Household Costs Indices for UK household groups: October to December 2024

28th February 2025

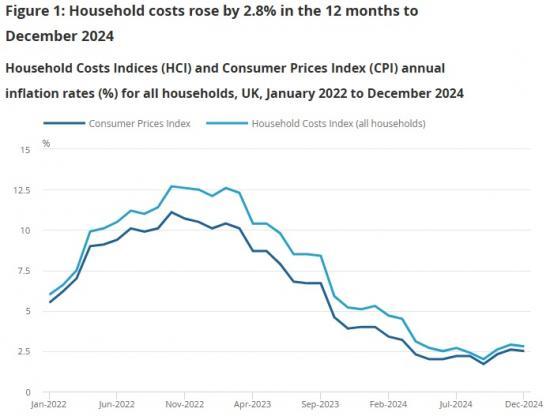

Overall, UK household costs, as measured by the Household Costs Indices (HCI), rose 2.8% in the year to December 2024, compared with 2.0% in the year to September 2024.

Over the past 12 months, the all-households inflation rate has followed the sixth income decile most closely; costs for these households rose 2.7% in the year to December 2024, compared with rises of 3.2% for high-income households (decile 9) and 2.6% for low-income households (decile 2).

By tenure type, private renter households had the highest annual inflation rate of 3.9% in the year to December 2024, reflecting rising private rental payments; followed by mortgagor households, with a 3.1% inflation rate, in the year to December 2024.

Outright owner occupiers experienced the lowest annual inflation rate of all tenure types, at 2.1% in the year to December 2024; social and other renters had the next lowest (3.0%).

Non-retired households continued to experience a higher annual rate of inflation (3.0%) in the year to December 2024 than retired households (2.3%).

The annual inflation rate for households with children rose to 3.0%, and the rate for households without children rose to 2.8%, in the year to December 2024.

Readthe full ONS report HERE