Labour market overview UK - June 2025 - 55,000 Fewer employees in one month

10th June 2025

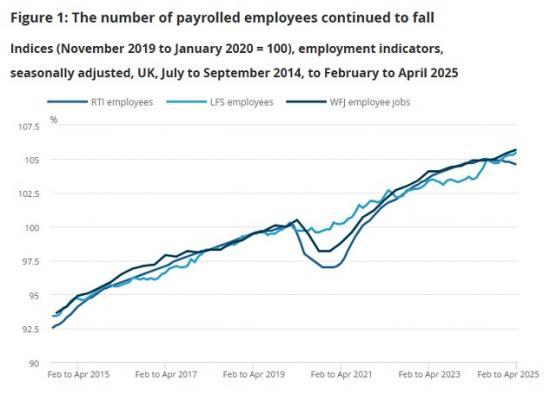

Estimates for payrolled employees in the UK decreased by 55,000 (0.2%) between March and April 2025 and fell by 115,000 (0.4%) between April 2024 and April 2025.

When looking at February to April 2025, the period comparable with our Labour Force Survey (LFS) estimates, payrolled employees fell by 78,000 (0.3%) over the quarter and fell by 51,000 (0.2%) over the year.

The early estimate of payrolled employees for May 2025 decreased by 109,000 (0.4%) on the month and decreased by 274,000 (0.9%) on the year to 30.2 million. Early estimates are subject to significant revisions as more returns are received by HMRC next month. The earlier timing of the data extract for May 2025 means these estimates are more uncertain than usual. Additional caution is needed in interpreting these earlier estimates.

LFS estimates from January to March 2025 include the full effect of recent improvements in LFS data collection and sampling methods introduced from January 2024, and are therefore more likely to be representative of labour market conditions. An increased amount of volatility will remain in the LFS estimates from mid-2023 and throughout 2024, so we would advise caution when interpreting change involving those periods. We recommend using LFS estimates as part of our suite of labour market indicators, alongside Workforce Jobs, Claimant Count and Pay As You Earn Real Time Information (PAYE RTI) estimates.

The UK employment rate for people aged 16 to 64 years was estimated at 75.1% in February to April 2025. This is above estimates of a year ago, and up in the latest quarter.

The UK unemployment rate for people aged 16 years and over was estimated at 4.6% in February to April 2025. This is above estimates of a year ago, and up in the latest quarter.

The UK economic inactivity rate for people aged 16 to 64 years was estimated at 21.3% in February to April 2025. This is below estimates of a year ago, and down in the latest quarter.

The UK Claimant Count for May 2025 increased on the month and the year, to 1.735 million.

The estimated number of vacancies in the UK fell by 63,000 on the quarter, to 736,000 in March to May 2025. This was the 35th consecutive quarterly decline with quarterly falls seen in 14 out of the 18 industry sectors. Vacancies were 59,000 below their January to March 2020 level. Feedback from our Vacancy Survey suggests some firms may not be recruiting new workers or replacing workers who have left.

Annual growth in employees' average regular earnings excluding bonuses in Great Britain was 5.2% in February to April 2025, and annual growth in total earnings including bonuses was 5.3%. Annual average regular earnings growth was 5.1% for the private sector and 5.6% for the public sector. RTI pay data is also published, and provides a provisional timelier estimate of median pay. The two data sources generally trend well for mean total pay.

Annual growth in real terms, adjusted for inflation using the Consumer Prices Index including owner occupiers' housing costs (CPIH), was 1.4% for regular pay and 1.5% for total pay in February to April 2025.

Annual growth in real terms, adjusted for inflation using the Consumer Prices Index excluding owner occupiers' housing costs (CPI), was 2.1% for regular pay and 2.3% for total pay in February to April 2025.

The number of Workforce Jobs in the UK was estimated at 37.1 million in March 2025. This is an increase of 187,000 (0.5%) from December 2024, and an increase of 304,000 (0.8%) from the level of a year ago.

Employment in the public sector was estimated at 6.15 million in March 2025, an increase of 7,000 (0.1%) compared with December 2024, and an increase of 35,000 (0.6%) compared with March 2024.

There were an estimated 47,000 working days lost because of labour disputes across the UK in April 2025.

Read the full ONS report HRE