Consumer Price Inflation UK October 2024 - Slight Rise Again With Housing Components Highest

20th November 2024

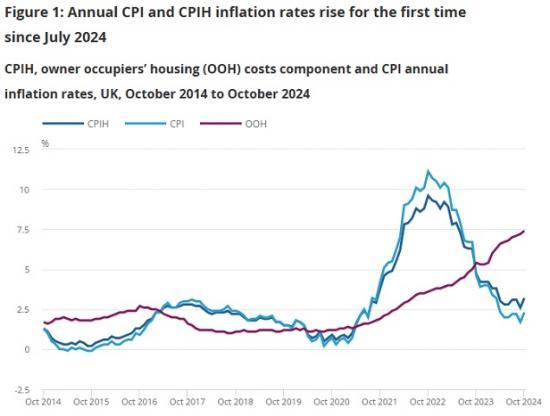

The Consumer Prices Index including owner occupiers' housing costs (CPIH) rose by 3.2% in the 12 months to October 2024, up from 2.6% in September.

On a monthly basis, CPIH rose by 0.6% in October 2024, up from 0.1% in October 2023.

The Consumer Prices Index (CPI) rose by 2.3% in the 12 months to October 2024, up from 1.7% in September.

On a monthly basis, CPI rose by 0.6% in October 2024, up from being little changed in October 2023.

The largest upward contribution to the monthly change in both CPIH and CPI annual rates came from housing and household services, mainly because of electricity and gas prices; the largest offsetting downward contribution came from recreation and culture.

Core CPIH (excluding energy, food, alcohol and tobacco) rose by 4.1% in the 12 months to October 2024, up from 4.0% in September; the CPIH goods annual rate rose from negative 1.4% to negative 0.3%, while the CPIH services annual rate was unchanged at 5.6%.

Core CPI (excluding energy, food, alcohol and tobacco) rose by 3.3% in the 12 months to October 2024, up from 3.2% in September; the CPI goods annual rate rose from negative 1.4% to negative 0.3%, while the CPI services annual rate rose from 4.9% to 5.0%.

The Consumer Prices Index including owner occupiers' housing costs (CPIH) rose by 3.2% in the 12 months to October 2024, up from 2.6% in September and from a recent peak of 9.6% in October 2022.

Our indicative modelled consumer price inflation estimates included in our Consumer price inflation, historical estimates and recent trends article suggest that the October 2022 inflation rate was the highest in over 40 years (the CPIH accredited official statistic series begins in January 2006).

The monthly CPIH rate was 0.6% in October 2024, up from 0.1% in October 2023.

The owner occupiers' housing costs (OOH) component of CPIH rose by 7.4% in the 12 months to October 2024, up from 7.2% in the 12 months to September. This is the highest annual rate since February 1992 in the constructed historical series. OOH costs rose by 0.8% on the month, up from 0.7% in October 2023.

The Consumer Prices Index (CPI) rose by 2.3% in the 12 months to October 2024, up from 1.7% in September 2024, and well below its recent peak of 11.1% in October 2022. Our indicative modelled consumer price inflation estimates suggest that the October 2022 peak was the highest rate in over 40 years (the CPI accredited official statistic series begins in January 1997).

The monthly CPI rate was 0.6% in October 2024, up from being little changed in October 2023.

The main drivers of the annual inflation rate for CPIH and CPI are the same where they are common to both measures. However, the OOH component accounts for approximately 16% of the CPIH and is the main driver for differences between the CPIH and CPI inflation rates. This makes CPIH our most comprehensive measure of inflation. We cover this in more detail in Section 4: Latest movements in CPIH inflation and provide a commentary on the CPI in Section 5: Latest movements in CPI inflation. We also cover both CPIH and CPI in Section 3: Notable movements in prices, though the figures reflect CPIH.

Notable movements in prices

The rise in the annual Consumer Prices Index including owner occupiers' housing costs (CPIH) inflation rate in October 2024 reflected offsetting contributions from the different product groups. There were upward contributions from eight divisions, most notably housing and household services (including energy), offset by downward contributions from three divisions, particularly recreation and culture.

Housing and household services (including energy)

Monthly housing and household services prices rose by 1.3% in October 2024, having fallen by 0.3% last year. The annual rate rose to 5.5%, up from 3.8% in the year to September. The rise in the divisional annual rate is mainly because of electricity prices, with a sizeable contribution from gas too. This reflects the rise of the Office of Gas and Electricity Markets (Ofgem) energy price cap in October 2024, described on the Ofgem website. Ofgem estimate that for an average household paying by direct debit for dual fuel, this equates to £1,717, a rise of £149 on an annual bill.

