Narrowing Choice Of Providers Across Credit Cards And Higher Interest Rates

23rd September 2024

Moneyfacts UK Unsecured Lending Trends Treasury Report data, which studies the UK personal finance market (Credit Cards, Personal Loans and Overdrafts), reveals a contraction in the choice of providers across the credit card and unsecured personal loan market.

During Q3 2024, the number of providers within the credit card market fell to 34, its lowest count on our electronic records, which started in June 2006.

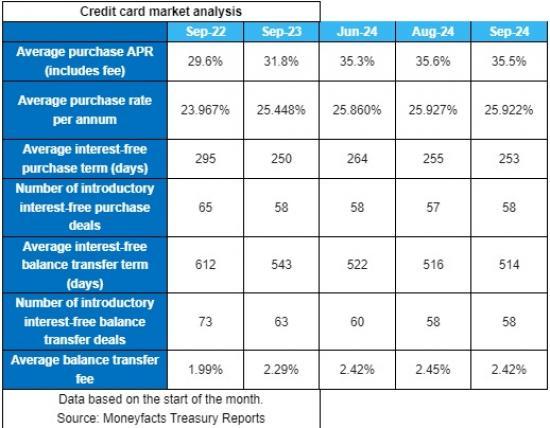

Between the start of June 2024 and the start of September 2024 (Q3 2024), the average purchase APR (which includes card fees) rose to 35.5% APR, close to the highest seen last month (35.6% in August 2024) on our electronic records, which started in June 2006.

A combination of card withdrawals and launches contributed to this change. The average purchase PA rate rose to 25.922% during Q3 2024, which is higher than a year ago.

The number of interest-free purchase offers remained at 58 during Q3 2024. There are the same number of offers as a year ago. The average interest-free purchase term on credit cards fell to 253 days, down from 264 days in June 2024, with terms up year-on-year.

The number of interest-free balance transfer offers fell from 60 to 58 during Q3 2024. There are fewer options for borrowers to choose from than a year ago, down from 63 offers to 58.

The average interest-free balance transfer term on credit cards reduced to 514 days, from 522 days in June 2024, with terms down year-on-year.

Balance transfer fees remained at 2.42% during Q3 2024, but up from 2.29% a year ago.

During Q3 2024, the number of unsecured loan providers fell to 25, its lowest count in over a decade (April 2012 - 25).

Rachel Springall, Finance Expert at Moneyfacts, said, "The market for unsecured lending across credit cards and loans noted a contraction in the number of providers during Q3 2024, which has subsequently narrowed the choice of offers for borrowers. Sainsbury's Bank withdrew from the loans and credit card market, and Metro Bank withdrew from the credit card market, which has resulted in the lowest number of credit card providers seen on our records and the lowest count of loan providers seen in over a decade. Interest rates are also on the rise for unsecured lending, the average credit card APR and the rates charged on multiple unsecured personal loan tiers rose during Q3 2024.

"Those borrowers searching for an introductory 0% credit card deal may be disappointed to see both the average terms for purchases and balance transfers reduced during Q3 2024. These deals would typically become more popular as we approach the festive season for those looking to spread the cost of their purchases, or indeed shift an existing debt to an interest-free balance transfer offer to give themselves more time to pay it off. Borrowers who are looking for a new balance transfer offer would be wise to watch out for transfer fees, while these have not risen over the last quarter, at 2.42%, it is higher year-on-year, up from 2.29%. However, borrowers can still find 0% balance transfer offers that do not charge a transfer fee, but they will usually have a much shorter interest-free term.

“Borrowers looking to consolidate their debts will need to compare deals carefully but note that around 56% of the market now consists of loans restricted to those with an existing relationship with the lender.

Average loan rates may have risen over the quarter for loans tiers of £3,000 up to and including £10,000, but an unsecured personal loan could still be a better choice for consumers versus a credit card, as they offer a fixed repayment plan. Credit cards are typically more suited for those who might need to drop down their minimum repayments temporarily, but borrowers should make every effort to pay off their debts before interest applies.

Those struggling with their debts should seek advice from a debt charity or ask their lender for support to try and avoid a debt spiral."