Access to External Finance - Small Business Survey Scotland 2023-2024

19th February 2025

76 per cent of SME employers in Scotland were currently using external finance at the time of the 2023-24 survey.

Figure 4: The most common forms of external finance used by SME employers were credit cards (36 per cent of SME employers), leasing/hire purchases (27 per cent) and bank overdraft facility (27 per cent).

Types of external finance currently used (2023-24). Multiple answers allowed across this question.

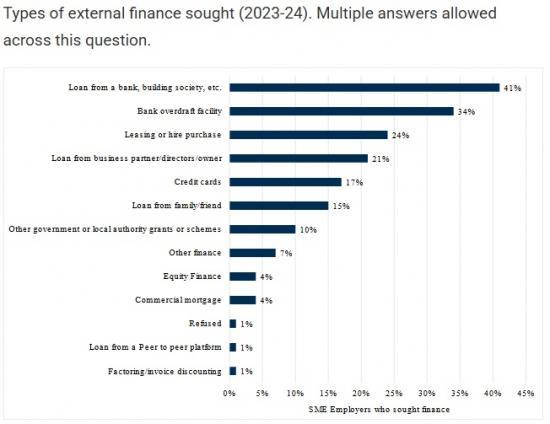

15 per cent of SME employers had tried to obtain external finance in the previous 12 months.

68 per cent of SME employers that had applied for finance did so for working capital or cash flow reasons (broadly in line with last year).

84 per cent of SME employers who sought external finance for investment purposes obtained the entire amount they were looking for. Meanwhile, 79 per cent who sought external finance for cashflow purposes received all the money desired (a statistically significant increase of 23 per cent compared to last year).

10 per cent of SME employers were discouraged borrowers (i.e. they had a need for external finance in the last 12 months, but they did not apply for it)

The above is an extract from the Scottish Government small Business survey published 19 February 2025