Consumer Card Spending UK Tourism-related Sectors - 2019 To 2024

4th October 2024

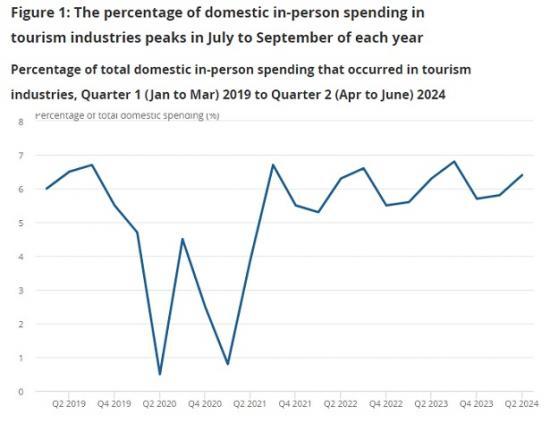

The percentage of in-person domestic spending in tourism-related industries dipped during 2020 and 2021 but has since recovered to around 6% of all in-person domestic spending.

The restaurant industry had the largest percentage of in-person domestic tourism spending across the time series, followed by accommodation and retail goods.

The percentage of face-to-face domestic spending on travel agents has decreased across the time series, while the percentage spent on fast-food restaurants has increased.

Spending on tourist industries accounts for around half of in-person spending by international visitors to the UK.

Overview of spending data

The Office for National Statistics (ONS) has entered into an agreement with Visa to receive aggregated and anonymised data on UK card payments. This data source offers new opportunities to understand UK consumer spending. This is the latest in a series of publications that provide new and granular insights for users. Our previous articles can be found in Section 8: Related links.

This bulletin explores the amount of in-person (also referred to as face-to-face) spending on Visa cards that we can attribute to spending categories associated with tourism. We have made efforts to align the categories in these data with the categories used by the Department for Culture, Media, and Sport (DCMS) in their DCMS Sector Economic Estimates for ease of use.

It includes data for England, Scotland, Wales, and Northern Ireland. In this bulletin, "spend" or "spending" refers to spending by UK residents with bank cards issued by Visa when referring to domestic tourism, or spending at UK merchants by consumers with Visa bank cards issued by non-UK countries when referring to international tourism. All spending referred to in this bulletin occurred in person, rather than online.

The analysis in this bulletin covers credit and debit card spending, which are part of the UK spending landscape, but this is not exhaustive.

Consumers may also use a variety of other payment methods, including cash, direct debit, faster payments, or standing orders, which will not be reflected in these data.

For more information on card usage, see Section 7: Data sources and quality and our Regional consumer card spending trends quality and methodology information (QMI).

Red the full ONS report HERE