Producer Price Inflation, UK - May 2024 - Highest Levels Since May 2023

19th June 2024

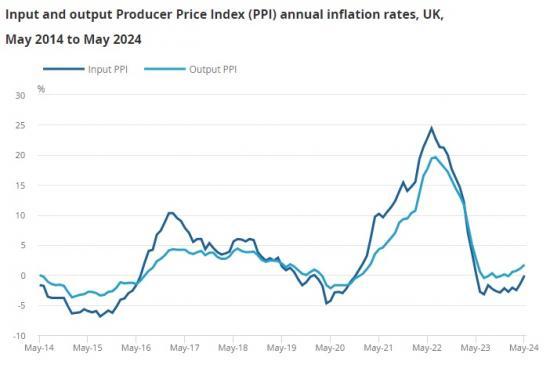

Producer input prices fell by 0.1% in the year to May 2024, up from a revised fall of 1.4% in the year to April.

Producer output (factory gate) prices rose by 1.7% in the year to May 2024, up from an increase of 1.1% in the year to April.

On a monthly basis, producer input prices showed no movement, while output (factory gate) prices fell by 0.1% in May 2024.

The annual inflation rates for both input and output PPI are at their highest levels since May 2023, based on provisional data.

Producer price inflation rates

Producer input prices fell by 0.1% in the year to May 2024, up from a revised fall of 1.4% in the year to April (Figure 1). Monthly input prices were unchanged between April and May 2024, following a revised monthly inflation rate of 0.8% in April (Table 1).

Producer output (factory gate) prices rose 1.7% in the year to May 2024, up from an increase of 1.1% in the year to April. Monthly output prices fell by 0.1% in May 2024, following a revised monthly inflation rate of 0.3% in April (Table 1).

The annual inflation rates for both input and output PPI are at their highest levels since May 2023 (Figure 1).

Estimates for both April and May 2024 are provisional, and figures for the latest 12 months are subject to revisions as additional survey data are returned and validated. Effective response rates at time of first publishing can be found in Section 8: Strengths and limitations.

Input producer price inflation

Producer input prices fell by 0.1% in the year to May 2024, up from a fall of 1.4% in the year to April.

Of the 10 product groups for the input Producer Price Index (PPI), 5 made downward contributions to the annual inflation rate in May 2024. The largest of these came from inputs of fuels, inputs of other parts and equipment, and inputs of chemicals, which contributed negative 0.59, 0.55 and 0.52 percentage points, respectively (Figure 3).

Fuel prices fell by 12.0% in the year to May 2024, up from a fall of 14.0% in the year to April (Table 2). The main contribution to this fall came from electricity prices. Fuel covers electricity and gas (D35) and coal (B05) of the classification of products by activity (CPA 2.1).

In comparison, the largest offsetting upward contribution came from inputs of crude petroleum at 1.01 percentage points. The annual inflation rate for crude petroleum increased from 13.9% in April 2024 to 18.3% in May.

The prices of materials and fuels imported by UK manufacturers fell by 0.7% in the year to May 2024, up from a fall of 1.3% in the year to April. Prices fell by 0.7% between April and May 2024, compared with a revised rise of 0.8% between March and April. The fall in import prices in the year to May 2024 may partly reflect the higher level of sterling, which rose by 3.3% in the same year.

Output producer price inflation

Producer output (factory gate) prices rose by 1.7% in the year to May 2024, up from a rise of 1.1% in the year to April.

Of the 10 product groups for the output Producer Price Index (PPI), 7 made upward contributions to the annual inflation rate in May 2024. The largest of these came from refined petroleum products and "other outputs", which contributed 2.54 and 1.12 percentage points, respectively (Figure 5).

Coke and refined petroleum prices rose by 16.2% in the year to May 2024 (Table 4), up from 12.8% in the year to April. This is the highest the annual inflation rate for this product group has been since January 2023. Prices for "other outputs" rose by 2.3% in the year to May 2024, up from a rise of 2.0% in the year to April.

In comparison, offsetting downward contributions came from chemicals and paper products, at negative 1.44 and 1.14 percentage points, respectively. Chemical prices fell by 4.0% in the year to May 2024 (Table 4), which was primarily driven by fertiliser prices.

Read the full ONS report HERE