UK environmental taxes - 2024

8th May 2025

Environmental taxes raised £54.3 billion in the UK in 2024, down by 0.5% from £54.6 billion in 2023.

As a proportion of gross domestic product (GDP), environmental taxes made up 1.9% of total GDP in 2024, compared with 2.0% in 2023.

Energy taxes accounted for 74.4% of total UK environmental tax revenue in 2024, followed by transport (23.3%), and pollution and resource (2.3%) taxes.

On average, environmental taxes paid per household in 2022 increased by 4.2% to £642, from £616 the previous year.

The energy sector remains the largest industry contributor to total environmental tax revenue in 2022 (28.0%), which saw an increase to £8.9 billion compared with £6.5 billion the previous year.

Tax revenue from environmental taxes

What is an environmental tax?

Environmental taxes are those whose base is a physical unit, for example, a litre of petrol or a passenger flight, that has a proven negative impact on the environment. These taxes should reduce the activity related to these units and therefore reduce negative environmental impacts. Increases in tax revenue can occur from either rising tax rates, increased activity, or both.

While other initiatives may promote environmentally positive behaviour, they may not currently be considered an environmental tax under this definition, which comes from the United Nations (UN) System of Environmental-Economic Accounting Central Framework (section 4.4.3) (PDF, 2.7KB).

Environmental taxes are grouped into three main categories:

energy; such as Fuel Duty (also known as taxes on hydrocarbon oils)

transport; such as Air Passenger Duty

pollution and resource taxes; such as Plastic Packaging Tax

Our latest classifications forward work plan sets out the organisations and transactions expected to be assessed and classified in the next 12 to 18 months. For example, various clean air zones charges have recently been classified as environmental taxes, and work is ongoing to include the data in the UK's National Accounts. This work is not completed and therefore these are not included in this iteration of the environmental taxes bulletin.

Environmental tax revenue

The UK's environmental tax revenue has increased, in current prices, from £24.3 billion in 1997 to £54.3 billion in 2024. However, over the same period, environmental taxation has decreased from 2.5% to 1.9% as a proportion of gross domestic product (GDP). Environmental taxation has also declined as a proportion of total taxes and social contributions, from 8.4% in 1997 to 5.4% in 2024.

So, while the absolute value of environmental tax revenue has risen, its relative share of total tax has fallen.

Energy taxes

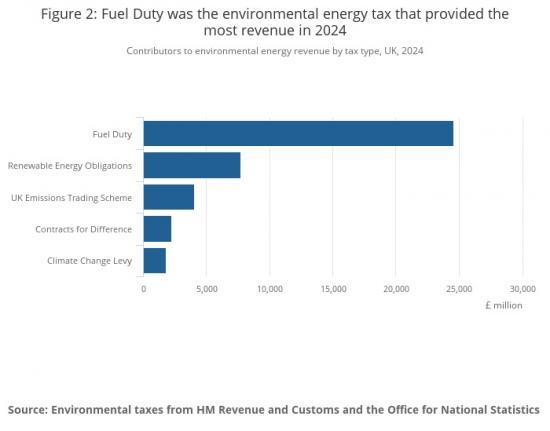

Energy taxes is the largest category of environmental taxes, which raised £40.4 billion in 2024.

This category predominantly comprises Fuel Duty on petrol, diesel and other fuels. This raised £24.6 billion in 2024, 60.9% of the total energy tax revenue, and has been the largest contributor to total environmental energy tax revenue since 1997.

Fuel Duty revenue decreased during the coronavirus (COVID-19) pandemic, and it has not returned to pre-coronavirus levels of £27.8 billion in 2019.

Other energy taxes, such as the Climate Change Levy and Renewable Energy Obligations, have also contributed to the overall revenue, but to a lesser extent compared with Fuel Duty.

Transport taxes

Transport tax revenue was £12.6 billion in 2024, 23.3% of total environmental taxes.

Approximately 40% of this is Motor Vehicle Duty paid by households, which accounted for £5.1 billion. The second-largest transport tax is Air Passenger Duty, generating £4.2 billion in 2024.

