Retail Sales Great Britain - April 2024

25th May 2024

Online retail

Retail sales data

Measuring the data

Cite this statistical bulletin

Print this statistical bulletin

Download as PDF

1.Overview

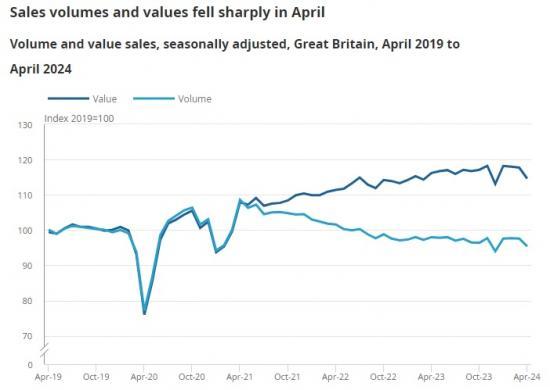

Retail sales volumes (quantity bought) fell by 2.3% in April 2024, following a fall of 0.2% in March 2024 (revised from 0.0%).

Sales volumes fell across most sectors, with clothing retailers, sports equipment, games and toys stores, and furniture stores doing badly as poor weather reduced footfall.

More broadly, sales volumes rose by 0.7% in the three months to April 2024 when compared with the previous three months, following a poor December 2023, and fell by 0.8% when compared with the three months to April 2023.

Sales volumes fell by 2.3% during April 2024 following a broadly flat February and March 2024. Over the year to April 2024, volumes fell by 2.7%, and were 3.8% below their pre-coronavirus (COVID-19) pandemic level in February 2020.

More broadly, there was a 0.7% rise in the three months to April 2024 when compared with the three months to January 2024, mainly because of an exceptionally poor December 2023.

Non-food stores sales volumes (the total of department, clothing, household and other non-food stores) fell by 4.1% in April 2024. This was the joint largest fall (shared with December 2023) since January 2021. Within non-food, falls were strongest within clothing retailers, sports equipment, games and toys stores, and furniture stores, with retailers reporting poor weather and low footfall as the main reasons.

This is consistent with national retail footfall data from our Economic activity and social change in the UK, real-time indicators bulletin, which reported footfall falling on the year. The Met Office climate summaries reported April 2024 as being a dull and wet month, receiving 155% of average rainfall and just 79% of average sunshine hours.

Automotive fuel sales volumes showed their largest monthly fall since October 2021, while food stores sales volumes fell for their third consecutive month, mainly because of supermarkets. Retailers reported cost of living and the impact of rising fuel prices as factors;

The amount spent online, known as online spending values, fell by 1.2% during April 2024, and by 1.5% over the year.

As total spend showed a greater fall during the month (2.6%), the proportion of sales made online increased from 26.2% in March 2024 (revised from 25.9%) to 26.5% in April 2024.

Read the full ONS article HERE