Electricity prices rose by 7.7% in October 2024, having fallen by 7.5% between the same two months last year. Gas prices rose by 11.7% in October 2024, having fallen by 7.0% between the same two months last year.

Figure 2 shows rebased price indices for electricity and gas from March 2021 to October 2024. By the first quarter of 2023 (January to March), electricity prices had peaked and were just under twice as high as they were in March 2021. Gas prices also peaked in the first quarter of 2023 but were just under three times as high as they were in March 2021.

Both indices fell between March 2023 and September 2024 before rising in October. Gas and electricity prices now stand at 36% and 22% below their respective peaks. However, gas prices peaked at a higher level than electricity prices. Therefore, although gas prices have fallen at a faster rate than electricity prices, they're still more elevated compared with their March 2021 level (around 88% higher) than electricity prices (around 56% higher).

Transport

Prices of second-hand cars rose by 0.2% in October 2024 compared with a fall of 3.0% a year ago. On an annual basis, prices fell by 3.2% in the year to October 2024, compared with a fall of 6.3% in the year to September 2024. The annual rate has been negative for 15 consecutive months.

Although monthly prices for airfares in October tend to fall, the monthly price in October 2024 rose by 6.3%. This was the highest rise in October since monthly price collection began in 2001 and was driven largely by increases in European air fares. In contrast, the fall of 5.4% in October 2023 was the lowest since October 2016. As a result, prices rose by 6.6% in the year to October 2024, compared with a fall of 5.0% in the year to September 2024.

For motor fuels, the average price of petrol fell by 2.8 pence per litre between September and October 2024 to stand at 134.0 pence per litre, down from 155.1 pence per litre in October 2023. Diesel prices fell by 2.7 pence per litre in October 2024 to stand at 139.1 pence per litre, down from 162.2 pence per litre in October 2023. These movements resulted in overall motor fuel prices falling by 13.7% in the year to October 2024, compared with a fall of 10.4% in the year to September.

Recreation and culture

Overall prices in the recreation and culture division rose by 3.1% in the year to October 2024, compared with a rise of 3.9% in the year to September. On a monthly basis, prices fell by 0.1% in October 2024 compared with a rise of 0.7% a year ago.

The categories that provided the largest downward contributions to the change in the 12-month rate between September and October 2024 were cultural services, data processing equipment and package holidays. These were partially offset by games, toys and hobbies.

Food and non-alcoholic beverages

Food and non-alcoholic beverage prices rose by 1.9% in the year to October, up from 1.8% to September 2024. The annual rate of 1.9% is down from a recent high of 19.2% in March 2023, the highest annual rate seen for over 45 years.

Prices for this division rose by 0.1% between September and October 2024, the same rate as a year ago. The annual rate of 1.9% in October 2024 compares with 10.1% in October 2023.

Overall prices in the transport division fell by 2.0% in the year to October 2024, compared with a fall of 2.4% in the year to September. On a monthly basis, prices rose by 0.1% in October 2024 compared with a fall of 0.2% a year ago.

The rise in the annual rate was mainly the result of upward effects from second-hand cars and from air fares, but this was partly offset by lower prices for motor fuels.

Vegetables (including potatoes) was the only one of the 11 food and non-alcoholic beverage classes to provide an upward contribution to the change in the annual rate of inflation between September and October 2024. The upward contribution occurred because prices rose between September and October this year but fell between the same two months last year.

Seven classes were little changed, and there were downward contributions from the other three classes because prices fell between September and October this year but rose between the same two months last year. The downward contributions came from:

fish

oils and fats

coffee, tea and cocoa

Further details on the items that provided notable upward and downward contributions to the change in the annual rate can be found in the detailed briefing note.

The core CPIH annual inflation rate was 4.1% in October 2024, up from 4.0% in September and down from a recent high of 6.5% in May 2023. This was the highest rate since November 1991, when it was also 6.5% in our constructed historical series.

The CPIH all goods index fell by 0.3% in the 12 months to October 2024, compared with a fall of 1.4% in the 12 months to September. The largest upward contribution to the change in the annual rate came from energy, particularly electricity and gas.

The CPIH all services index rose by 5.6% in the 12 months to October 2024, the same rate as in September 2024. The largest upward contribution to the change in the annual rate came from travel and transport services, particularly passenger transport by air. However, this was offset by other recreational and personal services, particularly cultural services.

Read the full ONS report for more links details and graphs HERE