Economic Activity And Social Change In The UK - Real-time Indicators

15th June 2024

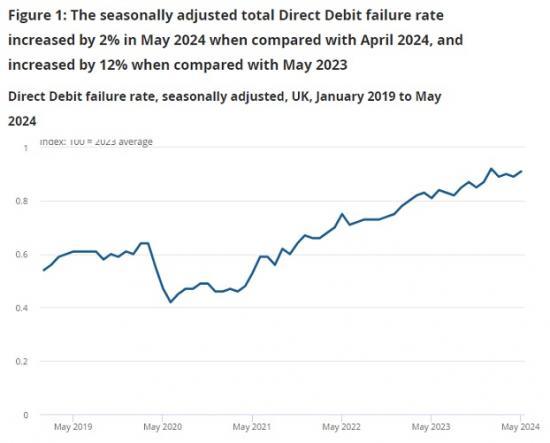

The seasonally adjusted total Direct Debit failure rate increased by 2% in May 2024 when compared with April 2024, and increased by 12% when compared with May 2023 (Vocalink and Pay.UK). Section 3: Consumer behaviour.

The seasonally adjusted monthly average Direct Debit transaction amount spent on electricity and gas continued to decrease, falling to 17% below the level seen in May 2023 (Vocalink and Pay.UK). Section 3: Consumer behaviour.

Following the May Bank holiday and school half term, overall retail footfall decreased by 6% in the week to 9 June 2024 when compared with the previous week, and was 1% below the level in the equivalent week of 2023 (MRI OnLocation). Section 3: Consumer behaviour.

The total number of online job adverts on 7 June 2024 increased by 1% from the level in the previous week but was 20% below the equivalent period of 2023 (Adzuna). Section 4: Business and workforce.

In the week to 9 June 2024, the System Price of electricity and the System Average Price (SAP) of gas decreased by 29% and 1%, respectively, when compared with the previous week; the System Price of electricity was 44% lower, while the SAP of gas was 20% higher when compared with the equivalent week of 2023 (Elexon, National Gas Transmission). Section 5: Energy.

In the week to 9 June 2024, the daily average number of UK flights remained broadly unchanged when compared with the previous week, and was 4% higher than the equivalent week of 2023.

The seasonally adjusted total Direct Debit failure rate in May 2024 increased by 2% when compared with the previous month. The main contribution to this came from increases in the "Electricity and gas" and "Water" spending categories, rising by 4% and 2%, respectively. When compared with May 2023, the total Direct Debit failure rate increased by 12%, influenced by year-on-year increases in the "Electricity and Gas" and "Water" spending categories, which rose by 29% and 26%, respectively.

In May 2024, the seasonally adjusted total monthly average Direct Debit transaction amount remained broadly unchanged when compared with April 2024, however we continued to see increases in the "Water" and "Mortgages" spending categories.

When compared with May 2023, the seasonally adjusted total monthly average Direct Debit transaction amount increased by 5%. The main contribution to this increase came from annual growth in the "Water" and "Mortgages" spending category. However, the seasonally adjusted monthly average Direct Debit transaction amount spent on "Electricity and gas" in May 2024 continued to follow the month-on-month decline since the peak a year ago, falling to 17% below the level seen in May 2023.

Automotive fuel spending

The annual growth rate in the estimated demand for fuel per transaction was negative 2% in the week to 2 June 2024. This was a decrease of 1 percentage point when compared with the previous week and was 7 percentage points lower than in the equivalent week of 2023.

The annual growth rate in average fuel prices was 4% in the week to 2 June 2024. This was broadly unchanged compared with the previous week and was 21 percentage points higher than in the equivalent week of 2023.

Footfall

In the week to 9 June 2024, overall retail footfall decreased by 6% when compared with the previous week, returning to normal levels after the May bank holiday and school half term. This was 1% below the level in the equivalent week of 2023.

All three location categories saw decreased footfall when compared with the previous week, with the largest decrease seen in shopping centres, which fell by 9%. When compared with the equivalent week in 2023, the largest decrease was seen in high streets, which fell by 2%. Retail parks was the only location category to see increased footfall, with a 1% rise when compared with the equivalent period last year.

Overall retail footfall decreased in 11 out of 12 UK countries and English regions when compared with the previous week. The largest decrease was seen in South West England, which fell by 11%, followed by Wales at 9%.

When compared with the equivalent week of 2023, 8 out of 12 UK countries and English regions saw a decrease in overall retail footfall, with four remaining broadly unchanged. The largest decrease was seen in Wales, which fell to 7% below the level seen in the equivalent week of 2023.

Job Ads

The total number of online job adverts on 7 June 2024 increased by 1% when compared with the previous week, with increases seen in 11 of the 12 UK countries and English regions. The largest week-on-week increase was in the North East, rising by 3%.

The total number of online job adverts fell by 20% when compared with the equivalent period of 2023, with the figure for all UK countries and English regions decreasing. The largest year-on-year decrease was in Scotland, falling by 31%.

When compared with the equivalent period of 2023, the total number of online job adverts fell in 25 of the 28 job categories. The categories with the largest decreases were "Admin, clerical and secretarial" and "Construction and trades", which fell by 51% and 49%, respectively.

Advanced notification of potential redundancies

Calculated as a four-week rolling average, the number of potential redundancies in the week to 2 June 2024 was 34% higher than the level in the equivalent week of 2023. The number of employers proposing redundancies was 18% higher when compared with the same period.

Read the full ONS report HERE