Building Societies Strive To Support First-time Buyers

7th May 2024

Building societies are working hard to support first-time buyers, for whom affordability has been cited at its worst for decades. Moneyfactscompare.co.uk reveals the availability and pricing of deals for new buyers with small deposits.

Mutuals have pioneered innovative products and initiatives for buyers, such as the Track Record mortgage from Skipton Building Society, the £5,000 deposit mortgage from Yorkshire Building Society and the partnership between Leeds Building Society and Experian to potentially help consumers to boost their credit score.

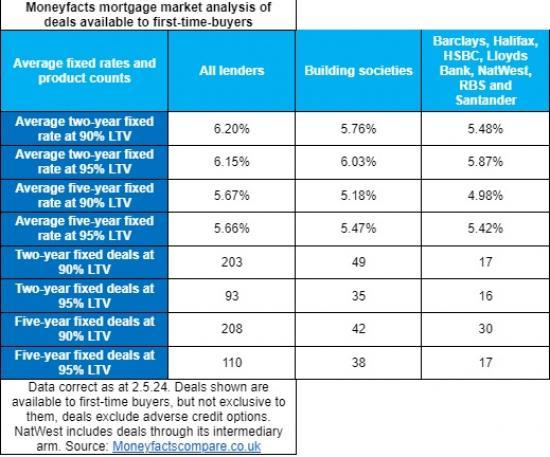

First-time buyers comparing mortgages will find building societies on average price lower than the market averages (90% and 95% loan-to-value, for two- and five-year fixed mortgages).

Out of the seven biggest high street banks, the average rates combined are lower than building societies' (90% and 95% loan-to-value, for two- and five-year fixed mortgages for first-time buyers), but the lowest rate deals might not be the best on a true cost basis.

Rachel Springall, Finance Expert at Moneyfactscompare.co.uk, said "Building societies offer competitive packages for first-time buyers and continue to support those who are the life blood of the mortgage market. Mutuals which offer two- or five-year fixed rate deals available to first-time buyers with a 5% or 10% deposit currently charge less on average compared to the market average in the same space. However, the biggest high street banks offer some of the lowest fixed rates in the same sectors, and indeed seven banks (Barclays, Halifax, HSBC, Lloyds Bank, NatWest, RBS and Santander) are priced lower, on average, than mutuals. High street banks traditionally have more margin to price their mortgages lower, but the lowest rate deal may not be the best choice when all the costs and incentives associated with the mortgage are included. Saving money on the upfront cost of a mortgage is incredibly important for first-time buyers who may have exhausted their cash on a deposit, legal fees and moving costs.

"The key challenge for first-time buyers is affordability, with interest rates higher than they may have expected this year, and affordable housing remaining in short supply. Indeed, to quote Paul Broadhead, Head of Mortgage and Housing Policy at the Building Societies Association (BSA), "becoming a first-time buyer is possibly the most expensive it has been over at least the last 70 years". The BSA found those without family help or on single and lower incomes have been excluded from homeownership. The ‘Bank of Mum and Dad' could help aspiring homeowners, such as with a Guarantor mortgage, but this may not be an option for everyone, so more innovation on mortgage lending would be widely welcomed by struggling buyers.

“Mutuals have made various efforts to be innovative, such as the Track Record mortgage from Skipton Building Society, the £5,000 deposit mortgage from Yorkshire Building Society and the partnership between Leeds Building Society and Experian to potentially help consumers to boost their credit score. Even with such innovation, a recent study by Coventry Building Society for Intermediaries noted ‘regional differences are acting as barriers' to those looking to step onto the property ladder for the first time. Any borrower looking to get their foot on the property ladder would be wise to seek independent advice to ensure they find the right deal for them."