Cutbacks Ahead - Considering The Impact Of Proposed Changes To Disability Benefits On Living Standards And The Public Finances

13th October 2024

A Resolution Foundation report published today 13 October 2024 examines some of the changes to benefits already announced by the former chancellor Jeremy Hunt last year. The new chancellor Rachel Reeves and the Labour government have a huge challenge to sort this one out.

The Chancellor has already come under pressure for making one welfare cut to help her address the challenging fiscal outlook in the run up to her first Budget. But there are more in store due to spending commitments inherited from the previous Government.

Specifically, if the Government goes ahead with changes to the Work Capability Assessment - the gateway to accessing Employment and Support Allowance (ESA) or Universal Credit on the grounds of ill-health - currently planned to begin from April 2025, it would mean around 450,000 people whose health prevents them from working seeing a cut in benefits of up to £4,900 a year, leading to a saving of £1.3 billion to the Exchequer by 2028-29.

These changes should not be made in haste. They will degrade living standards for low-income families, with 47 per cent of families who receive these incapacity benefits coming from the bottom 30 per cent of the income distribution. In addition, details are still lacking on a vital part of the policy change - the removal of the ‘substantial risk' descriptor, which is currently responsible for nearly a sixth of the flows onto these benefits.

A restriction like this risks harming some vulnerable claimants. These changes should be delayed - if not cancelled - to allow for sufficient time to consider their effective implementation.

Current spending forecasts already include a cut to incapacity benefits comparable to the restriction of Winter Fuel Payments.

The Chancellor and the Prime Minister have set a great deal of store by how tough the Budget will be, as they try to balance the Government's desire to invest for growth, address the pressures on public services, and remain within their own red lines on taxation.

And the Chancellor has already received criticism for one welfare cut: the restriction of eligibility for Winter Fuel Payments to those on Pension Credit, a change expected to save £1.3bn in 2024-25 and £1.5bn in subsequent years.

But there is another welfare cut due to take effect from April 2025, which is similar in scale, but has been much less debated. This cut was announced by Jeremy Hunt in the 2023 Autumn Statement and will affect working-age incapacity benefits (i.e. claimants of Employment and Support Allowance (ESA) or those claiming Universal Credit on the grounds of ill-health).

The savings will increase over time as the reforms affect more people, and are expected to reach £1.3 billion by 2028-29.[i] Crucially, these changes are baked into the Office for Budget Responsibility's forecasts of the public finances that will underpin the Budget on 30 October.

The proposed reforms are to the Work Capability Assessment (WCA), the assessment of how much people's illness or disability affects their ability to work. The outcome of the WCA affects the level of benefits people are entitled to, as well as whether there are conditions that need to be met in order for people to receive benefits.

Specifically, after completing a WCA, claimants are sorted into three groups: those deemed as having Limited Capability for Work Related Activity (LCWRA), who receive an additional £416.19 per month in 2024-25 under the Universal Credit system and are not expected to look for work or prepare for work; those who are deemed as having Limited Capability for Work (LCW), who receive no additional benefit award and are subject to limited work-search requirements; and those who ‘fail' the test and are deemed as fit for work, who are treated equivalently to jobseekers.

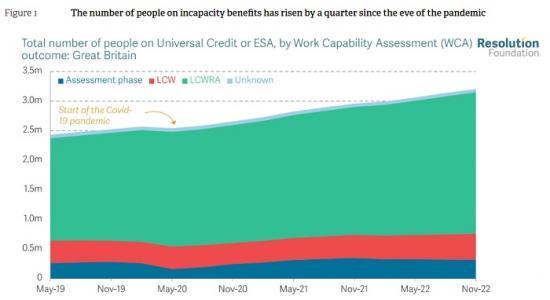

Broadly speaking, the three changes to the WCA announced by the previous Government each mean that people with certain health problems or disabilities will be less likely to be awarded LCWRA or LCW. As Figure 1 shows, the majority of people in receipt of incapacity benefits are in the LCWRA group.

These changes will impact a relatively small group of people, but those affected will see a significant drop in income.

The reform will apply to new claimants or those undergoing a reassessment of their health, and so the number of people affected will rise steadily: the DWP expects that it will affect around 450,000 claimants in 2028-29. The vast majority (93 per cent) are set to no longer be allocated to the LCWRA group, and will therefore see their awards drop by £416 per month (or £4,990 per year, in 2024-25 prices) compared to a world where the reform did not happen; they will also find themselves subject to some work-related requirements. The remaining 7 per cent of claimants (33,000 people) will move from the LCW group to being in the ‘intensive work search' group - these people won't lose any financial support, but will be subject to more intense work-search requirements.

