Alice in Treasuryland - A Reeves Budget Tale With No Reality But It May Only Seem So

5th July 2025

Rachel Reeves woke one morning to find herself not in 11 Downing Street but peering into a small, brass-lined hatch beneath her desk. A white rabbit—wearing a waistcoat embroidered with "Fiscal Year 2025/26"—scurried past, muttering about "deadline dips" and "threshold tunnels." Before she could grasp her speech notes, she tumbled headfirst into a labyrinth of shifting ledgers and whispering gold coins.

She landed on a checkerboard floor where each square lit up with a different tax band. Above her, a giant pocket watch spun backwards. "How curious," she thought, brushing off imaginary dust of frozen allowances. "If thresholds stay still while wages climb, do I really need to chase them?"

A jaunty Caterpillar made of stacked pay-slips drifted by on a puff of pension contributions. "Who are taxes to say who pays what?" it asked in a smoky drawl. Rachel felt herself swelling with ideas—raise the personal allowance? Yank the frozen Inheritance Tax bands? Yet every time she nodded, the Caterpillar shrank to half its size, leaving her wondering if relief was ever large enough.

Pressing on, she encountered the Cheshire Cat of Stealth Taxes, its grin framed by disappearing dividend and savings allowances. "You're destined to find revenue," it purred, “but do you want it from distant growth or household kitchens?” Its smile lingered on her daily shopping bill, reminding her that silent hikes bite hardest where spending lives.

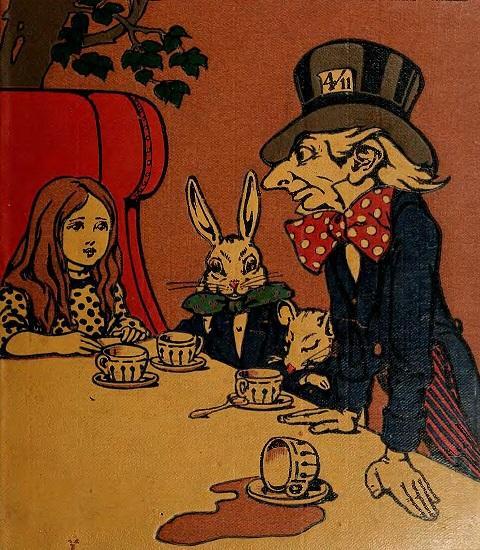

In the heart of the maze, a Mad Hatter's Tea Party of lobbyists clamored for their cups: “More support for first-time buyers!” “Freeze the fuel duty!” “Cut the council tax!” Each demand poured over her like cold tea. She balanced saucers labeled “Growth” and “Sustainability” on one elbow, “Fairness” on the other, and found herself dancing on a tax-curve tightrope that dipped and peaked at every step.

When the clock struck Budget Day, Rachel found herself before an oak podium guarded by a White Queen made of reams of economic forecasts. “‘Budget responsibility' or ‘bold investment'?” the Queen asked, gesturing with a quill that sprouted coins instead of feathers. Rachel paused. If she inked too boldly, borrowing would spike; inked too timidly, the nation's hopes would wilt.

Her reflection in a silver gilt mirror whispered: “Sometimes the bravest thing is to redraw the lines you once thought set in stone.” She uncapped her pen and, with a swirl, rallied the allowances, pruned the silent grabs, and paved new paths for green growth—just enough to surprise the caterpillar into bolder proposals and coax the Cheshire grin into a full-faced smile.

As she stepped back through the hatch, Budget speech in hand, the brass-lined door clicked shut behind her. The rabbit's pocket watch chimed on time, and Rachel Reeves—still pounding with Wonderland's curious wisdom—might never look at fiscal tables the same way again.

With apologies to Lewis Carroll.

Which Wonderland Reforms Could Fly in the Real World?

Five of Alice-in-Treasuryland tweaks made into a concrete UK policy option. Don't Ask The Mad Hatter or the dormouse.

1. Uprate Allowances with Inflation

Wonderland Reform: “Rally the frozen thresholds into new paths.”

Real-World Take: Index the Personal Allowance, higher-rate bands and the Inheritance Tax nil-rate band to CPI (or a wage measure) each year.

Prevents fiscal drag and silent tax rises

Keeps the threshold for the 40% band growing in line with pay

Could cost the Treasury ~£8 billion annually, but restores purchasing power

2. Green ISAs to Fund Sustainable Growth

Wonderland Reform: “Pave new paths for green growth.”

Real-World Take: Introduce a dedicated Green ISA wrapper allowing up to £5,000 of the £20,000 allowance into UK-based green bonds or approved climate projects.

Channels household savings into renewables, EV infrastructure or retrofit schemes

Builds on the existing Innovative Finance ISA concept

Could unlock £10 billion+ of retail capital for net-zero investment

3. One-Pot Allowance for Dividends, Interest & Gains

Wonderland Reform: “Merge the Cheshire Cat’s grins—dividends, interest and gains—into one.”

Real-World Take: Replace separate Dividend, Personal Savings and CGT annual exemptions with a single “Investment Allowance” (e.g. £10,000).

Simplifies tax planning and removes stealth-tax complexity

Reduces distortions between asset classes

Could be phased in over two years, with a transitional blended rate

4. Flattened Pension Relief

Wonderland Reform: “When the Caterpillar shrank, relief stayed large enough.”

Real-World Take: Move to a flat-rate pension tax relief (e.g. 30%) for all earners, replacing the 20/40/45% system and taper above £260,000.

Removes incentive for highest earners to shelter huge sums

Retains a generous boost for middle and lower-paid workers

Could raise £2 billion+ to fund NHS and schooling

5. Fiscal-Transparency Dashboard

Wonderland Reform: “Mirror whispered budgets, so no one feels blindsided.”

Real-World Take: Launch an HMRC-hosted online portal where every freeze, taper and stealth adjustment is quantified annually.

Empowers citizens to see exactly how “freezes” affect their take-home pay

Fosters trust and public buy-in for long-term fiscal plans

Low-cost digital build with high democratic value.

Illustration via Wikipedia - 1907 book cover