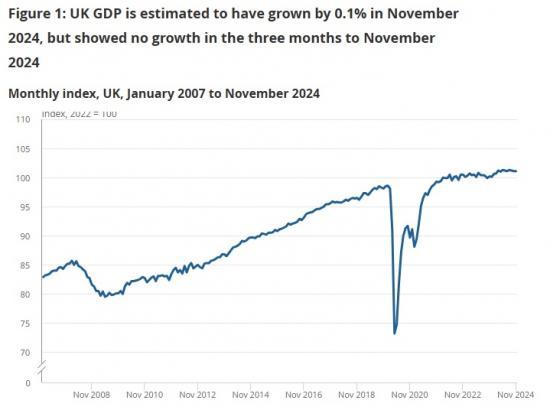

GDP monthly estimate UK - November 2024

16th January 2025

Monthly real gross domestic product (GDP) is estimated to have grown by 0.1% in November 2024 largely because of a growth in services, following an unrevised fall of 0.1% in October 2024.

Real GDP is estimated to have shown no growth in the three months to November 2024, compared with the three months to August 2024.

Monthly services output grew by 0.1% in November 2024, after falling by 0.1% in October 2024 (revised down from no growth in our last release), but showed no growth in the three months to November 2024.

Production output fell by 0.4% in November 2024, following an unrevised fall of 0.6% in October 2024; production fell by 0.7% in the three months to November 2024, driven by a decline in manufacturing.

Construction output grew by 0.4% in November 2024, following a fall of 0.3% in October 2024 (revised up from a fall of 0.4% in our last release); construction also grew by 0.2% in the three months to November 2024.

Monthly real gross domestic product (GDP) is estimated to have grown by 0.1% in November 2024, following an unrevised fall of 0.1% in October 2024.

Real GDP is estimated to have shown no growth in the three months to November 2024, compared with the three months to August 2024. Services showed no growth over this three-month period, while production fell by 0.7% and construction grew by 0.2%.

Services output grew by 0.1% in November 2024 and was the largest contributor to the growth in the month. Construction also grew, by 0.4%, while production fell by 0.4%.

Looking over the longer term, GDP is estimated to have grown by 1.0% in the three months to November 2024, compared with the three months to November 2023. Over this period, services grew by 1.5%, while production fell by 1.6% and construction fell by 0.2%.

Compared with the same month a year ago, GDP is estimated to be 1.0% higher in November 2024 than in November 2023.

The services sector

On the month, services output is estimated to have grown by 0.1% in November 2024, after falling by 0.1% in October 2024 (revised down from no growth in our last release). Of the 14 subsectors, output increased in seven, two showed no growth and five saw output decline in November 2024.

Overall, the services sector is estimated to have shown no growth in the three months to November 2024, compared with the three months to August 2024. There was a rise in output in 7 of the 14 subsectors in this period.

Human health and social work activities was the largest positive contributor to the rise in services output in this three-month period, increasing by 1.3% in the three months to November 2024, compared with the three months to August 2024. NHS junior doctors held industrial action in the three months to August 2024 (27 June to 2 July 2024), with NHS England reporting that 61,989 acute inpatient and outpatient appointments were cancelled as a result.

The next largest contributor was professional, scientific and technical activities where output increased by 0.6%. The largest negative contribution on the three months to November 2024 was administrative and support service activities, which fell by 1.3%.

The largest positive contribution in the services sector in November 2024 came from the accommodation and food service activities subsector where output rose by 2.0% in the month, following a fall of 1.2% in October 2024. Both food and beverage service activities, and accommodation grew in November 2024, by 1.6% and 3.0%, respectively.

The next largest positive contribution at the subsector level in November 2024 came from a 0.9% growth in information and communication, which was mainly driven by computer programming, consultancy and related activities (up 1.0%) and telecommunications (up 1.2%).

There was also a growth of 0.5% in wholesale and retail trade; repair of motor vehicles and motorcycles in November 2024, driven by increased output of 1.0% in wholesale trade, except of motor vehicles and motorcycles.

The largest negative contribution in November 2024 came from administrative and support service activities, which fell by 1.2%. This was mainly driven by falls in rental and leasing activities (down 2.4%), services to buildings and landscape activities (down 3.0%) and office administration, office support and other business support activities (down 1.3%).

Additionally, there was a fall of 0.5% in professional, scientific and technical support activities in November 2024. This fall in output can be mainly attributed to a 2.6% fall in accounting, bookkeeping and auditing activities; tax consultancy and a fall of 1.8% in scientific research and development.

