Labour market overview, UK - April 2025

15th April 2025

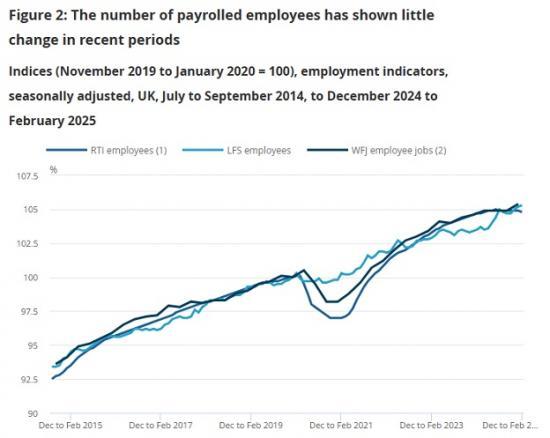

Estimates for payrolled employees in the UK decreased by 8,000 (0.0%) between January and February 2025 but rose by 35,000 (0.1%) between February 2024 and February 2025.

Payrolled employees fell by 21,000 (0.1%) over the quarter but rose by 50,000 (0.2%) over the year, when looking at December 2024 to February 2025. This is the period comparable with our Labour Force Survey (LFS) estimates.

The early estimate of payrolled employees for March 2025 decreased by 78,000 (0.3%) on the month and decreased by 70,000 (0.2%) on the year to 30.3 million. The March 2025 estimate should be treated as a provisional estimate and is likely to be revised when more data are received next month.

Increased volatility of LFS estimates, resulting from smaller achieved sample sizes, means that estimates of change should be treated with additional caution. We recommend using them as part of our suite of labour market indicators, alongside workforce jobs (WFJ), Claimant Count data, and Pay As You Earn (PAYE) Real Time Information (RTI) estimates.

The UK employment rate for people aged 16 to 64 years was estimated at 75.1% in December 2024 to February 2025. This is above estimates of a year ago, and up in the latest quarter.

The UK unemployment rate for people aged 16 years and over was estimated at 4.4% in December 2024 to February 2025. This is above estimates of a year ago, but largely unchanged in the latest quarter.

The UK economic inactivity rate for people aged 16 to 64 years was estimated at 21.4% in December 2024 to February 2025. This is below estimates of a year ago, and down in the latest quarter.

The UK Claimant Count for March 2025 increased on the month and the year, to 1.766 million.

The estimated number of vacancies in the UK fell by 26,000 on the quarter, to 781,000 in January to March 2025; following a revised December 2024 to February 2025 figure; this was the 33rd consecutive quarterly decline. Vacancies were 15,000 below their January to March 2020 level. This is the first time since March to May 2021 they were below the pre-coronavirus (COVID-19) pandemic figure.

For this release we have implemented Average Weekly Earnings revisions, on an exceptional basis, back to October 2020 to allow for late and updated returns we received from one business to be included and improve the quality of the estimates. Annual growth in employees' average regular earnings excluding bonuses in Great Britain was 5.9% in December 2024 to February 2025, and annual growth in total earnings including bonuses was 5.6%. RTI pay data showed a similar annual growth rate when compared with Average weekly earnings total earnings, including arrear payments.

Annual growth in real terms, adjusted for inflation using the Consumer Prices Index including owner occupiers' housing costs (CPIH), was 2.1% for regular pay and 1.9% for total pay in December 2024 to February 2025.

There were an estimated 52,000 working days lost because of labour disputes across the UK in February 2025.

Read the full ONS report HERE