UK House Price Index For May 2024 - Nationwide Prices For June

17th July 2024

The UK HPI shows house price changes for England, Scotland, Wales and Northern Ireland

UK house prices

UK house prices rose by 2.2% in the year to May 2024, compared with a increase of 1.3% in the 12 months to April 2024. On a non-seasonally adjusted basis, average house prices in the UK increased by 1.2% between April 2024 and May 2024, compared with a increase of 0.2% during the same period a year earlier (April and May 2023).

The UK Property Transactions Statistics showed that in May 2024, on a seasonally adjusted basis, the estimated number of transactions of residential properties with a value of £40,000 or greater was 91,000. This is 17.2% higher than a year ago (May 2023). Between April 2024 and May 2024, UK transactions increased by 2.4% on a seasonally adjusted basis.

The highest monthly increase was in London where prices rose by 3.9%. The highest annual growth was in the Yorkshire and the Humber, where prices increased by 3.9% in the year to May 2024.

The UK HPI is based on completed housing transactions. Typically, a house purchase can take 6 to 8 weeks to reach completion. As with other indicators in the housing market, which typically fluctuate from month to month, it is important not to put too much weight on one month's set of house price data.

Read the full report HERE

Scotland

Registers of Scotland has useful web site to check prices in areas and you can pop in your postcode to get useful data.

To see it go HERE

Nationwide June Report

House price growth broadly stable in June

UK house prices up 1.5% in June compared with a year ago

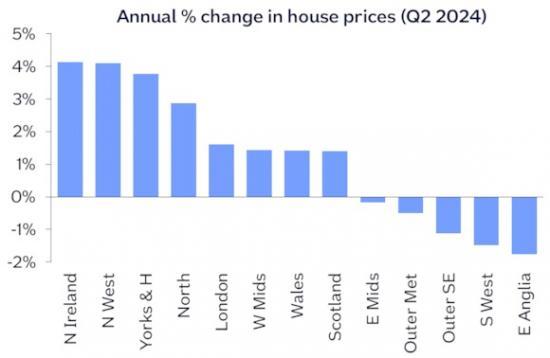

N. Ireland best performing region, with prices up 4.1% in Q2

East Anglia weakest performing region, with prices down 1.8% over the year.

Average Price in June £266,064

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said, "UK house prices edged up by 0.2% in June, after taking account of seasonal effects. This resulted in the annual rate of growth rising from 1.3% in May to 1.5% in June, leaving prices around 3% below the all-time high recorded in the summer of 2022.

Housing market activity remains fairly subdued

"Housing market activity has been broadly flat over the last year, with the total number of transactions down by around 15% compared with 2019 levels. Transactions involving a mortgage are down even more (nearly 25%), reflecting the impact of higher borrowing costs. By contrast, the volume of cash transactions is actually around 5% above pre-pandemic levels.

See the full Nationwide report HERE