GDP monthly estimate UK - May 2025 - Falling Slightly Compared To April

11th July 2025

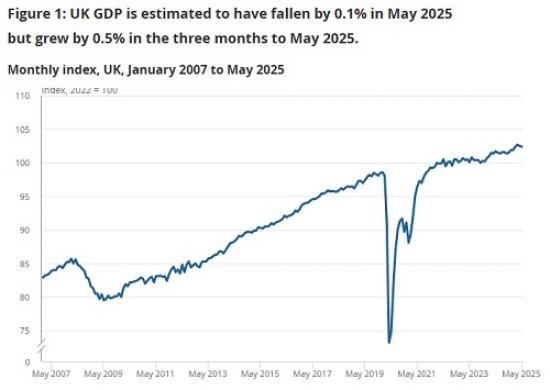

Monthly real gross domestic product (GDP) is estimated to have fallen by 0.1% in May 2025, following an unrevised fall of 0.3% in April 2025 and growth of 0.4% in March 2025 (revised up from 0.2% in our previous publication).

Real GDP is estimated to have grown by 0.5% in the three months to May 2025, compared with the three months to February 2025, largely driven by growth in the services sector in this period.

Monthly services output grew by 0.1% in May 2025, following a fall of 0.3% in April 2025 (revised up from a 0.4% fall in our previous publication), and grew by 0.4% in the three months to May 2025.

Production output fell by 0.9% in May 2025, following an unrevised fall of 0.6% in April 2025, but grew by 0.2% in the three months to May 2025.

Construction output fell by 0.6% in May 2025, following growth of 0.8% in April 2025 (revised down from 0.9% growth in our previous publication), but grew by 1.2% in the three months to May 2025.

Monthly GDP

Monthly real gross domestic product (GDP) is estimated to have fallen by 0.1% in May 2025, following an unrevised fall of 0.3% in April 2025, and growth of 0.4% in March 2025 (revised up from 0.2% in our previous publication).

Real GDP is estimated to have grown by 0.5% in the three months to May 2025, compared with the three months to February 2025. This reflected growth earlier in the year that resulted, in part, from some activity being brought forward to February 2025 and March 2025. There was growth in all three main sectors in the three months to May 2025. This included a rise of 0.4% in services sector output, which was the main contributor to the increase in GDP. Production and construction output grew by 0.2% and 1.2%, respectively.

Of the three main sectors in May 2025, production output was the largest contributor to the monthly GDP fall, decreasing by 0.9%. Construction output also decreased, by 0.6%. These figures were partially offset by an increase of 0.1% in services output in May 2025.

GDP is estimated to have grown by 1.0% in the three months to May 2025, compared with the three months to May 2024. During this period, services grew by 1.0%, while production showed no growth and construction output rose by 2.2%.

The services sector

Services output is estimated to have grown by 0.1% in May 2025, after falling by 0.3% in April 2025 (revised up from a 0.4% fall in our previous publication), with 10 of the 14 subsectors growing in May 2025.

Overall, the services sector is estimated to have grown by 0.4% in the three months to May 2025, compared with the three months to February 2025. There was a rise in output in 8 of the 14 subsectors during this period, with the largest positive contributions at the subsector level coming from information and communication (up 3.2%) and administrative and support service activities (up 2.3%).

The largest positive contribution to services growth in May 2025 was the information and communication subsector, which grew by 2.0%. Five of the six industries in this subsector grew in May 2025, with the largest contribution coming from an increase of 3.0% in the computer programming, consultancy and related activities industry.

Professional, scientific and technical activities was the second largest contributor to services growth in May 2025, with output increasing in this subsector by 0.8% during the month. This was largely because of legal activities output increasing by 6.1% in May 2025, after falling by 10.2% in April, and growing by 6.8% in March. Within legal activities, conveyancing solicitors have seen demand affected by the recent changes to Stamp Duty Land Tax (SDLT). This has led to property purchases being brought forward ahead of increases in SDLT rates in England and Northern Ireland on 1 April 2025.

The largest negative contribution at the subsector level in May 2025 came from the wholesale and retail trade; repair of motor vehicles and motorcycles subsector, where output fell by 1.5%. This was driven by a 2.7% fall in in retail trade, except of motor vehicles and motorcycles, following four consecutive months of growth.

Consumer-facing services

Output in consumer-facing services decreased by 1.2% in May 2025, following three consecutive months of growth. The largest contribution to this fall came from a 2.7% decline in retail trade, excluding motor vehicles and motorcycles.

