UK House Prices Up 4.7% Year On Year In December

2nd January 2025

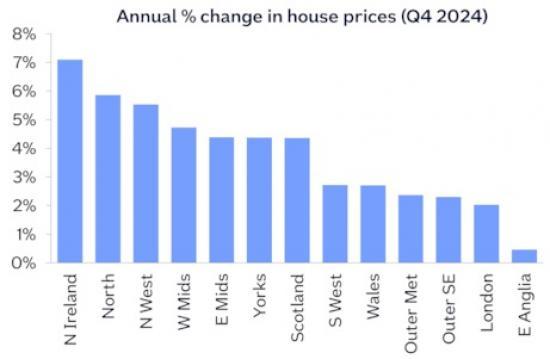

Northern regions see higher price growth than southern regions.

Northern Ireland best performing area for second year running, with prices up 7.1% over 2024.

East Anglia weakest performing region, with prices up 0.5% over the year.

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said:

"UK house prices ended 2024 on a strong footing, up 4.7% compared with December 2023, though prices were still just below the all-time high recorded in summer 2022. House prices increased by 0.7% month on month, after taking account of seasonal effects, following a 1.2% rise in November.

Looking back on 2024

"Mortgage market activity and house prices proved surprisingly resilient in 2024 given the ongoing affordability challenges facing potential buyers. At the start of the year, house prices remained high relative to average earnings, which meant that the deposit hurdle remained high for prospective first-time buyers. This is a challenge that had been made worse by record rates of rental growth in recent years, which has hampered the ability of many in the private rented sector to save.

"Moreover, for many of those with sufficient savings for a deposit, meeting monthly payments was a stretch because borrowing costs remained well above those prevailing in the aftermath of the pandemic. For example, a typical mortgage rate for someone with a 25 per cent deposit hovered around 4.5% for much of the year, three times the 1.5% prevailing in late 2021, before the Bank of England started to raise the Bank Rate.

"As a result, it was encouraging that activity levels in the housing market increased over the course of 2024 with the number of mortgages approved for house purchase each month rising above pre-pandemic levels towards the end of the year.

Where next in 2025?

"Upcoming changes to stamp duty are likely to generate volatility, as buyers bring forward their purchases to avoid the additional tax. This will lead to a jump in transactions in the first three months of 2025 (especially in March) and a corresponding period of weakness in the following three to six months, as occurred in the wake of previous stamp duty changes. This will make it more difficult to discern the underlying strength of the market.

"But, providing the economy continues to recover steadily, as we expect, the underlying pace of housing market activity is likely to continue to strengthen gradually as affordability constraints ease through a combination of modestly lower interest rates and earnings outpacing house price growth. The latter is likely to return to the 2-4% range in 2025 once stamp duty related volatility subsides.

The average house price in Scotland in 2024 was £187,016.

The average house price in Highland was £218,000 in October 2024, up 5.6% from October 2023.

For each property type, average prices as of October 2024 in Highland were:

Detached properties: £324,000

Semi-detached properties: £203,000

Terraced properties: £158,000

Flats and maisonettes: £118,000

Check prices in all UK areas at

https://www.ons.gov.uk/economy/inflationandpriceindices/articles/housingpricesinyourarea/2024-03-20