Banking Complaints Hit A 10-year High

12th July 2024

The Financial Ombudsman has reported that complaints about the banking sector are at their highest level in at least a decade.

Concerns about current accounts, credit cards and fraud and scams have driven a significant increase in banking and payment complaints.

Within the banking sector, we are investigating more fraud and scam complaints than ever before.

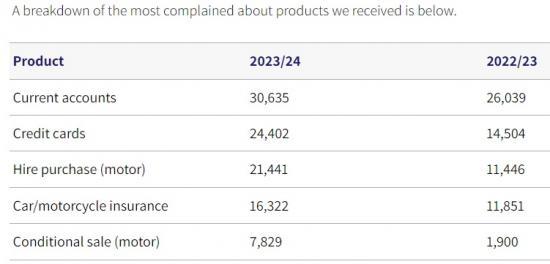

Across the board, the most complained about products have seen cases rise year-on-year.

In the last financial year (2023/24), consumers raised 80,137 cases about banking and payment products - that is a substantial rise from levels the previous year (2022/23) when there were 61,995 complaints.

Driving the increase were people's concerns about their current accounts and credit cards, as well as worries that they may have fallen victim to frauds and scams.

In particular, consumers complained about administration and customer service followed by perceived unaffordable or irresponsible lending by financial firms.

Complaints are not just rising in the banking sector. Overall, we are seeing higher case levels across the board with 198,798 new complaints in 2023/24 compared with 165,149 the previous year. The indications so far are that this trend is continuing into the new financial year.

Commenting on today's figures, Abby Thomas, Chief Executive and Chief Ombudsman of the Financial Ombudsman Service, said, "It's always concerning when you see cases rise so significantly, particularly when so many people are struggling in the current economic climate.

Whether someone is the victim of a fraud, struggling with credit card debt, or having issues with their overdraft, they deserve support and understanding from their financial provider.

It is imperative that all businesses treat their customers fairly and in a timely manner.

If consumers don't feel they've been treated fairly, they should contact our free, independent service and we'll investigate their complaint."

Across all categories, increasing levels of complaints are being brought by claims management companies (CMCs) and professional representatives - they accounted for 25% of cases in 2023/24 compared to 18% in the prior financial year.

We have seen examples of both good and bad practice from professional representatives. Some representatives submit mass claims without determining whether they have merit, whilst others fail to respond to requests for evidence slowing down our investigations.

When complaints are upheld, professional representatives can take a significant proportion of redress awarded to their clients. Consumers can bring their case directly themselves to us for free and keep 100% of any compensation awarded to them.

In recent months, we have been consulting on a proposed case fee for professional representatives, aiming to make the fee model fairer and better reflect the costs drivers being seen. Under the proposals, professional representatives in scope would be charged up to £250 to bring a case, reduced to £75 if the case outcome is determined in favour of the consumer.

We have also streamlined the process for professional representatives to submit clients' complaints, rolling out a new online form to gather all the required information in one place, helping allocate and investigate cases quicker.

James Dipple-Johnstone, Deputy Chief Ombudsman of the Financial Ombudsman Service, said:

A quarter of all cases coming to the Ombudsman were brought by professional representatives in the last financial year. While they have an important role to play in resolving financial disputes, they can also gain financially from our service without contributing to the running costs. There is sometimes little evidence of due diligence by some representatives to ensure claims they advance have merit.

We are committed to making our service is as accessible as possible, while ensuring it remains free for all customers and that those with upheld complaints can keep all of any reward we make.

Our proposed charges aim to ensure we cover the costs associated with resolving disputes while reflecting a fairer allocation of those costs."

Today's annual data release revealed that once again the most complained about product was current accounts - consumers lodged 30,635 complaints, compared to 26,039 the previous year.

Consumers brought 24,402 credit card complaints in 2023/24, of which 13,584 were due to unaffordable/irresponsible lending. By comparison, in 2022/23, there were 14,504 credit complaints and just 3,723 were about this complaint issue.

Meanwhile fraud and scams cases have risen by a fifth and are now at their highest level with 27,312 complaints in the 2023/24 financial year. Around half of these cases were authorised push payment (APP) scams where someone is tricked into sending money online to a fraudster posing as a genuine payee.

Aside from current accounts and credit cards, the other three categories in the top five most complained about products were hire purchase (motor), car/motorcycle insurance and conditional sale (motor), all of which saw year-on-year increases.

On average, across all financial products, we upheld 37% of the complaints we resolved, which is slightly higher than the 35% recorded in 2022/23.

www.financial-ombudsman.org.uk/