which increased to 105% of the same week in the previous year, and retail park footfall, which decreased to 95% of the same week in the previous year.

Overall retail footfall decreased in 6 of the 12 UK countries and regions, remaining broadly unchanged in three and increasing in three, when compared with the previous week. The largest change occurred in Northern Ireland, where footfall decreased to 88% of the level seen in the previous week.

When compared against the equivalent week of the previous year, overall retail footfall decreased in 6 of the 12 UK countries and regions. The largest decreases were seen in Northern Ireland and Scotland, falling to 87% and 94% of the equivalent week in 2023, respectively.

Read the full ONS report HERE