An overview of data sources used in our estimates of services output can be found in our GDP(O) data sources catalogue. The Monthly Business Survey (MBS) is used for 43.6% of the services sector by industry weight. In November 2024, the turnover response rate for the MBS element of the services sector was 86.2%. We would expect this to increase over time as more responses are received and any new data will be included in future monthly GDP releases. For context, the average turnover response rates for the services sector in 2022 and 2023 now stand at 97.0% and 97.5%, respectively.

Consumer-facing services

Output in consumer-facing services increased by 0.5% in November 2024, following a revised fall of 0.4% in October 2024 (this was a fall of 0.6% in our previous release).

Food and beverage service activities was the largest contributor to the increase at the industry level, with output growing by 1.6%, followed by other personal service activities, where output increased by 2.5%, and accommodation, which grew by 3.0%. There was a fall of 2.7% in sports activities and amusement and recreation activities in November 2024, which was the largest negative contributor to consumer-facing services in the month.

Consumer-facing services output rose by 0.3% in the three months to November 2024, compared with the three months to August 2024. The largest positive contributions in this period came from growth of 1.7% in wholesale and retail trade and repair of motor vehicles and motorcycles, and 0.4% in retail trade, except of motor vehicles and motorcycles. This was partially offset by decreases of 0.7% in food and beverage service activities and 1.2% in sports activities and amusement and recreation activities in the three months to November 2024.

The production sector

On the month, production output is estimated to have fallen by 0.4% in November 2024, following an unrevised fall of 0.6% in October 2024.

Three of the four sectors in production output saw a fall in November 2024, with the largest negative contribution coming from a 0.3% fall in manufacturing. There were also negative contributions from mining and quarrying, which fell by 1.5%, and water supply; sewerage, waste management and remediation activities, which fell by 0.3% in November 2024. These were partially offset by a rise of 0.2% in electricity, gas, steam and air conditioning supply.

Production output is estimated to have fallen by 0.7% in the three months to November 2024 when compared with the three months to August 2024, mainly because of a 1.0% fall in manufacturing over this period. Water supply; sewerage, waste management and remediation activities also decreased, by 0.4%, while mining and quarrying grew by 0.3% and electricity, gas, steam and air conditioning supply output increased by 0.5% in the three months to November 2024.

Electricity, gas, steam and air conditioning supply output grew by 0.2% in November 2024, following a growth of 1.5% in October 2024. The growth in November 2024 was driven by an increase of 4.9% in the manufacture of gas; distribution of gaseous fuels through mains; steam and air conditioning supply. This was partially offset by a decrease of 0.9% in electric power generation, transmission and distribution.

Water supply; sewerage, waste management and remediation activities output fell by 0.3% in November 2024, following a rise of 0.5% in October 2024. A fall of 4.0% in sewerage in November 2024 was partially offset by growths in waste collection, treatment and disposal activities (up 1.4%), water collection, treatment and supply (up 0.7%) and remediation activities and other waste management services (up 1.8%).

Mining and quarrying output fell by 1.5% in November 2024, following a fall of 2.9% in October 2024, continuing its longer-term downward trend. The decrease in November 2024 was mainly driven by a 1.8% fall in extraction of crude petroleum and natural gas.

Manufacturing output fell by 0.3% in November 2024 and was the largest contributor to the reduction in production output in the month, following a fall of 0.6% in October 2024. Manufacturing output decreased in 7 of the 13 subsectors in November 2024. The largest negative contributions in November 2024 came from other manufacturing and repair (down 2.1%), and the manufacture of basic pharmaceutical products and pharmaceutical preparations (down 1.9%). The largest positive contribution in November 2024 came from the manufacturing of computer electronic and optical products (up 2.6%).

The construction sector

Monthly construction output is estimated to have grown by 0.4% in November 2024, which follows a decrease of 0.3% in October 2024 (was a 0.4% decrease in our previous release). The rise in monthly output in November 2024 came from both new work, and repair and maintenance, which grew by 0.3% and 0.5%, respectively.

Five out of the nine sectors saw increases in November 2024. At the sector level, the main contributors to the monthly increase were private commercial new work, and non-housing repair and maintenance, which grew by 3.1% and 1.1%, respectively.

Construction output is estimated to have grown by 0.2% in the three months to November 2024 compared with the three months to August 2024. New work increased by 0.4% over the period, whereas repair and maintenance showed no growth (0.0%).

Within new work, the largest contributor to the increase came from private industrial new work, which grew by 5.8%. In repair and maintenance, the largest positive contributor came from public housing repair and maintenance, which grew by 2.9%, and the largest negative contributor came from private housing repair and maintenance, which fell by 1.3%.

Read the full ONS report HERE