Base rate cuts prove to be a double-edged sword

7th August 2025

The Bank of England Base Rate cuts are a double-edged sword, causing misery among savers.

But lowering mortgage costs, according to Moneyfactscompare.co.uk analysis.

Mortgage market analysis

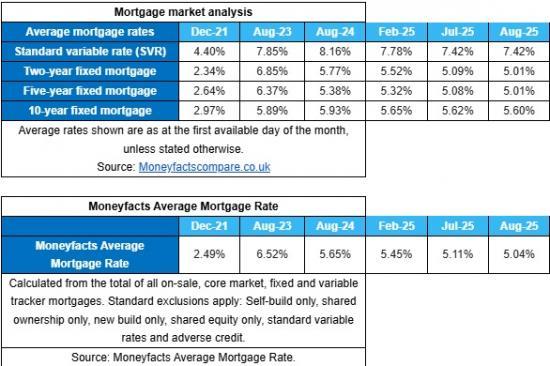

At the start of August 2024, the Bank of England Base Rate dropped to 5.00%, and 0.75% has been shaven off in total up to the start of August 2025, with standard variable rate (SVR) borrowers benefiting from the three 0.25% cuts.

The average standard variable rate (SVR) has fallen by 0.74% since the start of August 2024, down to 7.42% from 8.16%.

Since August 2024, the average two-year fixed rate has fallen from 5.77% to 5.01% and the average five-year fixed rate has fallen from 5.38% to 5.01%; both are down month-on-month. These average rates were 5.09% and 5.08% respectively last month.

On a 10-year fixed rate mortgage, the average rate was 5.93% in August 2024. This rate has fallen to 5.60% and is down month-on-month.

The Moneyfacts Average Mortgage Rate fell to 5.04%, down from 5.11% month-on-month. It is down from 5.65% since August 2024, and lower than 6.52% in August 2023.

Rachel Springall, Finance Expert at Moneyfactscompare.co.uk, said, "The continuation of falling mortgage rates will instil a sense of confidence among borrowers, with the Moneyfacts Average Mortgage Rate dropping by 0.41% over the past six months and down by 0.61% year-on-year. Lenders have also been relaxing stress tests to further support mortgage customers, but it is worth pointing out that fixed rates can move outside of base rate cuts.

"The unsteadiness of swap rates last month was a forewarning for lenders not to get too carried away with fixed rate mortgage cuts, which is why the margins of cuts by lenders were mixed. In positive news, swap rates have been edging downwards once again in recent days, which will give lenders more scope to reduce fixed mortgage rates.

This movement, coupled with expectations from economists for more cuts to the Bank of England Base Rate before the year is over, spells good news for millions of borrowers who need to refinance.

There remains a clear financial gain for borrowers to shift from a variable rate mortgage onto a cheaper fixed rate, as a typical mortgage borrower being charged the current average Standard Variable Rate (SVR) of 7.42% would be paying £372 more per month, compared to a typical two-year fixed rate*.

"First-time buyers remain the lifeblood of the mortgage market, so it's encouraging to see lenders do more to support them. Demand for affordable housing is high but there is not enough stock, which leads to new buyers stretching their deposits.

Unsurprisingly then, buyers who don't want to sit around might choose a longer-term deal to afford repayments, but it's essential they seek advice before entering any arrangement. Borrowing at higher loan-to-value ratios can put mortgage holders at risk of falling into negative equity if house prices were to plummet.

Overpaying a mortgage is then a wise choice to build up more equity and to shorten the mortgage term. Not only this, but having more equity leads to a greater choice of deals when buyers need to refinance."

*Average standard variable rate (SVR) is currently 7.42%. Calculations based on a £250,000 mortgage over a 25-year term on a repayment basis. SVR repayment £1,834 per month, versus £1,462 per month on 5.01% two-year fixed rate.

Savings market analysis

Average rates across easy access and notice accounts have fallen since the start of August 2024. The average easy access rate has fallen from 3.15%, the average easy access ISA rate has fallen from 3.36%. The average notice account has fallen from 4.29% and the average notice ISA rate has fallen from 4.22%.

Since the start of July 2025, the average easy access savings rate has risen from 2.67% to 2.68% and the average easy access ISA rate fell from 2.93% to 2.90%.

The average notice rate has fallen from 3.64% to 3.63% since the start of July 2025 and the average rate on a notice ISA has remained unchanged at 3.49%.

The Moneyfacts Average Savings Rate fell to 3.50%, down from 3.51% month-on-month. It is down from 3.92% since August 2024, and 0.64% lower now than 4.14% in August 2023.

Calculated from the total of all on-sale, core market, variable and fixed rate savings accounts and Cash ISAs. Standard exclusions apply: Regular savings, children's accounts, LISAs and JISAs.

Source: Moneyfacts Average Savings Rate.

Rachel Springall, Finance Expert at Moneyfactscompare.co.uk, said, "Savings rates are getting worse and any base rate reductions will spell further misery for savers. The Moneyfacts Average Savings Rate of 3.50% has dropped by 0.42% year-on-year, and is expected to fall further if the predictions from economists for further base rate cuts materialise. It is essential that savers do not wait around for too long to snap up the top rates on the market, particularly if they use their pots to supplement their monthly income.

“Switching savings accounts must become a regular habit to ensure savers are not getting a paltry rate. Convenience comes at a cost, because the biggest high street banks pay an average of 1.54%** across easy access accounts compared to the market average of 2.68%. These pots are further losing value due to sticky inflation, eroding the value of such cash in real terms. Loyalty does not pay, so it is crucial savers look towards building societies and challenger banks for better savings returns.

“Cash ISAs remain an attractive choice for savers, but in bad news the rates have taken a hit over the past year, with the average easy access ISA rate falling by 0.46%, a similar drop to its non-ISA counterpart. The tax-free perks of an ISA will continue to draw in savers, such as those who are expected to pay higher-rate tax at 40% and have their Personal Savings Allowance (PSA) halved from £1,000 to £500 as a result. However, some of the top cash ISA rates apply a heavy bonus, so it’s essential savers switch before the rate plummets. Apathy is a dangerous attitude for savers when inflation continues to take its toll on pots, and maximising the allowance is wise as the future of cash ISAs remains uncertain."

**High street banks include Bank of Scotland, Barclays Bank, Halifax, HSBC, Lloyds Bank, NatWest, Royal Bank of Scotland and Santander. Averages collected from gross interest rates paid across all live easy access accounts with these brands based on a £10,000 deposit, latest rates as at 5 August 2025.