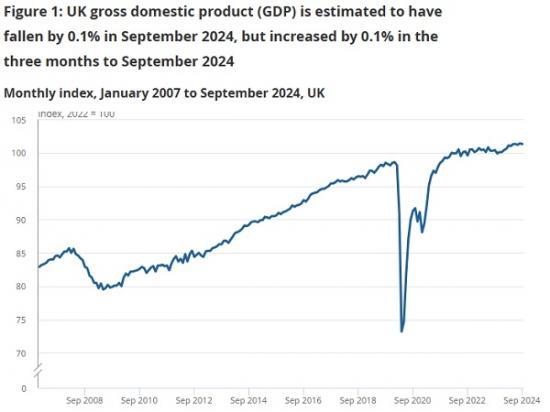

GDP Monthly Estimate - UK September 2024 - Slows To 0.1%

15th November 2024

Real gross domestic product (GDP) is estimated to have grown by 0.1% in the three months to September 2024 compared with the three months to June 2024, mainly because of growth in retail trade, excluding motor vehicles and motorcycles, and new construction work.

Monthly real GDP is estimated to have fallen by 0.1% in September 2024, largely because of declines in manufacturing output and information and communication services, after unrevised growth of 0.2% in August 2024.

Monthly services output showed no growth in September 2024, following an unrevised increase of 0.1% in August 2024, and grew by 0.1% in the three months to September 2024.

Production output fell by 0.5% in September 2024, mainly because of a fall in manufacturing output, following an unrevised growth of 0.5% in August 2024; it fell by 0.2% in the three months to September 2024.

Construction output grew by 0.1% in September 2024, following a revised growth of 0.6% in August 2024 (this figure was 0.4% growth in our last bulletin); it grew by 0.8% in the three months to September 2024.

Monthly GDP

Monthly real gross domestic product (GDP) is estimated to have fallen by 0.1% in September 2024, following unrevised growth of 0.2% in August 2024 and an unrevised estimate of no growth in July 2024.

Real GDP is estimated to have grown by 0.1% in the three months to September 2024 compared with the three months to June 2024. Services output was the main contributor to the growth in the three months to September, rising by 0.1%. There was also a 0.8% increase in construction output, while production output fell by 0.2% over this period.

On a quarterly basis, this gives growth of 0.1% in Quarter 3 (July to Sept) 2024, following growth of 0.5% in Quarter 2 (Apr to June) 2024 and 0.7% in Quarter 1 (Jan to Mar) 2024. Please see our GDP first quarterly estimate, UK July to September 2024 for more details.

July and August 2024 are open for revision in this release in accordance with the National Accounts Revisions Policy. It is important to note that early estimates of GDP are subject to revision (positive and negative), please see our Why GDP figures are revised article for more information.

Production output decreased by 0.5% in September 2024, and was the main contributor to the fall in GDP during this month, while construction sector output rose by 0.1% and services output showed no growth.

Looking over the longer term, GDP is estimated to have increased by 1.0% in the three months to September 2024 compared with the three months to September 2023, and by 1.0% in September 2024 compared with the same month last year.

The services sector

Overall, the services sector is estimated to have grown by 0.1% in the three months to September 2024 compared with the three months to June 2024. There was a rise in output in 8 of the 14 subsectors in this period.

Professional, scientific, and technical activities was the largest positive contributor to the rise in services output in this three-month period, growing by 0.7% in the three months to September 2024. The next largest contributor came from wholesale and retail trade; repair of motor vehicles and motorcycles output, which increased by 0.6%. The largest negative contribution during the three months to September 2024 was financial and insurance activities which fell by 0.3%.

The largest positive contribution in the services sector in September 2024 came from the professional, scientific, and technical activities subsector, where output rose by 0.5% in the month, following a growth of 1.8% in August 2024. Five out of the eight industries in this section experienced growth in September 2024. The growth was driven mainly by an increase of 3.2% in the scientific research and development industry.

The next largest positive contribution at the subsector level in September 2024 was a 0.3% growth in wholesale and retail trade; repair of motor vehicles. This was driven by wholesale and retail trade and repair of motor vehicles and motorcycles, which grew by 3.2%. The Society of Motor Manufacturers and Traders (SMMT) reported on their website that September 2024 had seen the highest number of new registrations since 2020.

The largest negative contribution in September 2024 came from information and communication, which fell by 2.0%, falling back after growth earlier in the year but remaining 1.2% above its level a year ago. September's contraction was because of falls in five out of its six subsectors, with the largest contribution coming from a 2.6% fall in computer programming, consultancy, and related activities. There were also falls of 3.6% in publishing activities and 1.1% in telecommunications. This offset the growth of 1.8% experienced in programming and broadcasting activities.

Other subsectors in September 2024 that contributed negatively to the services sector include falls of 0.8% in the other service activities subsector, 0.5% in arts, entertainment and recreation, 0.1% in financial and insurance activities and 0.2% in transportation and storage.

An overview of data sources used in our estimates of service output can be found in our GDP(o) data sources catalogue. The Monthly Business Survey (MBS) is used for 43.6% of the services sector by industry weight. In September 2024, the turnover response rate for the MBS element of the services sector was 85.3%. We would expect this to increase over time, as more responses are received and any new data will be included in future monthly gross domestic product (GDP) releases. For context, the average turnover response rates for the services sector in 2022 and 2023 now stand at 97.0% and 97.5%, respectively.

Consumer-facing services

Consumer-facing services output rose by 0.5% in the three months to September 2024. The largest positive contribution in this period came from a growth of 1.9% in the retail trade, except for motor vehicles and motorcycles industry. See our Retail Sales, Great Britain: September 2024 bulletin for more information on this industry. The largest negative contribution was a 3.1% fall in the other personal service activities industry, in the same period.

Output in consumer-facing services increased by 0.4% in September 2024, following growth of 0.3% in August 2024. Wholesale and retail trade and repair of motor vehicles and motorcycles was the largest contributor at the industry level, with output rising here by 3.2%. This was followed by food and beverage service activities where output increased by 1.3%. There was a fall of 1.6% in the other personal service activities sector in September 2024 which was the largest negative contributor to consumer-facing services in the month; this follows a growth of 4.1% in August 2024. More information on consumer-facing services data is available in our Consumer-facing services September 2024 dataset.

The production sector

In the three months to September 2024, production output is estimated to have fallen by 0.2%, when compared with the three months to June 2024. Growth in manufacturing (up 0.2%) was offset by falls in electricity, gas, steam and air conditioning supply (down 2.7%), and in water supply, sewerage, waste management and remediation activities (down 0.9%). Mining and quarrying showed no growth (0.0%).

On the month, production output is estimated to have fallen by 0.5% in September 2024, following growth of 0.5% in August 2024. Three of the four production sectors saw falls in September 2024, with the largest contribution to the fall being a 1.0% fall in manufacturing. There were also negative contributions from water supply, sewerage, waste management and remediation activities (down 0.7%), and from electricity, gas, steam and air conditioning supply (down 1.9%). These were partially offset by growth of 3.7% in mining and quarrying.

Read the full ONS report HERE