Since this is a reform to means-tested benefits paid to people who are mostly not in paid work, the people affected are overwhelmingly from lower-income households, with just under half (48 per cent) of recipients of these benefits being in the bottom 30 per cent of the income distribution. It’s also worth noting that while the reform was labelled (by the previous Government) as one that would boost labour market participation, it is in reality a straightforward cost-saving measure. The OBR expects that only 3 per cent of the affected claimants (or 15,400 people) will move into work. The previous Government’s hope that hybrid or remote working is enhancing the options available to disabled workers was over-stated: the rise in remote working since the start of the Covid-19 pandemic for adults with disabilities has tracked the overall rise almost identically (with just under one-in-four disabled people who work saying that they mainly work from home).

The changes to the WCA risk making the process too stringent

Of course, it would not be surprising if the current Government was keen to reduce spending on working-age incapacity and health-related benefits. Between 2013-14 and 2022-23, real spending on working-age incapacity benefits increased by one-third (34 per cent), and that on disability benefits rose by 89 per cent. This is likely to have been in part driven by structural changes to the benefit system, as well as health and economic trends.

Over the next six years, expenditure on both working-age incapacity and disability benefits is currently projected to increase at an even more rapid pace than in the past, from £43 billion in 2022-23 to £63 billion in 2028-29, a real-terms increase of £21 billion (or 48 per cent), albeit with most of the forecast rise coming from increased claims for disability benefits (i.e. claims for Personal Independence Payment, intended to support people with the additional costs of disability or health conditions) rather than incapacity benefits (intended to replace income for people whose health prevents them from working).

But any concern over the fiscal implications does not mean that we need to rush ahead with changes that will have very large impacts on claimants’ income while failing to deliver on their stated objectives. There is a very strong case for delaying the policy change so that the Government has sufficient time to work with stakeholders on the details, while reducing fear and uncertainty among claimants.

In particular, one of the proposed changes is to remove the ‘substantial risk’ descriptor that enables entry into the LCWRA group, which provides the highest level of support without conditionality. Currently, it is possible for a claimant to be treated as having LCWRA if there is a ‘substantial risk’ to their mental or physical health if they were found not to have LCWRA.

Around one-in-six (15 per cent) of new claims are now awarded LCWRA for this reason.[ii] Initially this route was intended, according to the previous Government, to be used only in very rare circumstances, and the intention of the reform is to cut back on this route. But it is not yet clear whether removing the ‘substantial risk’ descriptor will have the desired effect - i.e. reducing the LCWRA caseload enough to save money – but not making the process so stringent that very unwell or vulnerable claimants are denied LCWRA, and therefore subject to a substantial cut in income as well as work-search requirements, potentially with adverse impacts as a result.[iii]

The Labour party’s election manifesto said "[w]e believe the Work Capability Assessment is not working and needs to be reformed or replaced, alongside a proper plan to support disabled people to work." It would be better to spend the time to do this properly rather than rushing to implement a cut announced by the previous government.

Of course, because this change has already been announced and scored by the Treasury, then abandoning it entirely would push up forecast spending on incapacity benefits by £1.3 billion a year. Because (at the time of writing) the Government’s fiscal rules essentially rule out borrowing more to spend on welfare payments, this decision would need to be offset by a rise in taxes, or cuts to welfare or day-to-day public service spending elsewhere.

But there is a strong case for the Government to start its term in office by earning the trust of benefit claimants and disability organisations, by showing that changes will be properly thought through and not dictated by dogma. This will make it easier for the Government to pursue the future changes to all health-related benefits that it will want to make, either in pursuit of its stretching 80 per cent employment target, or the longer-term reform or replacement of the WCA.

More broadly, the current Government must do better than the ‘whack-a-mole’ strategy adopted by successive administrations over the past few decades, where governments make small changes to welfare benefits that just push cost pressures elsewhere. The rising spending on disability and incapacity benefits is a genuine pressure on the public finances, but the real public policy failure here is the underlying deterioration in the nation’s health. If the need for support for the nearly half a million people affected by this reform is not alleviated, then it’s almost certain that other parts of local or central government will end up stepping in to support these disabled people.

[i] HM Treasury, Autumn Statement 2023, November 2023, Table 5.1

[ii] DWP, Open consultation: Work Capability Assessment: activities and descriptors, 5 September 2023.

[iii] The previous Government said in 2023 that: "we will be taking forward changes which keep LCWRA Substantial Risk as a safety net for those with the most severe mental or physical health conditions, but sets out clearly when this should apply", and "we will specify the circumstances, and physical and mental health conditions, for which LCWRA Substantial Risk should apply. This will include protecting and safeguarding the most vulnerable, including people in crisis and those with active psychotic illness. We will work with clinicians to define the criteria and what medical evidence is required from claimants and people involved in their care, to ensure the process is safe, fair, and clear." At the time of writing, no further details had been announced.

https://www.resolutionfoundation.org/publications/cutbacks-ahead/