Sports activities and amusement parks and recreation activities also fell by 3.5%, and travel agency and tour operator and other reservation services fell by 4.2%. The largest partially offsetting positive contribution came from accommodation, which grew by 2.4% in May 2025.

Consumer-facing services output rose by 0.7% in the three months to May 2025, compared with the three months to February 2025. The largest positive contributions in this period came from:

food and beverage services (up 2.6%)

retail trade, excluding motor vehicles and motorcycles (up 0.9%)

The production sector

Production output is estimated to have fallen by 0.9% on the month in May 2025, following an unrevised fall of 0.6% in April 2025. The fall in May 2025 was mainly driven by manufacturing output decreasing by 1.0%. Mining and quarrying output also fell in May 2025, by 3.2%. These falls were partially offset by growth in water supply; sewerage, waste management and remediation activities, as well as in electricity, gas, steam and air conditioning supply, which grew by 0.8% and 0.3%, respectively in May 2025.

In the three months to May 2025, compared with the three months to February 2025, production output is estimated to have grown by 0.2%. Water supply; sewerage, waste management and remediation activities (up 3.7%) and manufacturing (up 0.4%) grew over this three-month period, while electricity, gas, steam and air conditioning supply (down 2.8%) and mining and quarrying (down 1.6%) fell.

Manufacturing output fell by 1.0% in May 2025, following a 0.7% fall in April 2025. Manufacturing was the largest contributor to the overall decrease in production output in May 2025, with 9 of the 13 subsectors declining.

The largest negative contribution came from a fall of 4.2% in the manufacture of basic pharmaceutical products and pharmaceutical preparations, following growth of 5.4% in April 2025. The manufacture of transport equipment also fell in May 2025, by 1.3%, following a fall of 5.3% in April 2025. Both monthly declines were largely because of the manufacture of motor vehicles, trailers and semi-trailers industry. The manufacture of basic metals and metal products also contributed negatively, falling by 1.8% in May 2025.

The largest positive contribution within manufacturing came from the manufacture of machinery and equipment n.e.c. which grew by 3.4% in May 2025.

other personal services (up 2.7%)

Manufacture of motor vehicles, trailers and semi-trailers industry

The manufacture of motor vehicles, trailers and semi-trailers industry fell by 3.7% in May 2025, following a fall of 9.5% in April 2025. The Society of Motor Manufacturers and Traders (SMMT) reported that the decline was driven by a combination of factors, including model changeovers, restructuring and the impact of US tariffs.

However, these two declines follow three consecutive months of growth and, in the three months to May 2025, compared with the three months to February 2025, the manufacture of motor vehicles, trailers and semi-trailers industry increased by 2.1%. Despite this growth over the last three months, in May 2025, the industry is estimated to be 15.6% below its peak, which was in February 2024.

The construction sector

Monthly construction output is estimated to have fallen by 0.6% in May 2025. This follows three consecutive months of growth, including an increase of 0.8% in April 2025. The fall in monthly output in May 2025 came solely from a decrease of 2.1% in repair and maintenance, as new work increased by 0.6%.

Five out of the nine sectors saw decreases in May 2025. At the sector level, the main contributors to the monthly decrease were non-housing repair and maintenance, and private housing repair and maintenance, which fell by 2.4% and 1.8%, respectively.

Construction output is estimated to have increased by 1.2% in the three months to May 2025 compared with the three months to February 2025. New work increased by 0.9% over the period, and repair and maintenance grew by 1.5%. Within new work, the largest positive contributor came from infrastructure new work, which grew by 5.3%. In repair and maintenance (R&M) the largest positive contributor came from non-housing R&M which grew by 1.7%.

Cross-industry themes

There were some common themes that were anecdotally reported to have played a part in performance across different industries in May 2025, as part of our monthly business surveys. However, it is difficult to quantify their exact impact.

Similarly to recent months, comments received suggested the change in Stamp Duty Land Tax (SDLT) thresholds for home buyers in England and Northern Ireland affected activity in May 2025. Most notably, real estate agencies saw a decline (down 4.3%) in May as property purchases were completed ahead of the changes. This change was also cited in legal activities by conveyancing solicitors and by house removal firms. While legal activities saw a sizeable monthly growth (up 6.9%) it is still below its March 2025 level.

Businesses who also export to the US cited the changes in tariffs on exports as a possible reason for reduced output in May 2025. These comments mainly centred on the manufacture of motor vehicles and wholesale industries but were also cited in other areas of manufacturing.

The above paragraphs are selected excerpts.

Read the full ONS report HERE