British household wealth increased to £13.6 trillion on the eve of the cost of living crisis

25th January 2025

The latest data from the Wealth and Assets Survey (WAS) shows that British household wealth continued its upward march.

It hit a record high of £13.6 trillion in the two years to March 2022 (equivalent to £294,000 for the typical household), before a likely fall during the cost of living crisis - according to quickfire analysis from the Resolution Foundation, produced with the support of the abrdn Financial Fairness Trust .

The survey, confirms that British household wealth grew at a faster pace than the size of the economy, continuing a trend that dates back to the mid-1980s. In recent decades, absolute non-pension wealth gaps had been widening, but this trend reversed in the latest data. The inflation-adjusted gap between average non-pension wealth in the top and middle wealth deciles narrowed slightly from £1.2 million in 2018-20 to £1.1 million in 2020-22.

But the data does reveal growing wealth gaps between generations. Between 2018-20 and 2020-22 typical financial wealth for someone aged between 65 and 74 increased by £3,300 in real terms, compared with a smaller increase of just £800 for someone aged between 25 and 34.

While we do not yet have official data beyond 2022, the high inflation and rising interest rates of this period are likely to have eroded the real value of British household wealth during the cost of living crisis. Nonetheless, the Foundation warns that while growth and wealth creation are worthy aims for the Government, it needs to ensure that prosperity is fairly shared across the country, and across the generations.

Simon Pittaway, Senior Economist at the Resolution Foundation, said, "New data shows British household wealth reached £13.6 trillion on the eve of the cost of living crisis - six times larger than the size of the economy.

"While this wealth creation is good news for many, the increases in wealth were not equally shared, with financial wealth for someone aged between 65 and 74 increasing by £3,400 in real terms, compared with just £900 for someone aged between 25 and 34.

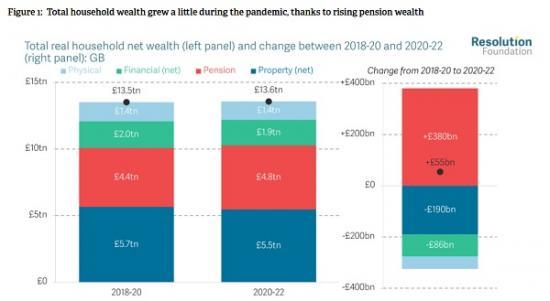

1. During the pandemic, total household wealth nudged up to reach a new peak

Since the early 1980s, the defining trend of Britain's wealth landscape has been the rapid rise in wealth relative to incomes. In 1985, total household wealth amounted to just under three times national income (280 per cent of GDP). By 2020-22, this had risen to a little over six times (610 per cent), up marginally on 2018-20 levels (590 per cent). All told, the median household saw their wealth rise by £1,500 in real terms between 2018-20 and 2020-22.[1] Higher wealth was entirely driven by rising levels of pension wealth, up £380 billion in real terms between 2018-20 and 2020-22.[2] Non-pension wealth (comprising net financial and property wealth, as well as physical wealth) actually fell by £320 billion over the same period, as shown in Figure 1.

Read the full Resolution Foundation report HERE