Pollution and resource taxes

Pollution and resource taxes are the smallest contributors to overall environmental tax revenue, raising £1.2 billion in 2024, about 2.3% of total environmental taxes. Landfill Tax raised almost half of this (£596 million). The Plastic Packaging Tax raised £267 million in 2024, and a total of £738 million since it was introduced in 2022.

Households

Household contributions to environmental taxes in the UK have remained relatively stable since 1997, peaking in 2010 to £763 per household, which totalled £20.0 billion.

Households paid £18.1 billion in environmental taxes in 2022, averaging £642 per household. This is up by 4.2% since 2021 when the average was £616. However, this has still not reached the pre-coronavirus (COVID-19) pandemic levels, when the average environmental tax paid by households was £759 (2019).

Overall, while the total amount has fluctuated, the average tax per household has shown only limited changes over the years. This relative stability is partly attributable to the effective freeze on Fuel Duty introduced in 2011.

Industry contributions

Industry breakdowns are available up to 2022.

Excluding households, the energy sector is the largest industry contributor to environmental tax revenue, regardless of type of environmental tax, in 2022. The industry contributed around £8.9 billion in total followed by transport and service industries contributing around £6.0 billion each.

The energy sector contributes the most to energy tax revenue

Contributions to energy taxes in the UK have shown variation across different industries over the years. Excluding households, the energy sector (electricity, gas, steam and air conditioning supply) is the largest contributor to energy tax revenue since 2019. In 2022, its contribution was £8.8 billion.

The energy sector has also seen the most substantial increase in contributions over the years compared with other industries. Between 1997 and 2019, transport and storage was the largest contributor to energy tax revenue.

The services sector contributes nearly 50% to transport tax revenue

Excluding households, the largest industry contributor to transport tax revenue is the services sector, at 49.6% in 2022. Other sectors, such as transportation and storage, wholesale and retail trade, and construction, have also seen increases in their contribution.

The mining sector remains the largest pollution and resource tax contributor

The mining sector has consistently contributed the most to pollution and resource tax since 2015. It contributed £378 million (32.7%) of the total pollution and resource taxes in 2022. The second- and third-largest contributors were water and waste management (23.9%) and services (20.2%), respectively.

Glossary

Air Passenger Duty

A duty on the carriage from a UK airport of chargeable passengers on chargeable aircraft. The amount due is dependent on the final destination and class of travel of the chargeable passenger. Data are included from 1995, the first full year of data for this particular duty.

Contracts for Difference

The Contracts for Difference scheme was introduced in 2014 and was previously included within the renewables energy obligation data. The scheme's aim is to incentivise investment in renewable energy generation.

Emissions Trading Scheme

The Emissions Trading Scheme (EU-ETS) is a multi-country, multi-sector greenhouse gas emissions trading scheme. Data are included for 2009 onwards, through from 1 January 2021 when the UK Emissions Trading Scheme (UK-ETS) replaced the UK's participation in the EU-ETS.

Environmental taxes

Environmental taxes are based on a physical unit that has a proven negative impact on the environment. The tax also needs to be defined as a tax and not another type of payment in the System of National and Regional Accounts (SNA 2008) (PDF, 9.1MB). The data are based on System of Environmental Economic Accounting guidance.

Fuel Duty

See Taxes on hydrocarbon oils.

Landfill Tax

Landfill Tax applies to any and all waste disposed of through landfill, unless the waste is specifically exempt. There are two charge bands.

Plastic Packaging Tax

Introduced in 2022, this tax is intended to encourage use of recycled plastic. It applies to the manufacture or import of plastic packaging components or packaged goods that does not contain at least 30% recycled plastic.

Renewables energy obligations

Introduced in 2002 to provide incentives for the deployment of large-scale renewable electricity in the UK. Data are therefore included for 2002 onwards.

Taxes on hydrocarbon oils (or Fuel Duty)

Paid on motor and heating fuels produced, imported, or used in the UK. Data are included from the start of the time series.

Read the full ONS report HERE