Are The Big Banks Complying With Their Consumer Duty Obligations?

6th June 2024

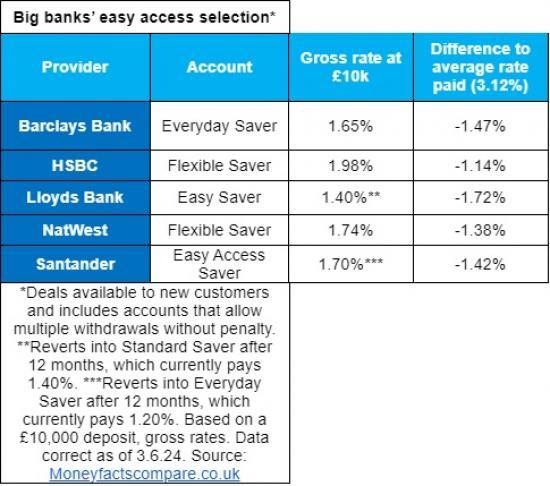

Data from Moneyfactscompare.co.uk shows that the big banks are continuing to offer easy access savings rates well below the average, despite their continued obligation via the Financial Conduct Authority to offer fair value to customers.

The big banks all pay less than 2% on their most accessible no-notice accounts, even though over 80% of the market (292 of 364 products) currently pay 2% or higher on a £10,000 balance.

These selected accounts, offered by Barclays Bank (1.65%), HSBC (1.98%), Lloyds Bank (1.40%), NatWest (1.74%) and Santander (1.70%) pay an average of 1.69% interest between them - a significant 1.43% less than the market average across all available easy access accounts at present.

In addition, their easy access ISA rates are less competitive still. While HSBC doesn't currently offer any easy access ISAs to new customers, the remaining four big banks offer an average of 1.62% on their easy access ISAs - less than half the market average of 3.31%.

James Hyde, Spokesperson at Moneyfactscompare.co.uk, said, "Consumer Duty regulations regarding existing products have been in effect since 31 July 2023, meaning companies have had almost a year now to review any previously uncompetitive products, and bring them into compliance with the rules laid out by the Financial Conduct Authority.

"Unfortunately, the big five banks are still paying significantly sub-par variable savings rates. Their most accessible no-notice accounts all offer less than 2% interest per annum - putting them all in the bottom fifth of the market.

"Currently, a saver who put £10,000 in an easy access ISA offered by a big bank would lose out on £169 in interest each year (compared to the market average rate paid), or £344 (on a market-leading account).

“Rules regarding closed accounts come into effect this summer, so it remains to be seen if there is more urgency to improve rates going forward.

“As always, customers are encouraged to proactively monitor savings rates, particularly if they're on a variable rate which providers can adjust on a very reactive basis. People should be prepared to switch if they feel their loyalty is not being adequately rewarded."