University Financial Crisis Will Undermine UK Innovation And Business, Warns Ncub

15th November 2024

The National Centre for Universities and Business (NCUB) latest report shows universities in England have serious financial problems. Similar issues apply in Scotland.

There will be widespread consequences for UK businesses, as well as innovation, skills, and economic growth.

The latest report from the Office for Students reveals that 72% of universities in England could face deficits by 2025-26, posing a serious threat not only to higher education but also to the wider economy and UK business.

Rosalind Gill, Head of Policy and Engagement at the National Centre for Universities and Business said: "Universities are one of the UK's greatest strengths and a key driver of innovation, skills, and economic growth. Today's new report from the Office for Students hammers home the scale of the crisis faced by our nation's world leading institutions. Increasing employer National Insurance contributions has also made the situation more challenging, significantly raising staffing costs for universities by £372 million a year."

Gill continued: "Although vital, this issue isn't just about universities - it's about the prosperity of the UK as a whole. The consequences of closures or scaled-back activities would ripple across industry, impacting businesses that rely on graduate talent and cutting-edge research. The university sector is a major reason why multinational businesses invest in the UK, providing the workforce and research collaborations that fuel innovation. We need solutions that protect the unique role universities play in driving growth and global competitiveness."

This report is intended to provide information about the sector-wide position, to support leaders and governors as they ensure their financial planning and forecasts are prudent and appropriately

stress-tested. Many providers are actively managing their financial risks and putting in place measures to respond to increased pressures. It is important that all providers continue to plan

proactively for an uncertain recruitment picture and do not rely on improved recruitment in future years.

Many providers will need to take increasingly bold action to address the impact of these challenges on their financial position in the short, medium and long terms. Where necessary, providers will

need to prepare for, and deliver in practice, the transformation needed to address the challenges they face. In some cases, this is likely to include looking externally for solutions to secure their

financial future, including working with other organisations to reduce costs or identifying potential merger partners or other structural changes. We recognise that cultural and other barriers in the

sector may deter institutions from considering some of these options, and so it is important that

options are identified and evaluated with sufficient time for action to be taken.

This report finds that:

• Acceptances of UK undergraduate students through UCAS appear to have increased slightly, by 1.3 per cent in 2024 compared with the same point in 2023. However, this is significantly below the sector's forecast of a 5.8 per cent increase.

• Recruitment of UK undergraduate students has mainly increased in larger, higher-tariff providers. It appears to have decreased across medium, smaller and specialist institutions, and has decreased by nearly a quarter in providers predominantly offering

Level 4 and 5 qualifications.

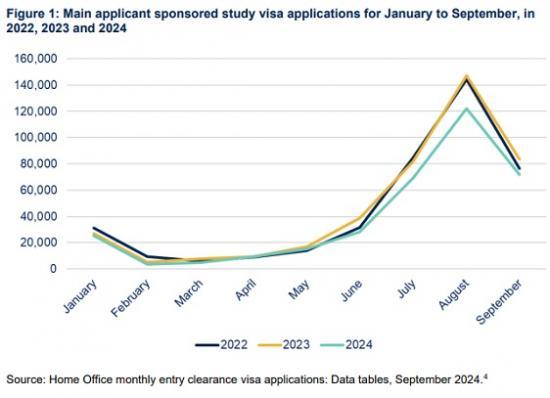

• Indicators suggest that recruitment of international students has decreased significantly

overall, with 16 per cent fewer applications for visas in 2024 than in 2023.

• The number of international students from certain countries that send significant numbers to study in the UK has decreased significantly. The number of students from some of these countries has decreased by more than 40 per cent.

• Our modelling indicates that many more providers than forecast must overcome financial challenges in the coming years. By 2025-26, based on current trends and not taking into account significant mitigating action, we estimate a net income reduction for the sector of £3,445 million, and, without significant mitigating actions, a sector-level deficit of -£1,636 million, with up to 72 per cent of providers being in deficit, and 40 per cent having low

liquidity.

• While these results are spread across all types of providers, the forecasts of larger, especially teaching-intensive, providers appear to be particularly at odds with the optimism in their previous forecasts.

The model also includes the following:

• An increase to UK undergraduate tuition fees at the Retail Price Index, excluding mortgage interest payments (RPIX) inflation rate for 2025-26, as announced by the Secretary of State for Education in the House of Commons on Monday 4 November 2024. We estimate this to represent up to an additional £371 million of annual fee income for the sector, if it is applied to entrants and continuing UK undergraduate students by providers subject to the higher fee limit for relevant students.

• An increase to employer National Insurance contributions for providers, based on the lower salary threshold of £5,000 at which employers must pay National Insurance and the 1.2 percentage point increase to the contribution rate from April 2025. We estimate that this will result in additional costs for the sector of £133 million in 2024-25 and c£430 million each year from 2025-26.

Our modelling suggests that there will be a total net reduction in annual income across the sector of -£3,445 million by 2025-26 compared with the sector's forecast position. This represents

approximately 7.7 per cent of the audited income achieved by the sector in 2022-23.

Read the full report HERE

Pdf 11 Pages