Next October How Budget Changes Could Hit Your Wallet - Get Ready Now

5th July 2025

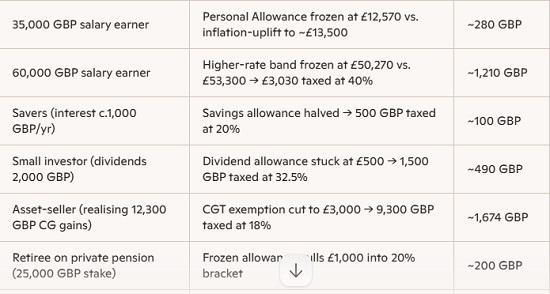

Below is a roadmap showing likely tax and benefit tweaks in Rachel Reeves's next Budget and illustrative impacts on different household profiles. These figures assume measures such as an extended freeze on income tax thresholds, tighter pension relief and allowance cuts to dividends, savings interest and capital gains.

Key Policy Shifts to Watch

Freeze on income-tax thresholds (personal allowance, 20%/40%/45% bands) to at least 2030.

Further tweaks to pension tax relief to curb high-value contributions.

Dividend-allowance cut (remain at £500) and stricter Capital Gains Tax (CGT) exemption (£3,000).

Halving of Personal Savings Allowance for basic- and higher-rate payers.

Potential small rises in national-insurance thresholds and council tax bands.

And don't forget about Council taxes that may rise again in 26/27.

Why These Shifts Matter

Squeezed Take-Home Pay: Freezing thresholds silently bakes in "stealth" rate rises as wages and prices inflate around fixed bands.

Investment and Retirement: Reduced allowances on dividends, savings and CGT mean any interest, yields or asset disposals you make now carry more tax.

Pension Planning: If relief on high contributions is scaled back, those near the £40k annual limit must factor in a lower effective tax break.

Local Costs: Even small council-tax uplifts and capped benefit rises compound the pinch for lower-income households.

What You Can Do

Use your full ISA allowance each tax year to shelter up to £20,000 of investments from income and CGT charges.

Maximise pension contributions while relief remains at your highest rate; consider carrying forward past unused allowances.

Stagger disposals and crystallise gains up to the CGT limit (£3,000) annually to avoid a big one-off hit.

Shift surplus savings into cash ISAs or National Savings & Investments bonds where possible.

Review family-income splitting options and marriage allowance if you have a lower-earning spouse.

Note re the graph - Figures are illustrative and rounded. Your real impact will vary based on exact income mix, tax-code, reliefs and local authority rates.

Think about saving for a rainy day.