Public sector finances UK - August 2025 - Borrowing Increased to Highest For 5 Years

19th September 2025

Borrowing – the difference between total public sector spending and income – was £18.0 billion in August 2025; this was £3.5 billion more than in August 2024 and the highest August borrowing for five years.

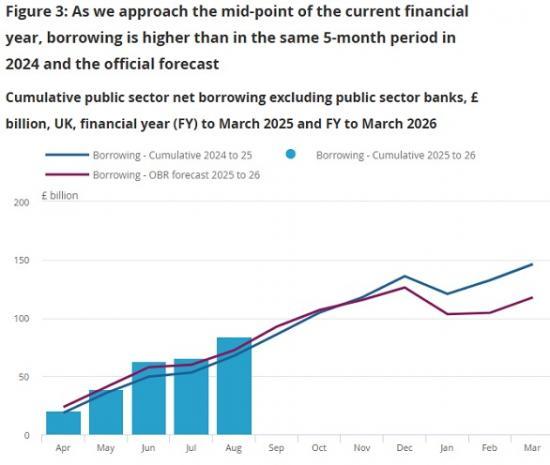

Borrowing in the financial year to August 2025 was £83.8 billion; this was £16.2 billion more than in the same five-month period of 2024 and the second-highest April to August borrowing since monthly records began in 1993, after that of 2020.

The current budget – borrowing to fund day-to-day public sector activities – was £13.6 billion in August 2025; this brings the total current budget deficit in the financial year to August 2025 to £62.0 billion, which is £13.8 billion more than in the same five-month period of 2024.

Public sector net debt excluding public sector banks was provisionally estimated at 96.4% of gross domestic product (GDP) at the end of August 2025; this was 0.5 percentage points more than at the end of August 2024 and remains at levels last seen in the early 1960s.

Public sector net financial liabilities excluding public sector banks were provisionally estimated at 84.5% of GDP at the end of August 2025; this was 2.5 percentage points more than at the end of August 2024, but 11.9 percentage points less than for public sector net debt.

Central government net cash requirement (excluding UK Asset Revolution Ltd and Network Rail) was £11.1 billion in August 2025; this was £0.1 billion more than in August 2024.

Borrowing in August 2025

Initial estimates show that the public sector spent more than it received in taxes and other income in August 2025, requiring it to borrow £18.0 billion.

This was £3.5 billion more than in August 2024 and £5.5 billion more than the £12.5 billion forecast in March 2025 by the Office for Budget Responsibility (OBR).

Public sector net borrowing is the sum of its current budget deficit and its net investment.

The current budget, which is usually in deficit, can be considered as borrowing to fund day-to-day public sector activities. This is the difference between its current receipts from taxes and other sources and its current expenditure on running public services, grants and administration.

The current budget was £13.6 billion in August 2025; this was £3.7 billion more than in August 2024.

Public sector net investment comprises acquisitions less disposals of capital assets (gross fixed capital formation), less the depreciation of capital assets, plus capital grants to the private sector, less capital grants from the private sector. Net investment was estimated at £4.3 billion in August 2025, which was £0.2 billion less than in August 2024.

Central government borrowing

Central government forms the largest part of the public sector and includes government departments such as HM Revenue and Customs (HMRC), the Department of Health and Social Care, the Department for Work and Pensions, the Department for Education, the Ministry of Defence and other government agencies.

The relationship between central government's receipts and expenditure is an important determinant of public sector net borrowing. Of the £18.0 billion borrowed by the public sector in August 2025, central government borrowed £13.1 billion.

Central government current receipts

Central government's current receipts were £84.3 billion in August 2025, £4.3 billion more than in August 2024. Of this £4.3 billion increase in income:

central government tax receipts increased by £1.6 billion to £62.2 billion; this included increases of £1.0 billion in Income Tax, £0.2 billion in Value Added Tax (VAT) and £0.1 billion in Corporation Tax receipts

compulsory social contributions increased by £2.6 billion to £16.4 billion; on 6 April 2025 changes to the rate of National Insurance contributions paid by employers came into effect

A detailed breakdown of central government income is presented in our Public sector current receipts: Appendix D dataset.

Self-assessed Income Tax

Self-assessed (SA) Income Tax receipts were provisionally estimated as £1.3 billion in August 2025, £0.2 billion less than in August 2024.

Payments due in July that miss the deadline are recorded as August receipts. The extent to which delayed payments occur varies each year, and so we recommend considering July and August SA Income Tax receipts together when making year-on-year comparisons.

Combined SA Income Tax receipts for July and August 2025 were provisionally estimated as £16.8 billion, £2.5 billion more than in the same two months last year.

Central government current expenditure

Central government spending data for August 2025 are provisional. There is uncertainty around these estimates until more detailed departmental information becomes available over time.

Central government's current expenditure was provisionally estimated as £89.1 billion in August 2025, £7.8 billion more than in August 2024. Of this £7.8 billion increase in spending:

central government departmental spending on goods and services increased by £3.7 billion to £38.0 billion, as pay rises and inflation increased running costs

central government debt interest payable increased by £1.9 billion to £8.4 billion, with movements in the Retail Price Index (RPI) adding volatility to the monthly debt interest costs

net social benefits paid by central government increased by £1.1 billion to £27.3 billion, largely caused by inflation-linked increases in many benefits and earnings-linked increases to State Pension payments

payments to support the day-to-day running of local government increased by £0.2 billion to £10.1 billion; these intra-government transfers are both central government spending and a local government receipt, so they have no effect on overall public sector borrowing

Interest payable on central government debt

At £8.4 billion in August 2025, the interest payable on central government debt was in line with the £8.5 billion forecast by the OBR in March 2025.

The interest payable on index-linked gilts rises and falls with the RPI, adding volatility to central government debt interest costs. This additional RPI inflation-linked component of interest is described as "capital uplift" and affects the value of the gilt principal.

Capital uplift was £2.6 billion in August 2025, which largely reflects the 0.4% increase in the RPI between May and June 2025. It is accrued throughout the life of each index-linked gilt but is paid to gilt holders at redemption. Accrued capital uplift is shown as the light blue portion of each stacked bar in Figure 2.

Borrowing in the financial year to August 2025

The public sector spent more than it received in taxes and other income in the financial year (FY) to August 2025. Provisional estimates show it borrowed £83.8 billion over the five-month period, £11.4 billion more than the £72.4 billion forecast by the Office for Budget Responsibility (OBR) in March 2025.

Read the full ONS report HERE